RECENT Perspectives

From the Top of the Mountain

Check out the latest perspectives from our team at Black Mountain Investment Group.

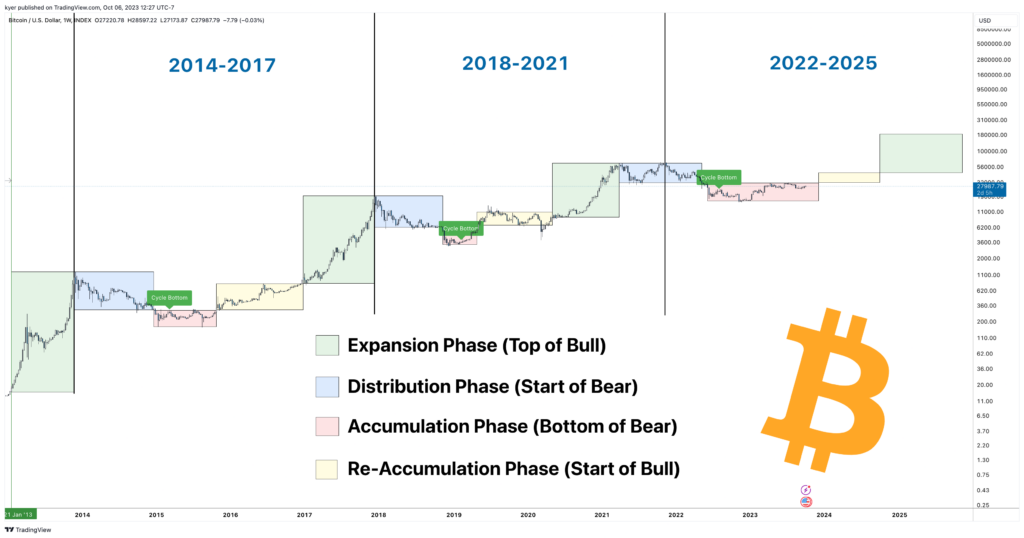

2024 Predictions

In the world of cryptocurrency, we are currently seeing seismic shifts that are reshaping the landscape, influencing trading preferences, market dynamics, and the very fabric of blockchain technology. From the rise of decentralized exchanges and the intricate dance...

The Jupiter Fund 2023 Update

As we conclude another remarkable year at The Jupiter Fund, I am delighted to share that we we ended the year with a return of over 120% and have at least doubled the capital of all our investors who joined before the start of 2024. We saw outstanding growth in the...

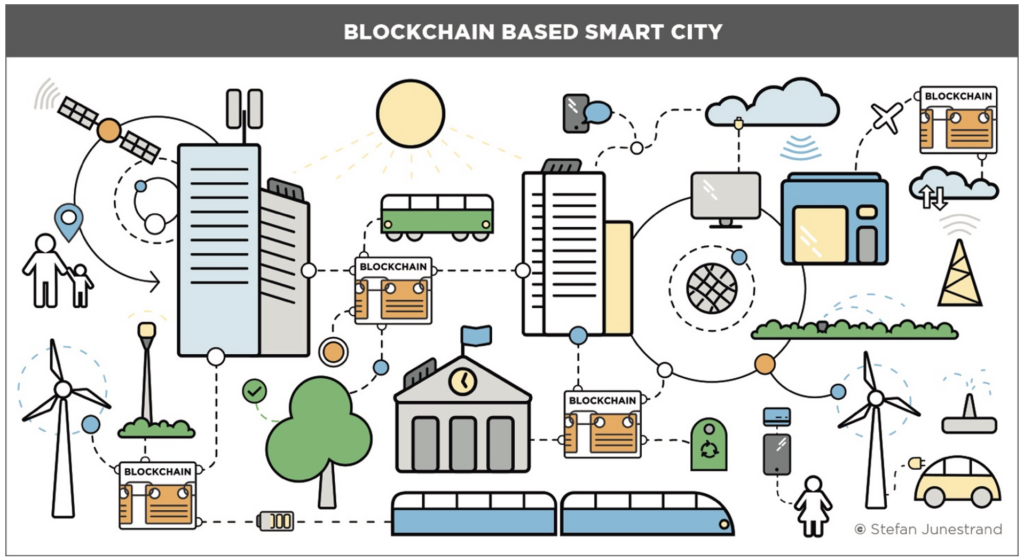

Blockchain Technology Disrupting Real Estate

Blockchain can truly touch all aspects of real estate. That said, some touchpoints are inevitably more valuable than others that can be improved with other modern technologies. For this analysis, I will focus on the main areas where blockchain can make a true...

The Macroeconomic Tug of War of Today

In the last several weeks, I’ve had the privilege of speaking with Howard Marks (Co-Founder of Oaktree Capital Management) and Jeff Aronson (Co-Founder of Centerbridge). Two legends in the investing world that I have been following and inspired by for some time. I...

2023 Q3 Update

Last quarter was jam packed with action not only across markets but with our business. Some highlights: • Due to a last minute spike in one of our largest holdings, ICP, the fund ended last quarter over +12% from committed capital and up just under +5% on the...

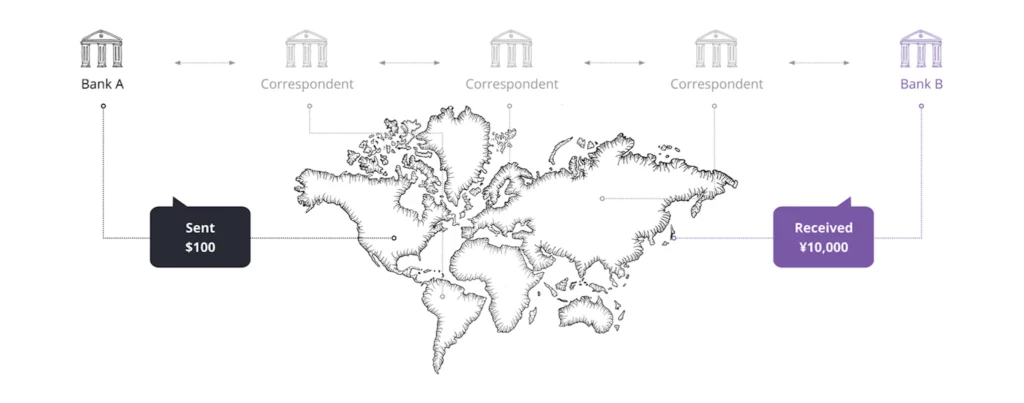

Blockchain: a Cure for FX Discrepancies

Blockchain: a Cure for FX Discrepancies and International Trade Issues Written by John Trahan, edited by Kyle Niedzwiecki and Elijah Levine Since the pandemic, the world’s economies have and continue to see numerous tremendous stir-ups. Most countries faced high...

Macro Updates & Observations

Written by Elijah Levine, edited by Kyle Niedzwiecki It was very interesting to see the SEC sue Coinbase and Binance, especially as, unlike the CFTC, they do not have international jurisdiction. Contrary to most, we saw this legal action as a bullish indicator and...

Why ICP Will Change Internet Infrastructure

Written by Kyle Niedzwiecki, edited by Elijah Levine. Amid this cryptocurrency bear market, The Jupiter Fund is not only positive and highly liquid, but steadily holding a long-term outlook and well prepared for the next cycle. Cryptocurrencies as we know them are...

2023 Q2 Update

The last few months have been some of the most pivotal in Black Mountain’s history. We have been making serious progress building and increasing the enterprise value of all our businesses... some highlights: Since Elijah has gone full-time on Black Mountain in...

Why Memecoins Aren’t Securities

The article, sourced from an original PDF found at the bottom of the page, presents a compelling collaboration between Black Mountain Partners, Kyle Niedzwiecki, Elijah Levine, and Eric Swartz, our esteemed Chief Compliance Officer and General Counsel. With a...

FedNow is not a CBDC

Central Bank Digital Currencies (CBDCs) have been a topic of interest for central banks around the world, including the Federal Reserve Bank of the United States (the Fed) for some time now. The concept of a CBDC is essentially a digital version of a country’s fiat...

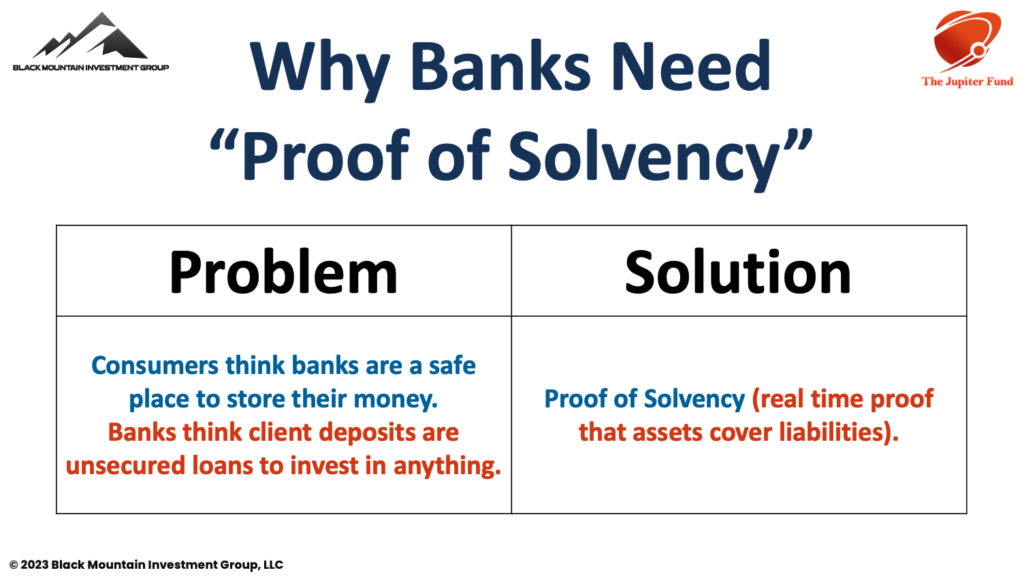

Why Proof of Solvency Will Change Finance

In November of last year shortly after the FTX collapse, Vitalik Buterin, one of the co-founders of Ethereum, released his "Proof of Solvency" white paper, which proposed a new way to verify that a cryptocurrency exchange is solvent, meaning that it has sufficient...

2024 Predictions

In the world of cryptocurrency, we are currently seeing seismic shifts that are reshaping the landscape, influencing trading preferences, market dynamics, and the very fabric of blockchain technology. From the rise of decentralized exchanges and the intricate dance...

The Jupiter Fund 2023 Update

As we conclude another remarkable year at The Jupiter Fund, I am delighted to share that we we ended the year with a return of over 120% and have at least doubled the capital of all our investors who joined before the start of 2024. We saw outstanding growth in the...

Blockchain Technology Disrupting Real Estate

Blockchain can truly touch all aspects of real estate. That said, some touchpoints are inevitably more valuable than others that can be improved with other modern technologies. For this analysis, I will focus on the main areas where blockchain can make a true...

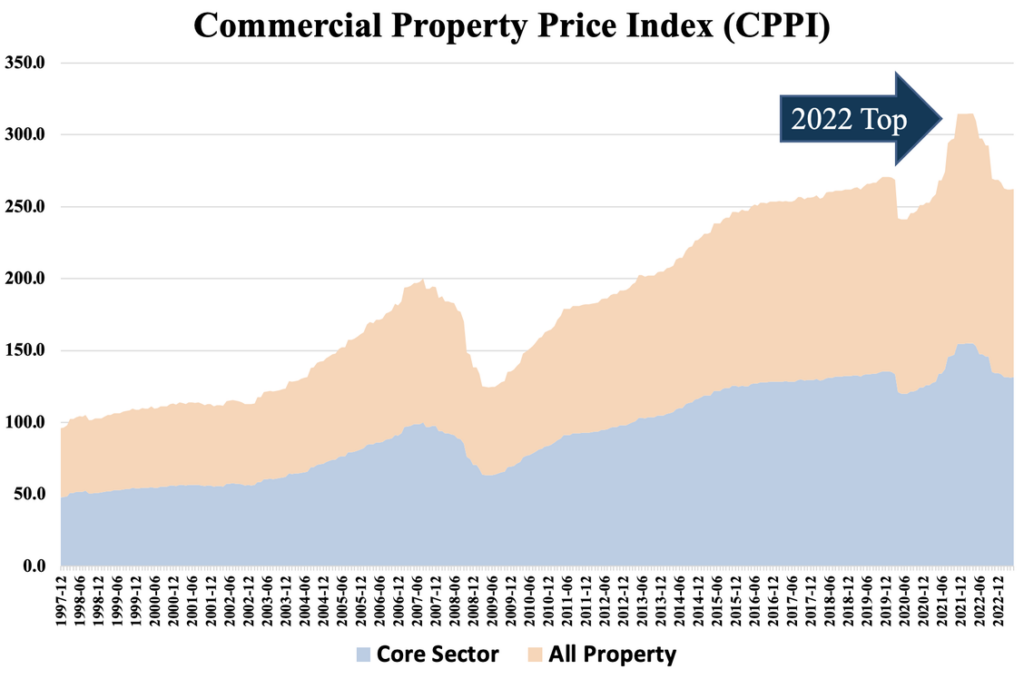

The Macroeconomic Tug of War of Today

In the last several weeks, I’ve had the privilege of speaking with Howard Marks (Co-Founder of Oaktree Capital Management) and Jeff Aronson (Co-Founder of Centerbridge). Two legends in the investing world that I have been following and inspired by for some time. I...

2023 Q3 Update

Last quarter was jam packed with action not only across markets but with our business. Some highlights: • Due to a last minute spike in one of our largest holdings, ICP, the fund ended last quarter over +12% from committed capital and up just under +5% on the...

Blockchain: a Cure for FX Discrepancies

Blockchain: a Cure for FX Discrepancies and International Trade Issues Written by John Trahan, edited by Kyle Niedzwiecki and Elijah Levine Since the pandemic, the world’s economies have and continue to see numerous tremendous stir-ups. Most countries faced high...

Macro Updates & Observations

Written by Elijah Levine, edited by Kyle Niedzwiecki It was very interesting to see the SEC sue Coinbase and Binance, especially as, unlike the CFTC, they do not have international jurisdiction. Contrary to most, we saw this legal action as a bullish indicator and...

Why ICP Will Change Internet Infrastructure

Written by Kyle Niedzwiecki, edited by Elijah Levine. Amid this cryptocurrency bear market, The Jupiter Fund is not only positive and highly liquid, but steadily holding a long-term outlook and well prepared for the next cycle. Cryptocurrencies as we know them are...

2023 Q2 Update

The last few months have been some of the most pivotal in Black Mountain’s history. We have been making serious progress building and increasing the enterprise value of all our businesses... some highlights: Since Elijah has gone full-time on Black Mountain in...

Why Memecoins Aren’t Securities

The article, sourced from an original PDF found at the bottom of the page, presents a compelling collaboration between Black Mountain Partners, Kyle Niedzwiecki, Elijah Levine, and Eric Swartz, our esteemed Chief Compliance Officer and General Counsel. With a...

FedNow is not a CBDC

Central Bank Digital Currencies (CBDCs) have been a topic of interest for central banks around the world, including the Federal Reserve Bank of the United States (the Fed) for some time now. The concept of a CBDC is essentially a digital version of a country’s fiat...

Why Proof of Solvency Will Change Finance

In November of last year shortly after the FTX collapse, Vitalik Buterin, one of the co-founders of Ethereum, released his "Proof of Solvency" white paper, which proposed a new way to verify that a cryptocurrency exchange is solvent, meaning that it has sufficient...

Recent coverage

Hot Off the Press

Luxury Rally Club Taps Black Mountain Investment Group to Launch New Digital Initiative

Luxury Rally Club, the leading luxury automotive experience company, announces a collaboration with multifaceted investment manager Black Mountain Investment Group. The initiative aims to leverage digital platforms to enhance networking opportunities and provide exclusive benefits to its esteemed members.

Black Mountain Investment Group Announces Its Acquisition of Flight GPS, Expanding Its Aviation Portfolio

This acquisition, funded by the company’s investment arm, The Jupiter Fund (“TJF”), will bring Flight GPS into Black Mountain’s private portfolio, put TJF LPs as major stakeholders on the cap table, and allow the investment firm to continue tapping into the growing aviation technology market.

Black Mountain Investment Group Introduces Youngest Fund Managers in the Industry

Recently, the Co-Founders of Black Mountain Investment Group have established themselves as the youngest Fund Managers in the industry. BMIG manages and invests out of their private hedge fund, The Jupiter Fund, which deploys an actively managed long / short strategy focused on emerging technology.

RECENT Podcasts

Featuring Black Mountain

Check out the latest podcasts from our Partners at Black Mountain Investment Group.

Black Mountain Partners Discuss Advancements in Cryptocurrencies

Welcome to Episode 1 of “The New Internet” podcast, where we dive deep into the exciting world of web3 and explore the latest developments in the industry. In this episode, we are joined by special guests Kyle Niedzwiecki and Elijah Levine, experts and partners from Black Mountain Investment Group, to discuss the advancements in the cryptocurrency sector.

Contact

Get In Touch

Whether you’re seeking to grow your business or seeking investment opportunities, our team is here to assist you. Simply fill out the form with your inquiry, and we’ll promptly respond to address your needs. Let’s collaborate to unlock the potential for growth and success. Get in touch with us today and take the next step toward achieving your long-term goals.