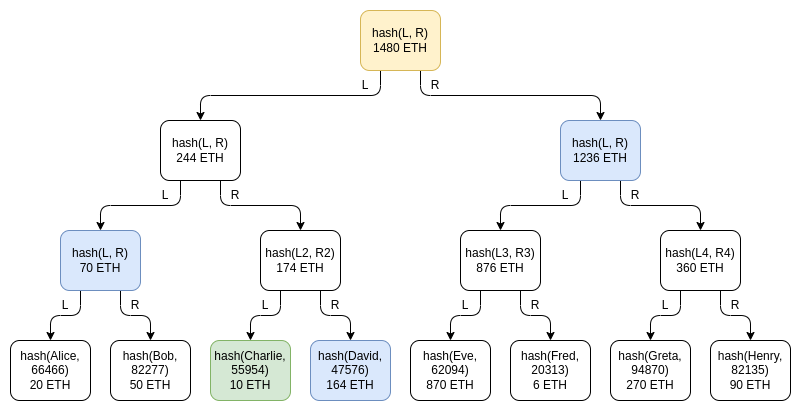

In November of last year shortly after the FTX collapse, Vitalik Buterin, one of the co-founders of Ethereum, released his “Proof of Solvency” white paper, which proposed a new way to verify that a cryptocurrency exchange is solvent, meaning that it has sufficient funds to cover liabilities to its users. The proposed method builds on the idea of “Proof of Reserves,” which is a cryptographic technique used by some exchanges to prove that they have control over the assets they claim to hold.

Vitalik’s approach goes a step further by introducing a protocol that enables exchanges to prove not only that they have control over their assets but also that the assets they hold are sufficient to cover their users’ balances. This protocol relies on a combination of cryptographic techniques and economic incentives to ensure that exchanges cannot cheat the system.

The basic idea behind the protocol is to have the exchange publish a commitment to its asset balances, along with cryptographic proof that the commitment is valid. Users can then use this proof to verify that the exchange does indeed hold sufficient assets to cover their balances. The protocol also includes a mechanism for updating the commitment periodically, so that users can be sure that the exchange’s assets have not been depleted since the last update.

Green: Charlie’s node. Blue: nodes Charlie will receive as part of his proof. Yellow: root node, publicly shown to everyone.

To incentivize exchanges to participate in the protocol, Vitalik suggests that users be offered a discount on their trading fees if they use an exchange that has proven its solvency using this method. This would create a competitive advantage for exchanges that can prove their solvency, which would in turn encourage other exchanges to adopt the protocol as well.

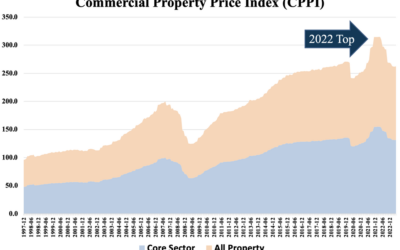

This proposed technology is particularly interesting to us because of its potential application across the world of finance. For example, as of now, the entire global banking system is experiencing a huge shock. This is primarily because there is a massive discrepancy between what consumers think banks are and what banks think they are.

Consumers think banks are a safe place to store their money that they can get their money out of at any time, while banks think that client deposits are unsecured loans they can use to invest in anything. Unsophisticated banks have mistakenly invested in long-term maturing assets despite the short-term nature of deposits. This has created a wide range of problems such as the recent bank runs, asset value collapses, and more- all things that likely could have been prevented with proof of reserves and solvency protocols.

The big idea here is that most large institutions (especially banks and governmental organizations) are seriously technologically behind modern times. This, combined with the people in these organizations (and their auditors) not paying attention to what is going on behind the scenes (i.e. literally doing their jobs) cause these dramatic crises. For example, being able to mark assets to market is something that should be done much more frequently but that institutions don’t do very often because it’s a lot of work and not necessarily required by law.

Doing this more often, or even though automated technology, would allow institutions to constantly check to make sure they are above water and have enough assets to cover their liabilities. This solution would prevent future bank runs and massive solvency issues like we have seen around the world lately. While this adoption is likely several years away, large institutions and governments are already starting to work on this, and we urge them to start implementing technology-based controls like this sooner rather than later.

Some other traditional finance sectors that come to mind that could significantly benefit from these protocols are equities, real estate, and bond markets. Institutions could use a technology like this to prove (in live time) that they have sufficient assets to cover their liabilities to investors/bondholders/shareholders.

A potential application of this protocol beyond the traditional finance and cryptocurrency industries is in the field of decentralized finance (DeFi). DeFi platforms allow users to access financial services such as borrowing, lending, and trading without the need for intermediaries like banks. However, DeFi platforms are still subject to risks such as smart contract bugs and insolvency of underlying assets, especially in obscure liquidity pools. The “Proof of Solvency” protocol could help to mitigate some of these risks by providing a way to verify the solvency of DeFi platforms. As the tech improves, there’s no doubt these technologies will work in tandem to establish a new age of financial transparency for institutions and individuals alike.

In summary, Vitalik’s “Proof of Solvency” proposal has the potential to increase transparency, trust, and operations across various industries beyond just the world of centralized cryptocurrency exchanges. While the protocol is still in the theoretical stage and requires further development and testing, it has the potential to become an invaluable tool for verifying solvency and mitigating risks in live time across a variety of financial contexts.

0 Comments