|

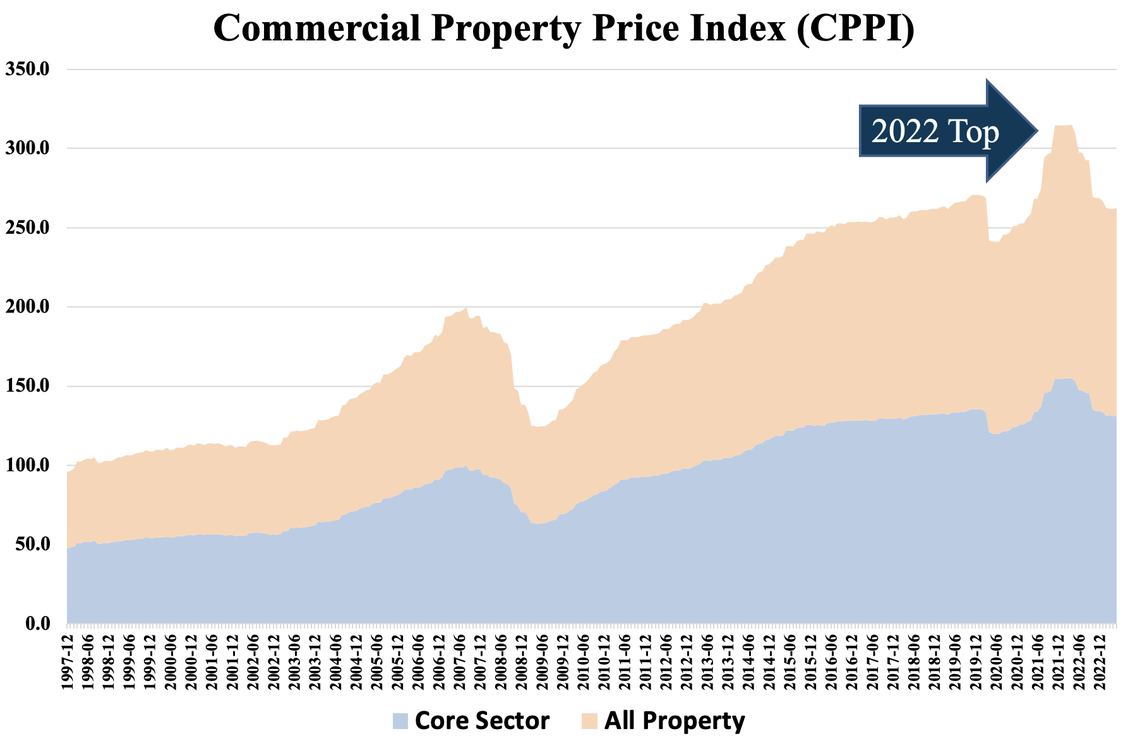

Written by Elijah Levine, edited by Kyle Niedzwiecki It was very interesting to see the SEC sue Coinbase and Binance, especially as, unlike the CFTC, they do not have international jurisdiction. Contrary to most, we saw this legal action as a bullish indicator and deployed more of our cash than we have this entire year. Even more interesting, less than a week after the SEC’s legal action, some of the biggest names in traditional finance made some major moves in crypto. Fidelity, Charles Schwab, and Citadel launched a centralized, non-custodial exchange, Blackrock filed its 33rd request for a Bitcoin ETF, and the SEC approved the first ever levered Bitcoin ETF… We are confident that things can’t get a lot worse in the crypto markets, that said, we are well prepared for if that were to happen. Most of our crypto assets are off-exchange and either stored on biometrically-secured cold ledgers or multi-signatured by the fund’s general partners. As discussed in our 2023 Q2 Update, we have also been diversifying our portfolio into exceptional technology products that we have either been building or buying for pennies on the dollar. Additionally, Kyle actively manages TJF’s entire portfolio which allows us to be in and out of markets ahead of our competition and often even the largest market makers. Broadly, macro markets still seem unpredictable, which is why we have been mostly holding cash. That said, many of our predictions have come true, especially related to real estate markets, which we have been keeping a close eye on. As I come from a traditional real estate background, we have been advising real estate companies and underwriting certain investment opportunities when it makes sense. With many debt maturities approaching, we are considering raising another open-ended fund to take advantage of distressed real estate, which we are already seeing a lot of and only expect to see more of heading into this winter. |

|

|

Data by Green Street, Graph by BMIG |

|

We are already in talks with several very impressive operators to accelerate our plans to become a massive player in the real estate space and will look forward to sharing hopefully many more exciting progress reports next update. In the meantime, we have been doubling down on building and improving our existing businesses. A great example of this is our new decentralized exchange, MountainSwap. Kyle has been silently and diligently building this for months and has now created a beautiful, user friendly, scalable, and secure solution for crypto enthusiasts of all experience levels. Our public financials have been fully updated and some small updates have been made to our offering documents to reflect our now almost two years in business. We invite LPs and non-LPs to review here if there is interest. |

0 Comments