In November of last year shortly after the FTX collapse, Vitalik Buterin, one of the co-founders of Ethereum, released...

Co-founder

Elijah Levine

Elijah Levine attended the Wharton School of Business for two years before taking a leave of absence to work full time in Private Equity Real Estate with Bridge Investment Group. At Bridge, he has worked closely with top executives on new strategic company initiatives which includes but is not limited to over $2.5B in M&A underwriting and $30B of real estate underwriting across asset classes (primarily industrial, SFR, multifamily, and manufactured housing). He also met regularly with large venture capital firms/funds in the PropTech space to analyze potentially accretive balance sheet investment opportunities for Bridge and has worked directly on the launch of two new funds/verticals within Bridge: a long term, open-end, cash yield-focused Logistics Net Lease fund, and a series of closed-end Logistics Value-Add/Development funds targeting high touch, high yield deals in “Global Gateway” markets. Both new funds have leadership from top public firms in the industrial real estate space, Brookfield and Gladstone, namely. Elijah continues to work with top leadership from Bridge on strategic/operational matters relating to company as well as new initiatives, including both new Logistics verticals. Elijah has founded, advised, and/or worked on numerous companies, startups, non-profits, and other organizations across industries and product/service offerings in his career and looks forward to continuing to make a positive impact in people’s lives by allocating and managing capital aimed at creating a better future for all.

Macro Analysis: Understanding the Big Picture

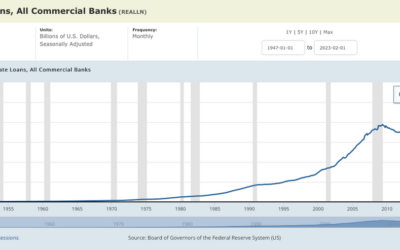

Along the lines of what we have been saying for well over 18 months now, we are concerned about the macroeconomy-...

Finding Opportunities in Distressed Markets

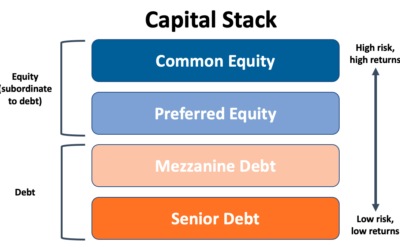

Ever since rates started rising well over 12 months ago, we have been talking about the stress that will be put on all...

Real World Problems Being Solved with Blockchain Technology

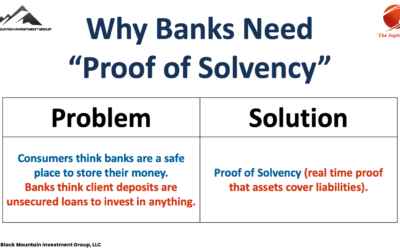

Real World Problems Being Solved with Blockchain TechnologyWhether you believe in the actual technology or have just...

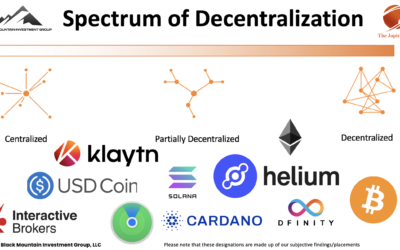

Does Total Decentralization Exist?

An analysis on current “decentralization” in modern technology; what it is, the pros and cons, why it's a spectrum for...

Investment Laws, Commodities, and Unregistered Exchanges

Securities, Commodities, Accreditation Laws, and the Risk of Unregistered Exchanges More and more “assets” in the...