Ever since rates started rising well over 12 months ago, we have been talking about the stress that will be put on all areas of the economy for a sustained period of time. It’s clear to see with the recent news of Silicon Vally Bank and Signature Bank that we are in the depths of that distress, and I am sad to say that we think it is likely to continue for some time.

That said, with distress comes opportunity. Things must be destroyed in order to build them back better, and that’s exactly what we think is going to happen over the next several years during this down market. Rather than watching this happen from the sidelines, why not get in the game and take part in that growth and reconstruction? In this article, we will discuss four main areas of that present exceptional opportunities to take advantage of the up-and-coming transformation that will be seen throughout all economies of the world.

Those four main areas are:

- Technology

- Capital stack arbitrage

- Underserved geographies

- Education and regulation

Technology

Technology is the biggest focus of our company, and this is because the opportunities to create world-altering technologies are perhaps greater than any opportunity in the world today. This is because so many of the largest asset classes, businesses, and institutions of the world are extremely outdated as compared to the modern technology that younger generations grew up with. Of course, you can’t blame them because older generations didn’t know what smart phones were until the same time that we did. The crazy part is how recent that was and that industries like real estate, lending, transportation, energy, and other massive sectors have been built over the decades with the outdated technologies that they had at the time.

Microsoft Excel, for example, completely revolutionized the world of finance and continues to be one of the most popular pieces of business software out there for every major institution. Excel has improved greatly over the years, adding features, plugins, and customability. That being said, compared to more modern technology that many of us are used to today, like Notion, the user experience of Excel looks and feels very outdated. It gets worse when you try creating complex models that require large data structures and automations across formulas, assumptions, and outputs. This has led to the rise of enterprise SaaS, which has been one of the hottest spaces for investment and B2B transactions for the last decade or so.

However, even many of these SaaS platforms lack the modern UI/UX that many of us crave- not to mention that the current state of enterprise SaaS is incredibly expensive and largely inaccessible to the average small or medium sized business, let alone non-enterprise users. This needs to and likely will change, and we hope to be at the forefront of that change.

Another space that we are already starting to see being revolutionized by technology is documentation and administrative processes. The world of real estate is a great example of this, especially in foreign countries (which we will talk about more below), almost every aspect of a real estate transaction is currently unbelievably inefficient. Companies like Redfin and Airbnb have worked to improve these experiences and have created very nice synergies alongside fintech firms like Stripe and Square. However, on the commercial and institutional side of things, data discovery and analytics, mortgages, escrow, legal, and accounting are all very much inefficient and outdated.

The lending business presents a particularly large opportunity for massive technological disruption given the size and current state of clunkiness. Many companies, from startups to large institutions, are already working to tackle this issue through the use of blockchain technologies. The likely outcome is that change to an industry as large as bonds and mortgages will need to come from the inside, rather than startups. Companies like Citibank and JP Morgan are already working to develop their own in-house blockchains to improve the lending business and financial transactions in general.

Climate, food, transportation, construction, infrastructure, and education are all other categories outside of the financial services sector that represent massive opportunities for technological innovation over the coming years. In fact, technology will likely play a role in most, if not all of the opportunities of tomorrow, across industries and geographies, and is an important thing to understand, rather than be scared of, and try to use it to your advantage.

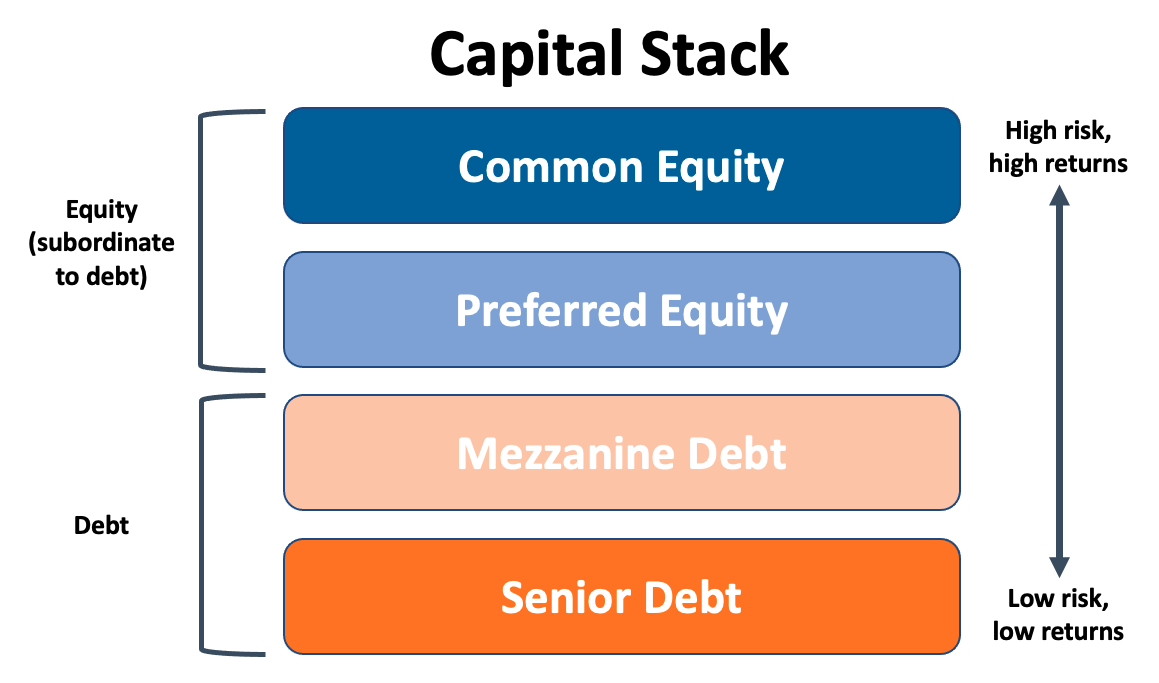

Capital Stack Arbitrage

Another area for opportunity that we recognized right as the sharp rate increases started to occur was exploring arbitrage opportunities across the capital stack. As we have seen in the abrupt downfall of Silicon Valley Bank, matching liquidity maturity is incredibly important. Something that is one of the simplest concepts to understand in all of finance/banking was completely overlooked by one of the top 20 banks in America, and they are not alone.

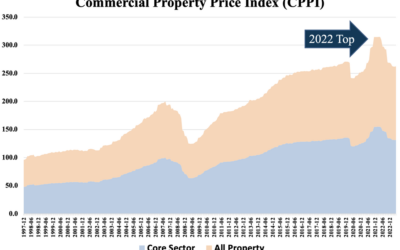

Since we underwrite deals across industries and leverage rates, we have seen that SVB is not the only entity making these mismatching mistakes. Unfortunately, we believe that many deals done in commercial real estate and over levered business that took on floating rate debt during the time of low interest rates are going to be at risk of default. We are already starting to see this happen and unfortunately think it’s just the beginning. That being said, it presents exciting opportunities for those who understand capital stacks and have the liquidity and expertise to help recapitalize fundamentally strong companies at a discounted rate.

A “capital stack” refers to the stack of debt and equity within a business. Usually there are several types of each with their own levels of seniority and privileges. Debt is paid out before equity and senior debt is paid out before junior debt. Many folks who took on debt during the period of low rates, say at 2%, might be operating at a 7% gross margin, leaving a 5% spread. However, with rates rising to 5%, that spread narrows to 2%, putting them at risk of covering their debt payments and venerable to other operational impacts to the business.

Underserved Geographies

Geographical diversification is something that most investors do not understand well and therefore are not able to properly hedge their bets in different parts of the whole that represent strong growth opportunities. This is not only because of a lack of knowledge and understanding, but also a lack of accessibility because of things like geopolitical risk, different rule of laws, liquidity, as well as easily accessible platforms and transportation in / to these areas.

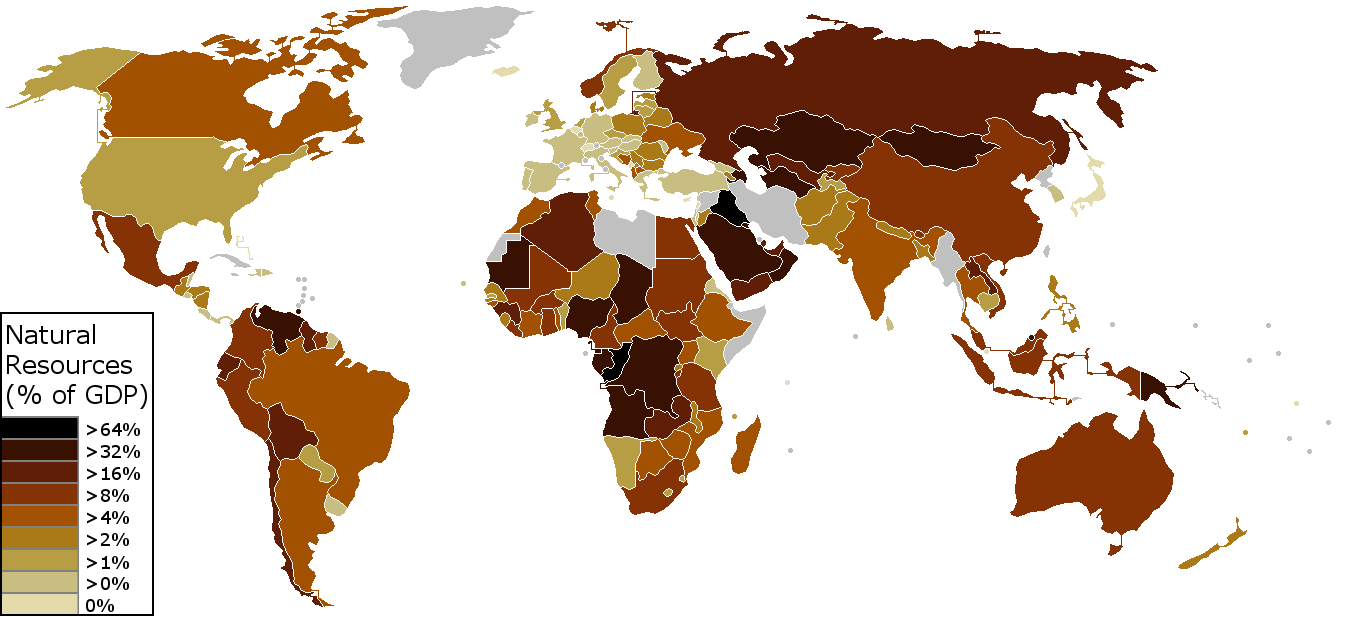

The relationship between the opportunities that exist in underserved geographies overlap heavily with the opportunities in technology. This is because many countries that are rich in natural resources and human capital are far behind the west in terms of technological advancement. China is a prime example of a recent growth success story, growing not only in population but economic supremacy over the last several decades. India seems to be the next country that’s primed for growth with the highest ratio of working age to elderly people, at over 10 to 1. That working age population is full of incredibly bright tech talent, which has and almost certainly will continue leading to a myriad of businesses being created both domestically and abroad. This presents wonderful opportunities for investment into the region and/or partnerships with Indian businesspeople. The next highest working age to elderly ratio is China but that number is likely to decrease sharply because of the one child policy.

In terms of more tangible assets, Africa is known for its extensive resources and is growing faster than ever in all aspects of economic activity. Nigeria, Africa’s largest economy, trades around $1B in $BTC and exports around $30B of crude oil every year. Many countries in Africa seriously lack proper infrastructure to even traverse across the country by car, let alone the financial systems needed to develop into the economic superpower that it inevitably will one day. Many countries, namely China and India, have been investing heavily in the continent as they see the promise of Africa to develop into a massive superpower backed by natural resources and an incredible pool of human capital.

Geographical diversification doesn’t just mean other countries, it can mean underserved areas of the United States as well. COVID was a time when many people started rethinking how they want to live their lives, particularly coming to value a better quality of life over being in highly concentrated urban areas. Red states with more friendly development/zoning laws and open space like Utah and Florida saw a massive influx of people during that time and it doesn’t look like that growth is slowing, even though places like NYC have largely returned to “normal,” at least in terms of housing prices.

Office is a completely different story, however, and we expect to continue seeing serious disruption in that space. It’s likely that governing bodies and political decision makers will need to seriously consider allowing the redevelopment office into more practical assets like multifamily apartments or affordable housing. This need can be seen in large cities like New York City all the way to small resort towns like Sun Valley, Idaho and Park City, Utah. Long story short, there is not enough affordable housing to support the labor needed to match demand. This is an issue that many large institutions are working to tackle, but even with large, coordinated efforts this will still be a difficult challenge to get in front of.

Education and Regulation

Two things that very few people like talking about, and even fewer people are excited about pursuing a career in. That said, educating people about opportunities to better themselves and their situation is perhaps one of the greatest opportunities that compliments technology that is available for everybody with access to the internet today.

Over one third of the world has never used and doesn’t have access to the internet and therefore, over two billion people do not have access to the near infinite amount of knowledge that you and I have access to every single day of our lives. Of course, most people want to help educate others for free, look at what we do with all our articles, as an example. However, there are ways to monetize this and benefit in non-monetary ways as well. Consulting and “freemium” style educational content are great ways to monetize, and non-monetary benefits of providing free education may include gaining trust from important people, building long-lasting relationships, and opportunities for travel and other forms of monetization in the future such as speeches or books. Afterall, most of the world’s largest institutions are in the business of monetizing education, so you shouldn’t feel bad about doing it either. A good place to start could be with a freemium model to gauge how large of an audience appreciates your educational content, and work to start building up monetization strategies from there.

Regulation is something that few people take the time to understand and that is incredibly boring for most people. Because of this, however, it presents a massive opportunity for those who take the time to understand it and work to improve and/or disrupt it. Both education and technological advancements pose incredible opportunities for this disruption. Education in the sense that regulatory consulting can be very lucrative and technology in the sense that all regulation across geographies and industries is likely going to be completely redesigned over the coming decades.

We say this because of something called a “smart contract.” For those who don’t know, smart contracts are basically legal contracts that are verified by algorithms rather than a central legal body. Of course, there are pros and cons to smart contracts, but the point is that they are going to be very disruptive for regulation of all assets and regions. Unlike anything ever seen before, smart contracts allow legal agreements to be carried out with no intermediary while maintaining a high level of mutual trust. What this means is that the regulation of tomorrow will be written not just by lawyers, but by coders and everyday people as well.

Escrow is an example of where smart contracts will likely have an extremely big impact. That is because, currently, in order to complete a transaction between two parties, an escrow service is often used to verify that both parties are acting in good faith. This works by allowing the buyer to send their money to an escrow account, and for the seller to see that money there before releasing their asset(s) to the buyer. There has been an entire industry built around this service that is about to get turned upside down by algorithmic approaches to achieving the same level of trust, transparency, and action with no middleman.

This revolution presents a massive opportunity for anybody willing to put in the work, learn something new, and then apply that knowledge to a gap in the market. The more that technology advances, the easier it will become to implement these changes on a large scale. Historically, regulators in the US have been very behind the curve of the latest and greatest technologies partially because they don’t take the time to understand it but also because they assume that everybody is acting in good faith (innocent until proven guilty or something like that), which creates a largely reactionary response when things don’t go well.

This once again presents a great opportunity to help regulators get ahead of the curve by working with them and educating them on the technologies that will drive change across industries in the coming years. Becoming a builder of these technologies will likely be one of the most profitable roles anybody could have in the coming years, being a technology and regulation consultant will likely be a close second, and educational content providers could become a third-place contender (and at the very least, win you some goodwill with people that it’s beneficial to gain the trust of).

Of course, nothing put forward in this article, or any of our public facing content, is or should be considered financial advice. This is merely us sharing our thoughts and perspectives on where we think the world is headed and how we plan to benefit from it. If this resonates with you, or if you have any questions, concerns, or feedback, we would be delighted to hear from you. Please feel free to reach out to us at hello@blackmountainig.com or 435-655-5211.

Thank you for reading!

The Black Mountain Investment Group Team

0 Comments