As we conclude another remarkable year at The Jupiter Fund, I am delighted to share that we we ended the year with a return of over 120% and have at least doubled the capital of all our investors who joined before the start of 2024.

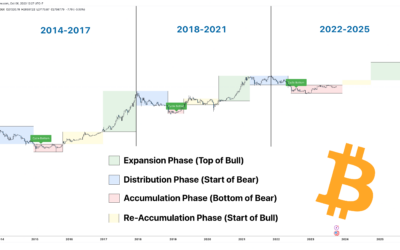

We saw outstanding growth in the crypto sector in Q4 of 2023 and our optimism remains high as we believe this is only the beginning of our journey. Surpassing benchmarks, we have outperformed Ethereum by 168% and the S&P 500 by 112% since inception.

While we received the top-performing (multi-strategy) crypto fund award in 2022, I personally felt a tinge of disappointment with our modest performance for the year. My aspiration was to make a bold entrance, and I am confident that you will witness a reflection of my commitment to the performance not only this year but in the years to come.

Observing the surges in other Layer-1 cryptocurrencies like Solana, Avalanche, and Cardano, I resisted the urge to follow market trends blindly. Instead, I exercised patience and navigated the time-based capitulation, which resulted in our portfolio rising almost 100% in the month of December.

Maintaining confidence in my thesis, I resist the urge to make portfolio changes for the sake of re-allocation. Our strategy, I believe, will stand the test of time. It doesn’t make sense to diversify or re-allocate without a proper change in the thesis.

On the risk management front, we made a pivotal decision to move away from centralized exchanges (CEXs) and secure our coins in multi-signatured cold storage. These measures, undertaken during the SEC lawsuits in August, have proven effective in safeguarding investor interests amid market volatility.

Last year, we were boasting about de-risking our assets from FTX prior to the exchange collapsing and would’ve got caught with our pants down if we would’ve lost investor capital due to an exchange collapsing. There was a point in the summer and fall where just north of 50% of the entire fund’s AUM was stashed on CEXs, a point where I don’t wish to return to. So, we made the choice of not losing sleep and removed all exposure to centralized exchanges.

Technological advancements in our business, notably the creation of Easefolio and the implementation of a proprietary quantitative trading bot, showcase our dedication to staying at the forefront of innovation and building phenomenal technology that not only we use and love, but others do too. Our approach is inspired by legends such as Jim Simons, ensuring our operations stay at the pinnacle of efficiency and sophistication.

To our investors, your trust and support have been the cornerstone of our success. We extend our heartfelt gratitude for the confidence you have placed in The Jupiter Fund.

The Jupiter Fund reaffirms its commitment to striving for excellence in the cryptocurrency and technology markets. We are always open to questions, comments, or feedback and encourage everybody to engage in further discussions, openness and transparent communication is imperative to impactful collaboration. As we anticipate the challenges and opportunities of the upcoming year, The Jupiter Fund stands poised to continue its journey of success and growth. Thank you for being part of this remarkable endeavor.

All bets on Black (Mountain).

Warm regards,

Kyle Niedzwiecki

0 Comments