Securities, Commodities, Accreditation Laws, and the Risk of Unregistered Exchanges

More and more “assets” in the digital space continue to face scrutiny as to what they are registered as and therefore what operating guidelines they must abide by. Needless to say, an overwhelming majority of the ecosystem is not operating under the proper guidelines, and this is starting to become more and more apparent across the space. Unfortunately, this phenomenon is only likey to increase, and we are going to explain why we think that throughout this article citing some current events as evidence. To be clear, this isn’t and should never be considered financial advice, it is purely educational and to help you become a better critical thinker when it comes to analyzing potential investment opportunities.

What is a security?

Believe it or not, the outcome of a Supreme Court case that happened over eight decades ago determined what the definition of a security is to this day.

The story behind the case is that in 1940, the Securities Exchange Commission (SEC) sued an orange farmer in Florida over not registering his business in which he would sell plots of land, lease them back form the landowner(s), sell fruit, and then share profits with the landowners. The Supreme Court sided with the SEC, creating the four prongs of the “Howey Test” that determine what assets are considered securities in the eyes of the law or not.

These four prongs are:

- An investment of money

- in a common enterprise

- with the expectations of a profit

- to be derived from the effort of others.

As you can see, the orange farmer’s business should certainly be considered a security and therefore registered with and disclosing certain information to the SEC.

It is important to note here that this test can (and will) be applied all assets… NFTs, DAOs, stocks, gold, $BTC, beach houses in Miami, baseball cards, whatever tangible thing it might be that is under scrutiny from the SEC… However, just because something is getting “howey-tested,” does not mean that it is a security. For example, most single family homes, $BTC, and $ETH (as we will talk more about in this article), are not securities.

Another example of a security is our uniquely structured hedge fund, the Jupiter Fund, which is considered a security because we are bringing together investor’s money to invest in specific assets that they hope to derive profits from, therefore, we meet all of those prongs. The reason we don’t have to disclose all of our info with the SEC yet (although we are still “registered” with them through something called a Form D*), is because we are under a certain size ($100M in AUM) and only offering our fund to a select group of individuals according to the accreditation laws which were established before the Howey Test- we talk about these more below.

*Form D allows us to be exempt from registering and disclosing certain information to the SEC until we break out of one or all of the exemptions.

Seven years before the Howey Test was created, it became US law that businesses selling securities must be registered. This Securities Act also determined an “Accredited Investor” to be somebody who has made at least $200K per year for the last two years or has a net worth of over $1M. A “Qualified Purchaser,” was determined to have at least $5M in investments (beyond house, car, etc.).

Being an accredited investor and of course a qualified purchaser opens you up to the most exceptional investment opportunities… At least as compared to “retail investors,” or everyday people that aren’t very wealthy or in financial services- otherwise deemed to be not sophisticated enough to invest in unregistered securities by the SEC.

Note that the above definitions were from Regulation D of the Securities Act of 1933.

Finally, in 2020, the SEC expanded the definition of an accredited investor to include those that hold specific certifications or qualifications such as a Series 7, 65, or 82 license. While nothing too crazy, in our opinion this was a step in the right direction to qualify more people as “educated” or qualified enough to invest in risky, early stage, unregistered securities- it’s almost as risky as purchasing cigarettes and alcohol, or how about some lottery tickets!

Quickly following the Securities Act of 1933 was the Securities Exchange Act of 1934 which created the SEC and empowered them to regulate exchanges, brokers, clearing agencies, and all self-regulatory organizations (SROs), like the Financial Industry Regulatory Authority, (FINRA). Registering with the SEC does not require a lot of disclosure and they make it especially easy when first starting out. This law also defines prohibited behavior when acting in markets and puts the SEC in charge of defining the rules for the space, along with the ability to come after any potential bad actors, even SROs. The SEC and SROs are supposed to work together to protect the integrity of the markets.

These laws that were created decades ago are being referenced more and more today as projects are being exposed as having been operating outside of US Legislation (wonder who saw that coming). A recent example is the SEC charging three Coinbase managers with insider trading. The SEC stated that at least nine of the sixteen assets under investigation “were securities,” however, Coinbase’s Chief Legal Officer said that “Coinbase doesn’t list securities. Period.” Clearly, there are some serious misconceptions of not only what a security is but also what legal and regulatory implications come with that determination.

Some people argue that coins used for “utility” shouldn’t be considered securities, but Commodity Futures Trading Commission (CFTC) Commissioner, Caroline Pham, when speaking on the SEC v Wahi (Coinbase case), said that that “the SEC complaint alleges that dozens of digital assets, including those that could be described as utility tokens and/or certain tokens relating to decentralized autonomous organizations (DAOs), are securities.”

Prior to this action, in early August 2022, the Digital Commodities Consumer Protection Act was introduced and clarifies (or claims) that Bitcoin and Ethereum are commodities, as opposed to securities which are under purview of the SEC.

We believe these assets got determined to be commodities, rather than securities, because they meet the first two prongs of the Howey Test but not the second two. When people put money into $BTC looking at it as a “store of value,” they aren’t necessarily expecting a profit from it, but perhaps for it to hold its value relative to other assets over the test of time. Additionally, there isn’t one group of people who’s job it is to make $BTC profitable; instead, there are computers executing immutable code (unfortunately currently at a momentous clip of energy).

Michigan Senator Stabenow said in a statement that “one in five Americans have used or traded digital assets, yet these markets lack the transparency and accountability that people expect from our financial system… that’s why we are closing regulatory gaps and requiring that these markets operate under straightforward rules that protect customers and keep our financial system safe.” Both the House and Senate Agriculture Committees have signaled interest in subsuming more digital assets to the authority of the CFTC.

NFTs and DAOs are also areas with a lot of confusion right now, as most NFTs involve a lot of speculation and a lot of DAOs involve governance and/or utility as part of their value proposition. Both of these assets are starting to be ubiquitously looked at (but not yet regulated as) securities. In our next article we will be diving in much deeper on this, but technically, most of them are currently and have been raising money completely illegally as they should in almost all cases probably be considered securities.

Some states, like Wyoming and Vermont, have made it easy for people to create and operate DAOs legally, assuming you follow the prevailing securities laws. Some projects, like Orange DAO, are doing this legally by setting up a traditional domestic fund alongside an offshore to DAO to help fill the fund with additional investors as only one slot in the fund.

KKR, one of the largest asset managers on the planet, recently enlisted Securitize Capital to tokenize an interest in their $4B Health Care Strategic Growth Fund II (HCSG II) on the Avalanche blockchain.

Investing in funds like these are usually reserved for large institutions and ultra-high-net-worth individuals. However, a creative approach to structuring, infrastructure to support public reporting requirements, and the continued development of new technologies have enabled large asset managers like KKR to accept smaller checks, improve digital onboarding and compliance protocols, and increase liquidity for a large number of investors that previously haven’t had access to these limited access and usually more illiquid vehicles.

While this isn’t the first time KKR has revolutionized the fund space, it certainly is the first time an institution of this scale has tokenization an interest in one of their large funds. We are very excited about this maneuver and see it as a massive bullish indicator for the entire space 1. because it happened with these very reputable groups and 2. because it showcases blockchain’s ubiquitous room for adding value across industries.

Avalanche on Medium

While regulatory bodies continue to figure out exactly how to regulate this space, they are certainly starting to crack down and becoming more and more vocal about their intensions.

SEC Chair, Gary Gensler, is currently urging cryptocurrency exchanges to voluntarily register with the SEC. He says “it’s a question of whether they’re registered or whether they’re operating outside of the law and I’ll leave it at that.” Sad to say, but we have made very similar observations to this and our estimates are that <5% are the former.

For example, earlier this year, in February, BlockFi agreed to pay the SEC $100M to settle charges that arose from BlockFi’s failure to register its cryptocurrency interest account. BlockFi was found in violation of three areas of federal securities laws – selling unregistered securities, operating as an unregistered investment company, and making “materially false and misleading statements” on their website about their loan products. Common guys, even us as first time fund managers in our early twenties figured that one out.

“This is the first case of its kind with respect to crypto lending platforms. Today’s settlement makes clear that crypto markets must comply with the time-tested securities laws, such as the Securities Act of 1933 and the Investment Company Act of 1940. It further demonstrates the Commission’s willingness to work with crypto platforms to determine how they can come int compliance with those laws.”

– SEC Chair Gary Gensler

This might be Gary’s first time seeing cases of this on lending platforms, but we have been seeing it all over the ecosystem for months now and the liquidity problems are getting worse and worse- especially in the NFT space. Although, it is good to see the Commission’s willingness to allow these assets and products to continue existing if they agree to operate under the existing securities laws. The problem is that most currently are not.

Without putting down a project we believe and are invested in, we wanted to share an unfortunate recent case study with you in the DeFi space on Giddy. There were two parts to this investment, Giddy and a USDC-Giddy Pair invested into a “Liquidity Pool” (see our next article for more info on liquidity pools). When we started observing some potential liquidity problems across the platform, we tried pulling some of our money out…

Luckily, we were able to cash out on a good amount of Giddy, but when we went to pull out our USDC and Giddy from the liquidity pool on this DeFi platform, we quickly realized that the only liquidity left in the pool was less than our current investment. Said differently, there wasn’t enough money in the pool to pull out our remaining ~$4K in the pool.

SushiSwap Giddy-USDC LIquidity Pool

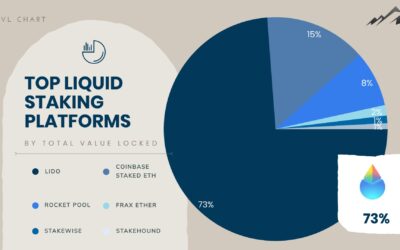

Even more troubling, the website shows over $23M of “Total Value Locked” (TVL), clearly misrepresenting the actual liquidity in the project.

coinlaunch.giddy.co

Risk undoubtedly comes with investing on a small unregistered exchange, but there is a line in the sand between risk and downright fraud. Granted, the higher the risk the higher the reward, but this sort of rug pull is exactly why regulatory bodies like the U.S. Securities and Exchange Commission are needed to regulate marketplaces.

Luckily for us, this was a small bet. Unfortunately though, we believe that most of the bad actors haven’t even been exposed yet and that right now, on average from what we are seeing, for every 1 great project there are 100-500 complete frauds.

The hilarious irony of building a fraudulent company on chain is investors can see exactly what’s happening with all of the money.

Some final notes:

- If you don’t know where the yield is coming from, you are the yield.

- Be careful of speculation, especially in places like NFTs and DeFi.

- As an investor you must do your research.

- You must register your business and follow proper “Know Your Customer” and “Anti Money Laundering” (KYC / AML) requirements even though many securities and accreditation laws in general are stupid and outdated (even with the recent definition expansion).

- DAOs too but NFTs in particular broke this, and what we are seeing happening now is simply history repeating itself: more regulation and a further wind-down in prices, likely until market participants have more transparency into the industry.

- Certain assets do still shine in the darkest of times though, usually those that solve complex and pressing issues faced by a large number of people; these are the projects we are currently seeking out and the ones you should be too.

In conclusion, it’s very important to follow the laws. This is why we make it such a point to remind all our readers and listeners that all the information we provide is not and should not be considered financial advice, but this also goes to registering your company, disclosing accurate information in a timely manner to the proper organizations, and understanding that not knowing the laws is not an excuse for breaking them. Most people have understood crypto, at least most coins, to be securities, but they have not formally been designated as such yet (likely because everybody has been making money), but now that people are unable to pull their money out of “assets” to cover the continued rising costs of goods and services, precedent is starting to be handed down from regulators.

Our observations have made us nervous about how little people have done in terms of research to understand what type of vehicle they are and therefore what guidelines they must operate under. This comes with every new industry, especially complicated ones in the technology space, but what worries us more is the inability to track most of this stuff and the intense accounting / auditing that must be done to track the capital that has constantly been moving on and off-chains across various exchanges, decentralized platforms, cold ledgers, etc.. Not to mention that unique transaction types like staking paired assets in liquidity pools, mining, tax loss harvesting, airdrops, etc. currently have no clear guidance on how to be treated from a tax perspective (more to come on this as well).

It appears that these issues are front and center for everybody from small retail investors to the largest and most reputable incumbent institutions. As regulators haven’t stepped in to comment on many of these nuances yet, it’s at the back of most people’s minds as something that will need to be figured out in the near future, but less than 1% of people in the space are working to actually solve it. Needless to say, we see this supply / demand imbalance as a massive opportunity to be pioneers in the space.

This is why, at Black Mountain, we are proud to say that we are building proprietary, in-house models to be able to keep up to date with our trading and investment tracking alongside our professional partners as they help guide us on proper disclosures and accounting practices. We feel this same way about our legal documents, which we worked hard to properly register and are about to pay to renew. We also work to maintain regular open communication with the SEC, the IRS, and other regulatory bodies as we continue building out our conglomerate.

As always, please feel free to reach out if you have any questions, concerns, or feedback.

Best,

The Black Mountain Team

0 Comments