Last quarter was jam packed with action not only across markets but with our business. Some highlights:

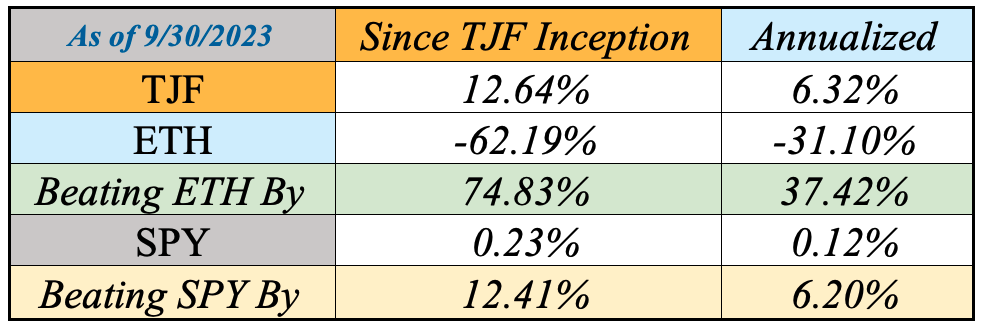

• Due to a last minute spike in one of our largest holdings, ICP, the fund ended last quarter over +12% from committed capital and up just under +5% on the month. Markets have been sideways for the most part but we are still managing to beat our benchmark (ETH) by over 74% since the fund’s inception.

• As many of you know, ICP (created by the Dfinity Foundation) has been one of our strongest conviction holdings for years now.

• Wharton MBAs recently visited Dfinity’s HQ in Switzerland’s Crypto Valley. Elijah is currently taking “Real Estate Disruptions” at Wharton alongside many MBAs, which is mainly focused on blockchain and other soon to be major technological disruptions to real assets.

• After sharing this article with the class and explaining why ICP solves many of the problems that the professors claim will hinder blockchain from ever working in the context of real estate, many students started joking to him that “you should be teaching this class.” Maybe in a few years he will be… just next semester he will be a teacher’s assistant for one of Wharton’s most notoriously difficult classes, Real Estate Development with Asuka Nakahara.

• Our portfolio companies now passively generate enough income to cover all of our company’s operating expenses. If we include the Nigeria Opportunity and Jupiter Fund’s management fees, our operating margins are over 90%. This is much better than our competitors by design, BMIG was built on identified inefficiencies in traditional asset managers’ business models. We identified that many variable costs could be automated away using technology, which is what we have been building since we started our company over two years ago.

• We are excited to share that the EaseFolio app is now live- although still in its infancy, we are confident this product is going to completely change the world of asset management. Some recent updates to the platform include a customizable asset comparison chart and the ability for investors in multiple funds (as we now manage) to seamlessly switch between the funds that they are invested in, as well as other performance upgrades.

• We have received multiple soft offers for one of our portfolio companies, Coinucation, as many firms and private investors are gearing up for the next crypto cycle, which Kyle believes we will start to see early next year around the time of BTC’s halving (more below). Although the offers have been in the ~100x range of the small initial amount we paid for it, we believe that the true value of this asset is yet to be discovered so we haven’t let go of it just yet.

This year we have been intensely focused on growing our brand…

• Elijah recently spoke alongside BlackRock’s Global Head of Tax, Jennifer Moss, at a networking event hosted by ones of our partners, Business Brilliance.

• Elijah and Kyle recently traveled to NYC, Elijah on back to back weekends. The first was for ETH NYC, where Kyle, Eric, and Elijah had the chance to network with large crypto and web3 institutions and investors. Eric, our lawyer, got us a sponsorship at one of the most intimate, high-value events of the weekend at no cost to us. Thank you again for that, Eric!

• The second visit was to meet and speak with real estate and legal professionals from KKR, Sculptor, The Georgetown Company, and Kirkland and Ellis. These executives shared stories of successes and failures, as well as their current outlooks on the markets which are very similar to ours and will be shared in much greater detail below.

• We sponsored another Business Brilliance event at Columbia University with executives from Google, Azura, and GreenLink Education. Thank you, Shane (the founder of Business Brilliance), for continuing to put together such exceptional events and choosing to include us in them!

• The word is quickly getting out about our brand and people love it. We are excited to have you all along for this journey as we genuinely still feel like we are just getting started. By this time next year, we expect to have one or more offices, even more investment vehicles, and several full-time employees. If you want to follow our weekly updates, we invite you to connect with us on LinkedIn and follow us on Instagram.

Business Brilliance x BlackRock x Black Mountain “Importance of Networking” Event

Jupiter Fund Portfolio Update, by Kyle Niedzwiecki

While Bitcoin and Ethereum both are up around 45% YTD, they’re still down ~60% from their respective all-time highs. Altcoins are down ~80-90% and The Jupiter Fund since inception is up ~10% during this same period.

The Jupiter Fund employs a long-only, quantitative strategy and we are making progress, albeit a bit slower than I’ve anticipated. However, we have been doing our best to play the cards that we have been dealt, weathering the storm by continuing to hold a large cash position and preparing for the upcoming cycle by acquiring assets we believe in at attractive prices.

We started our fund at the absolute top of all global markets, in October 2021. Since that time, most competing funds are down more than 50% and many have even gone bankrupt or shut down for other reasons. As newcomers to the scene, we want to of course give outstanding returns to our LPs, but more than anything, make a name for ourselves as a trustworthy company that can weather any storm. So while we have been on the defensive for the most part due to macro factors, I believe our patience during this time will be what separates us from the hundreds of other firms that were too trigger happy and are going to shut down in the coming years.

I want all of you to know that by investing into the fund, you’re investing into me. I successfully found and entered Ethereum well before the mainstream and held strong despite “expert” after “expert” in my ear telling me it would never be a success. I am fully invested in running and growing this business. I own nearly half the fund myself and confidently believe that I have identified the next major paradigm shift in the cryptocurrency landscape.

A prominent principle from our team is “you can’t change the winds, but you can adjust your sails,” as Elijah says. It’s just going to take patience, at this point we’re battling time-based capitulation.

Kyer on TradingView

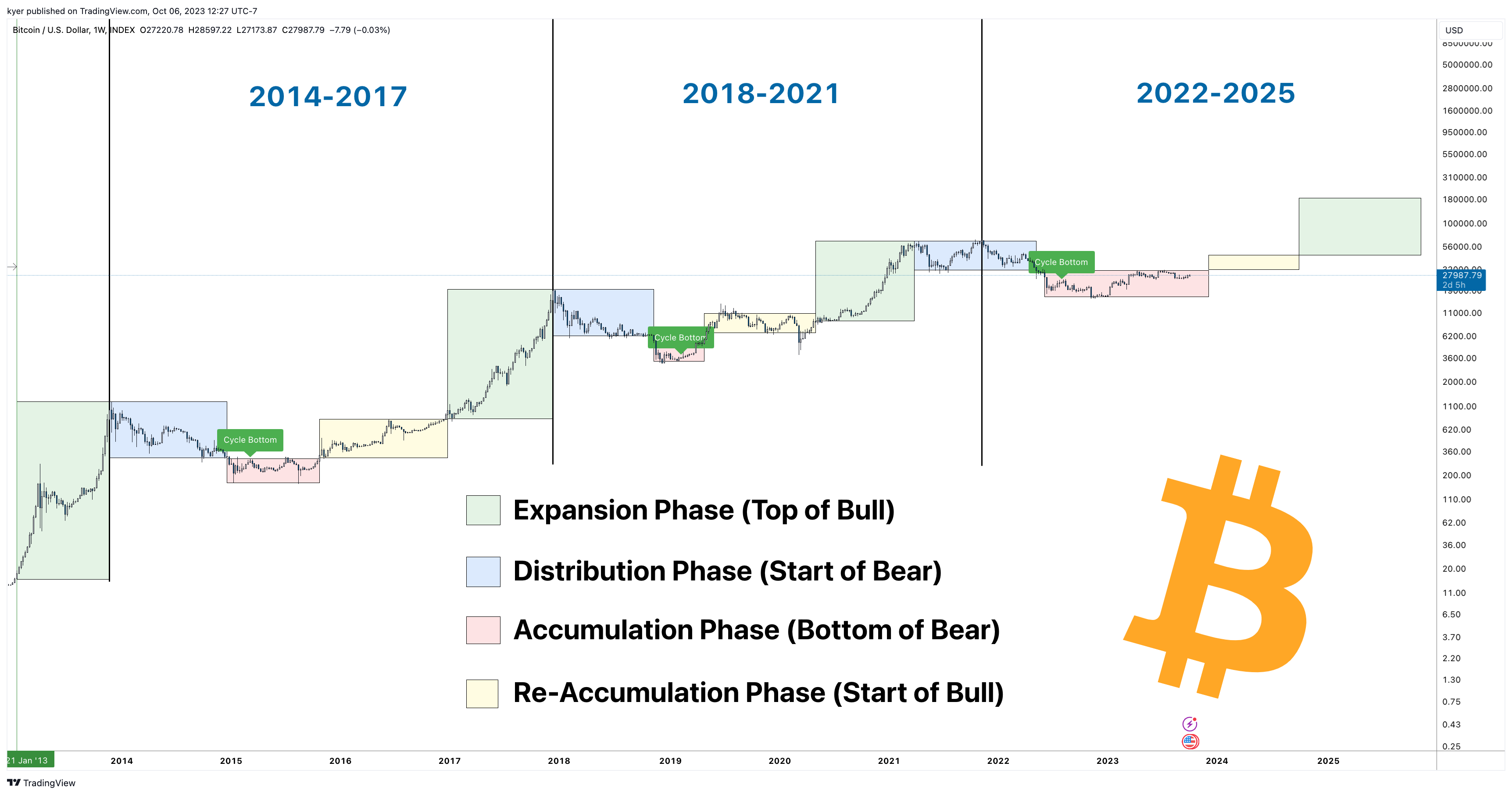

As illustrated in the chart above, Bitcoin moves cyclically off its underlying mathematics. The monetary (reward) policy changes every 4 years and cuts the daily issuance of Bitcoin in half, reducing the amount of Bitcoin in circulation, causing a supply shock to miners and exchanges. Because of the cyclical nature and hard-coded monetary policy, this makes the coin very predictable on a longer time frame.

From what I’ve been noticing in the global cryptocurrency markets, the longer-term holders that have tenure in the industry are remaining composed, while the speculators that joined us during the 2021 cycle are either long gone, liquidated, or losing their minds through this capitulation phase. The reason why I’m not losing sleep over some moves down this cycle is because we’re in the accumulation phase and this is my 4th rodeo (Bitcoin cycle).

During the 2014-2017 cycle, I purchased many of my current holdings in 2016 at the tail end of the accumulation phase. I bought more Ethereum at the bottom of the accumulation phase in 2019 and we have been doing the same thing during the current accumulation phase. History doesn’t always repeat itself, but it often rhymes and although there is always a probability of this time being different, I envision the same trade playing out for The Jupiter Fund (and other crypto bulls) this cycle.

During this bear market, It almost seems like a broken record of purveyors telling others to “build in the bear.” Unironically, this is exactly what I’ve been spending most of my time doing. As prices have already fallen significantly, I’m confident that what we’re going through now is time-based capitulation.

When the price of an investment is falling, investor interest and faith starts to wane, in many cases causing them to sell (price-based capitulation). In time-based capitulation, investors surrender after a long and exhausting struggle as their interests (and/or liquidity needs) shift to other things.

Many have heard the John D. Rockefeller saying, “When the shoeshiner starts giving investment tips, it’s time to exit the market,” but how do you know when is a good time to enter the market?

To us, what’s happening right now is a clear distinction between price-based capitulation and time-based capitulation. These two operate in tandem to test the investor’s loyalty, patience, and belief in their own narrative.

Great investors understand this and make strategic investments during the storm, coming out smarter and stronger than when they entered. A good example of price capitulation in the cryptocurrency market was the 2017 bear market after Bitcoin’s peak of reaching almost $20,000 per coin. The ending of this price-based capitulation was also the start of the time-based capitulation, as many investors who did not leave the market in the price capitulation down from $20,000 to $6,000 eventually did so during the next 2 years due to a lack of movement to the upside.

The FTX disaster created the crypto market cycle bottom (price capitulation). That brings us to where the market stands now, in time-based capitulation.

For our fund, it’s more beneficial to weather the storm of the bear market and to not make any sudden changes to our investment thesis (which we frequently and thoroughly discuss), as time in the market outweighs the benefits of timing the market. Our investment horizon is 4-5 years or more, and bear markets in the cryptocurrency landscape have historically lasted 2 years. While it might be brutal now, we believe the tides will soon change.

It’s one thing when both retail and institutions lose interest in an asset class, it’s a different story when, while retail loses interest, the world’s biggest and best institutions start gearing up for an asset class to significantly grow, like we are seeing now throughout the entire financial services industry. Crypto is here to stay and the world’s biggest and best institutions (and regulators) know that.

On this most recent August liquidation event, we added onto our existing positions with more dry powder. The Jupiter Fund is weathering this time-based capitulation relatively unscathed, outperforming the market (both ETH and the SPY since inception), and just like the exponential growth that’s going to be seen in our core holdings, I’m expecting exponential growth for the fund in the coming years.

Despite the macroeconomic headwinds and regulatory hurdles currently hindering cryptocurrencies, Blockchain Capital, Polychain Capital, and Coinfund recently raised a collective $930M, demonstrating the continued interest and resilience of cryptocurrency investors and the broader blockchain venture capital landscape.

As we inch closer towards the next Bitcoin halving cycle, I expect to see more inflows of new capital into the cryptocurrency sector that will ultimately propel new growth and innovation for the leaders of the new, decentralized internet.

We realize there’s a long way for us to go, but we are ready and excited for it.

“The summit is what drives us, but the climb itself is the best part of the journey.”

Best,

The Black Mountain Team

0 Comments