The last few months have been some of the most pivotal in Black Mountain’s history. We have been making serious progress building and increasing the enterprise value of all our businesses… some highlights:

Since Elijah has gone full-time on Black Mountain in lieu of a junior year internship, monthly revenue has increased by over 800% and, upon recently closing a separately managed account, our AUM has grown by over 200%.

Kyle has been full-time on both Black Mountain and The Jupiter Fund (TJF) for nearly two years now, and it clearly shows in the fund’s performance.

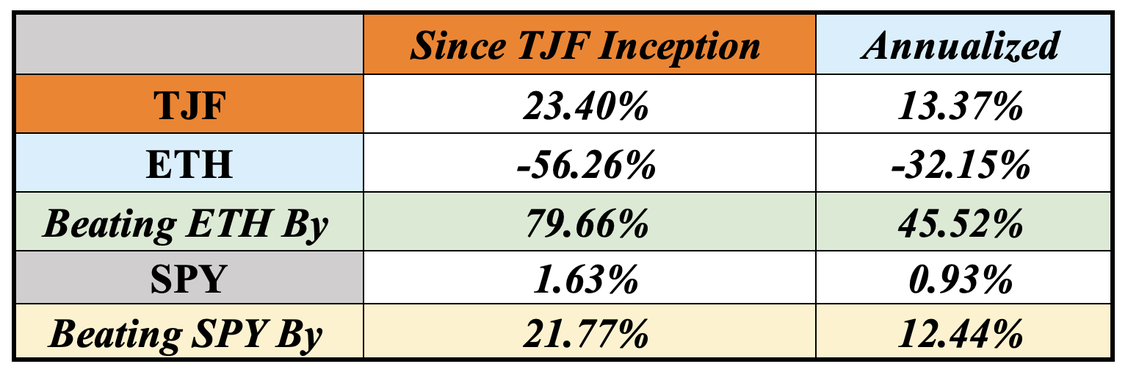

Not only did TJF win Crypto Fund Research’s “Top Performing Multi-Strategy Fund” in 2022, but the fund is up around 20% YTD and ~23% from committed capital, fully liquid, representing a ~13% annualized return since inception.

For reference, ETH is down more than 55% during that same period and the SPY is slightly positive but essentially unchanged.

That means we are beating our benchmark (ETH) by over 79% and we continue to outperform both ETH and the SPY.

We also recently passed the $1M capital raised mark for TJF. While still a very small fund in the grand scheme of them, this is an exceptional victory for our team of first-time fund managers raising for an open-ended vehicle.

We recently signed three incredibly important partnerships that reinforce our frequently misunderstood dual-company structure and represent massive upside potential for our company and investors.

Luxury Rally Club (LRC), a premier luxury automotive experience company, hired us to do database management, financial reporting, sales strategies, and several custom tech buildouts.

We negotiated getting both TJF and Black Mountain equity in Echo Labs, Dubai’s leading Web3 development shop, in exchange for ongoing business support. We are strategically partnered with Echo Labs for the LRC deal as well.

Mandelbrot Capital has hired Black Mountain to manage their new fund, which focuses on emerging market arbitrage in a strategy they have been developing infrastructure around for several years.

Our firm also took a massive step and brought securities lawyer, Eric Swartz, onto the team as in-house counsel and our new Chief Compliance Officer. This comes after co-authoring a white paper and starting a podcast called “The New Internet” together. This is a remarkable milestone for our firm that we have had our eyes on since we first started. We could not be more excited to have Eric on the team as we continue to build out our in-house offerings.

We have finally launched the beta for our revolutionary portfolio management and investor relations software, EaseFolio, that TJF investors not only get significant ownership in, but also first access to.

TJF LPs received a separate email from Elijah with a link to the secure portal where they can view fund performance in live time, as well as their share of holdings, realized/unrealized gains, and more.

Even though it’s still in beta and less than six months into development, we are ecstatic about this software as we’ve been giving demos to some of the biggest names in finance and the feedback has been nothing short of astounding.

Sam Levine, CEO of BMIG Aviation, secured a partnership with Drew Reggie, one of the biggest influencers in aviation, famous for his “Fly Me to the Fun” videos, who will be helping sell our flagship aviation technology product, Flight GPS. A special thank you to our first official advisor and one of our earliest investors, Kirk Posmantur, for facilitating that introduction.

Another internally built portfolio company that we have been silently working on for months, Skatedex, has quickly become the largest skatepark directory in America and amassed over 8,000 users since our soft launch less than two months ago.

TJF portfolio company Coinucation has seen a 10x increase in website visitors and a 200x increase in subscribers since our last update. This comes after enhancing the user experience with our in-house tech capabilities and getting featured in “Innovation Tech News.”

0 Comments