Blockchain: a Cure for FX Discrepancies and International Trade Issues

Written by John Trahan, edited by Kyle Niedzwiecki and Elijah Levine

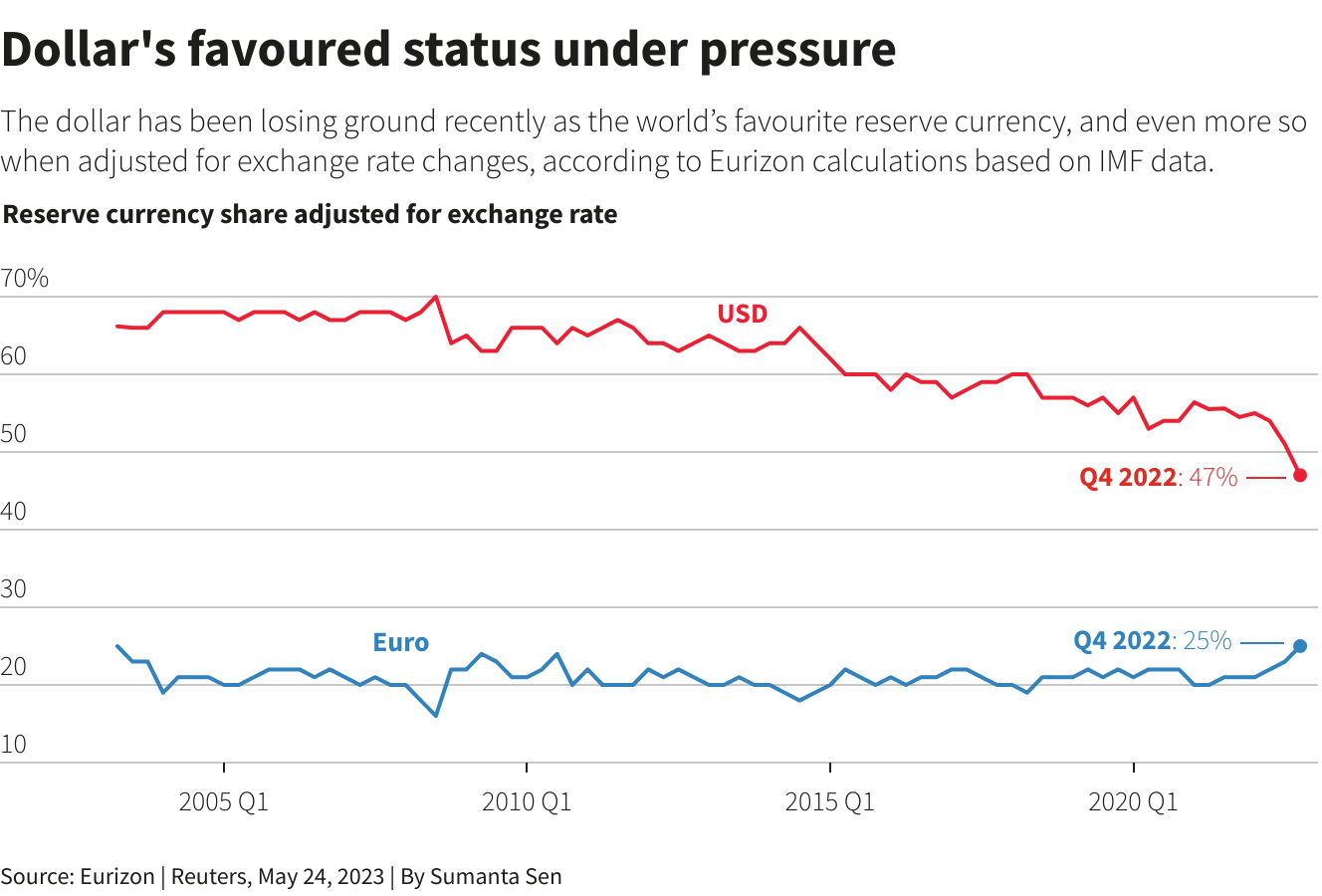

Since the pandemic, the world’s economies have and continue to see numerous tremendous stir-ups. Most countries faced high inflation and have attempted to curb this by aggressively hiking interest rates. The United States faced a default scare. Massive global players are moving away from trading in USD, threatening dollar depreciation for the first time in modern history.

China and Brazil recently agreed to trade in the Chinese Yuan. As China is the greatest economic rival to the United States and Brazil is the largest economy in South America, this represents a monumentally pivotal point in the history of the United States Dollar.

Other South American countries have too been ditching the dollar. Venezuela, a top 10 exporter of oil, recently de-dollarized as well. Argentina now settles imports with China using yuan. Two other massive global economies, India and Russia, also de-dollarized in the last year.

An easy explanation of this, especially in Latin America, is that the United States has been blatantly abusing the economic sanctions that arose from the 150-year hegemony of the United States Dollar. Now the tide is shifting and countries are de-dollarizing at an alarming rate; 85 countries have reportedly de-dollarized since the Great Financial Crisis. Brazil, India, Russia, China, and South Africa have also created an official trading partnership and are in discussions around a new asset-backed currency to trade amongst themselves.

The alliance is called BRICS, and many more countries have expressed an interest in joining, including several US enemies. A new stabilized currency between these highly influential nations could lead to a further decline in the value of the dollar, and overall much more global destabilization. In the long run, this could end up being a good thing for global currencies as a whole, but it is pretty certain that it will end up harming the dollar in a massive way.

Besides economic sanctions, numerous macroeconomic factors can affect the strength of one currency with respect to another. Perhaps the three biggest factors are:

- Government Debt

- Interest Rates and Inflation

- Balance of Payments

These indicators of foreign exchange rates all come down to the overall supply and demand for a currency which are largely related to the reliability of government debt, the setting of interest rates, a country’s inflation rate, and its terms of trade.

Government Debt

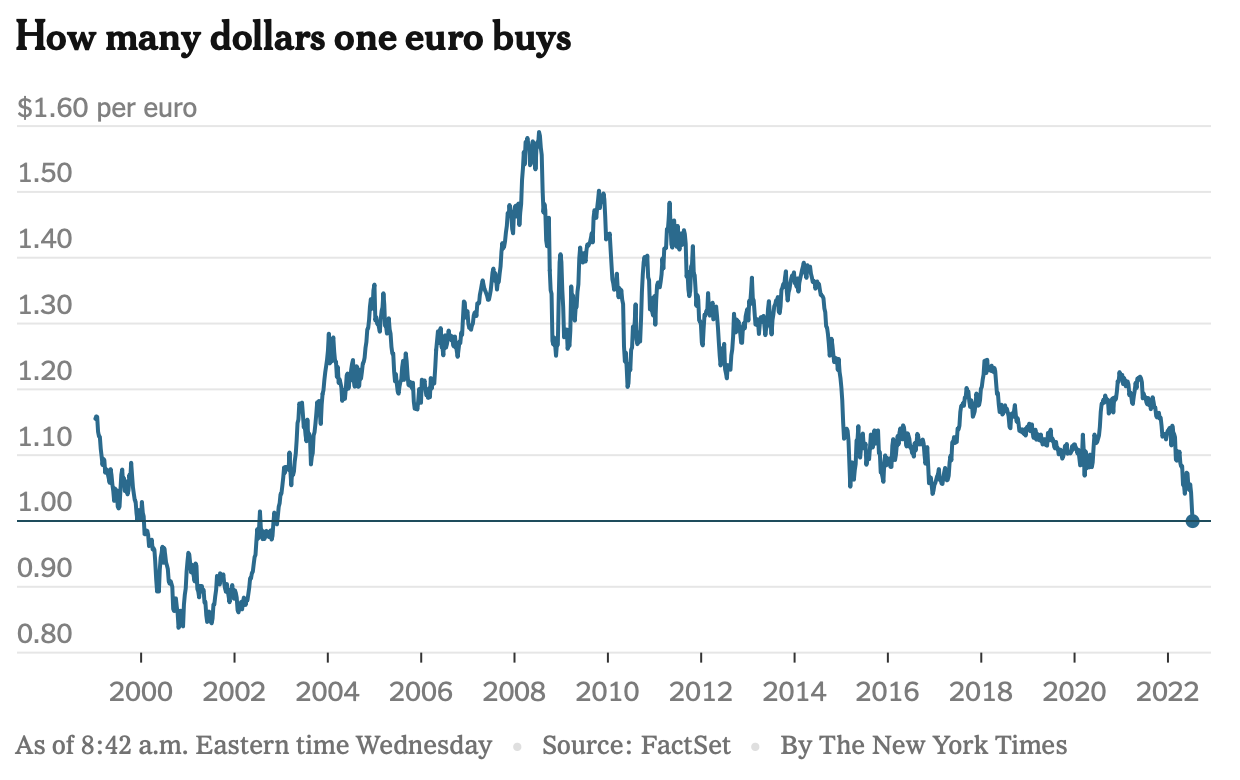

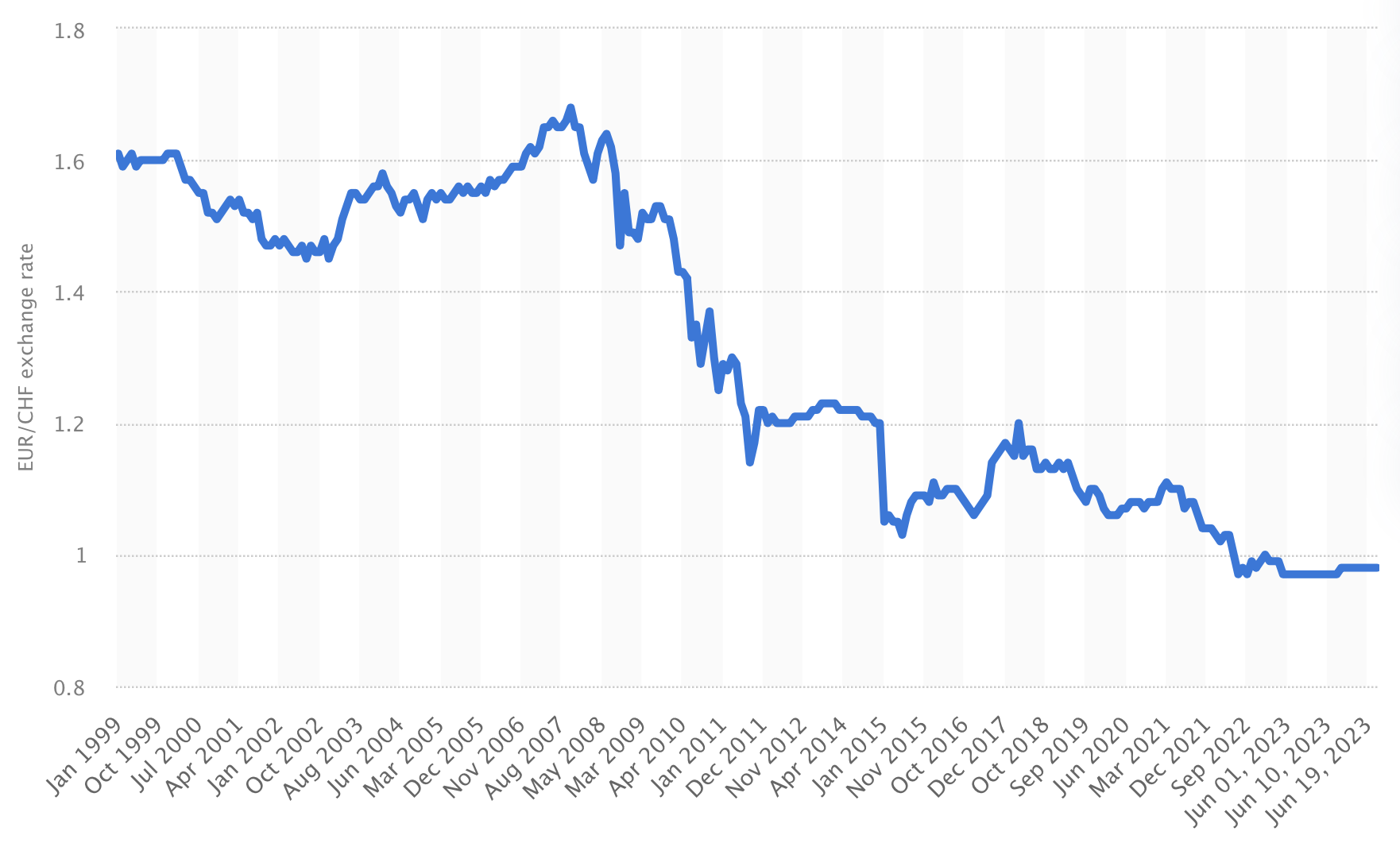

Greece is an interesting case study of a country that became overrun with high national debt in the last decade. Even though Greece makes up just a sliver of the Eurozone’s GDP, this level of debt can have numerous implications on the power of the euro in the foreign exchange market.

The European Union had to bail out Greece from its international debt obligations three times in the 2010s on the condition that they establish the Hellenic Financial Stability Fund. There is a reason that the economic powerhouses of the European Union – the United Kingdom and Germany – stepped in: to avoid the depreciation of the euro. This would make their imports overall more expensive, therefore limiting the purchasing power of the euro.

With countries like Greece heavily driven by tourism, foreign visitors would have had more purchasing power in the European Union, but Europeans would have had less purchasing power abroad. The European Union understood the implications of default on the foreign exchange market for the Eurozone as a whole. In a region where tourism is a key part of the economy, fiscally responsible policy is key for economic growth. Notice the sheer volatility of the euro and dollar trading pair in the 2010s below:

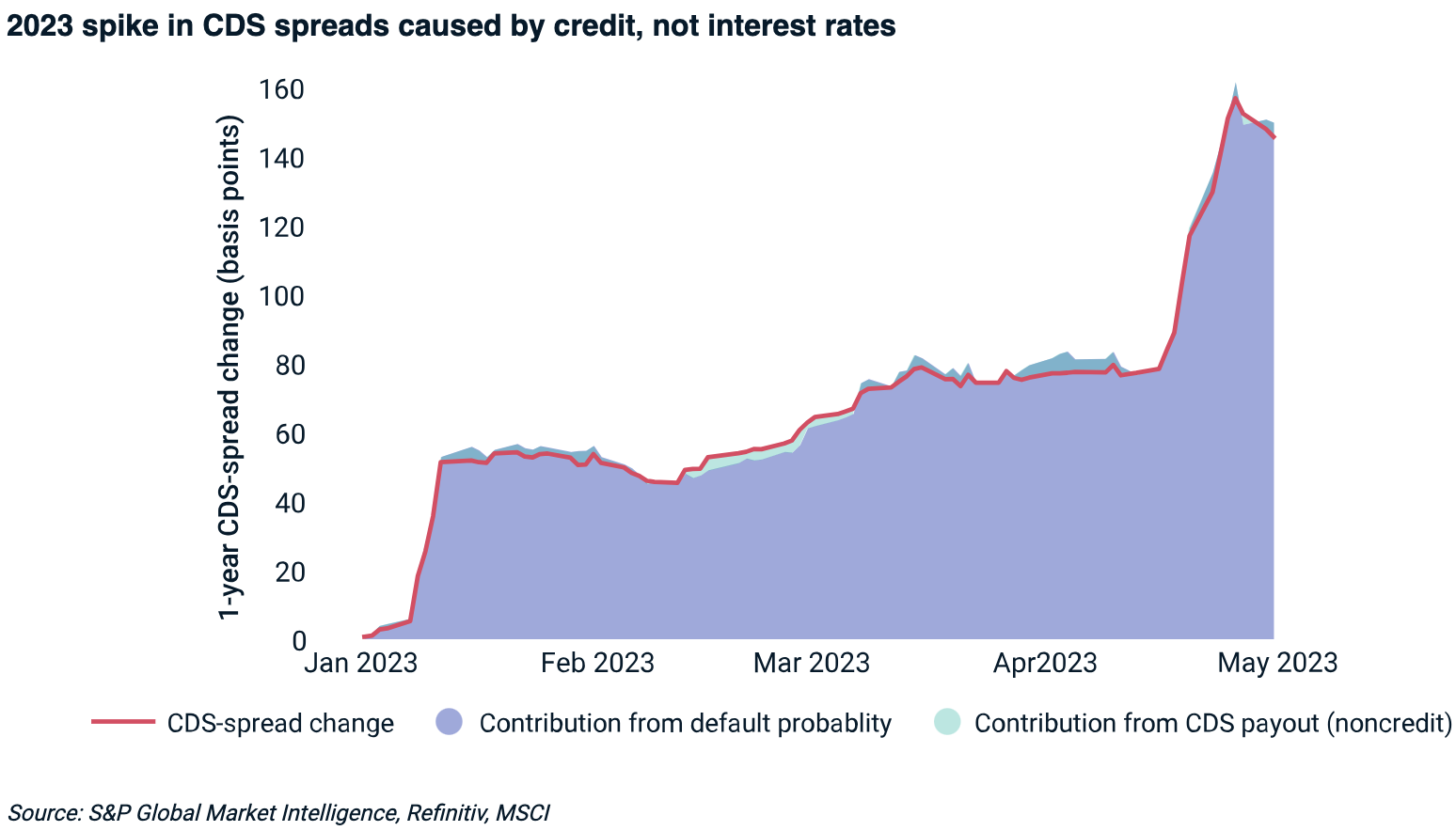

The demand for the dollar decreased during the risk of a United States default in May 2023. United States government bonds have always been “risk-free,” but this notion of course changes with the possibility of default.

Although this possibility was still slim, the cost of insuring U.S. debt for one year reached well over 100 basis points, the highest since the 2008 recession. This level of low investor sentiment hurts the stability of the United States Dollar immensely. This forced lawmakers to come together and raise the debt ceiling with urgency in order to prevent further instability.

Interest Rates and Inflation

The demand for a currency increases as interest rates increase with respect to other currencies. Foreign investors seek high returns, so they are bound to enter markets where the investment yields the highest returns. Interest rates and inflation are directly correlated; monetary policy attempts to curb inflation by reducing interest rates to reduce consumer spending.

However, inflation hurts the value of a currency relative to other currencies. This brings up the concept of a yield differential: the difference between interest rates and inflation. Countries must attempt to maximize their yield differential to increase demand for their currency. In the American market, interest rates are not necessarily strengthening the dollar because investors are also looking at the Consumer Price Index (inflation).

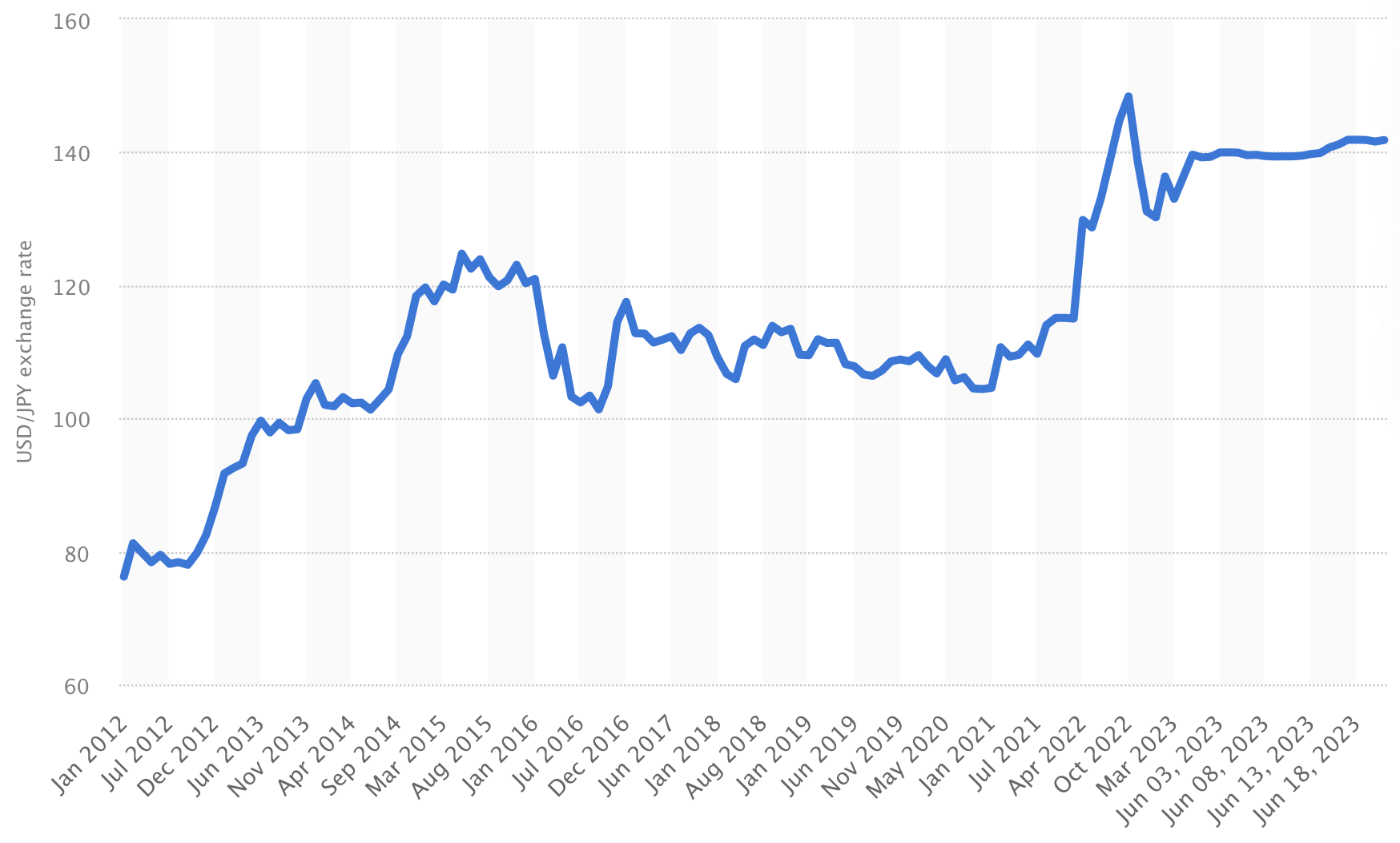

One great example of these factors impacting the foreign exchange market is to look at the United States and Japan. The Federal Reserve uses a contractionary monetary policy to combat inflation, while the Bank of Japan uses an expansionary monetary policy to curb deflation and promote consumer spending.

Japan’s interest rate is currently -0.1%, but this makes sense when you notice the Japanese CPI was in the negatives from 2019 to 2021. The United States asset market attracted Japanese investors hoping to see returns on their yen. However, inflation expectations look bright for Japan as their CPI was around 4% in April. Economists believe this inflation was due to energy and supply chain problems, and the International Monetary Fund now believes that their 2% inflation target is possible due to a surge in tourism.

Being the third largest economy in the world, with carefully executed monetary and fiscal policy, Japan has the potential to rebound from a 30-year economic slump. Trade will once again be executed using the yen, and the yen will appreciate. That said, Japan is still facing other serious demographic issues that may prevent this optimistic view from ever coming to life.

Balance of Payments

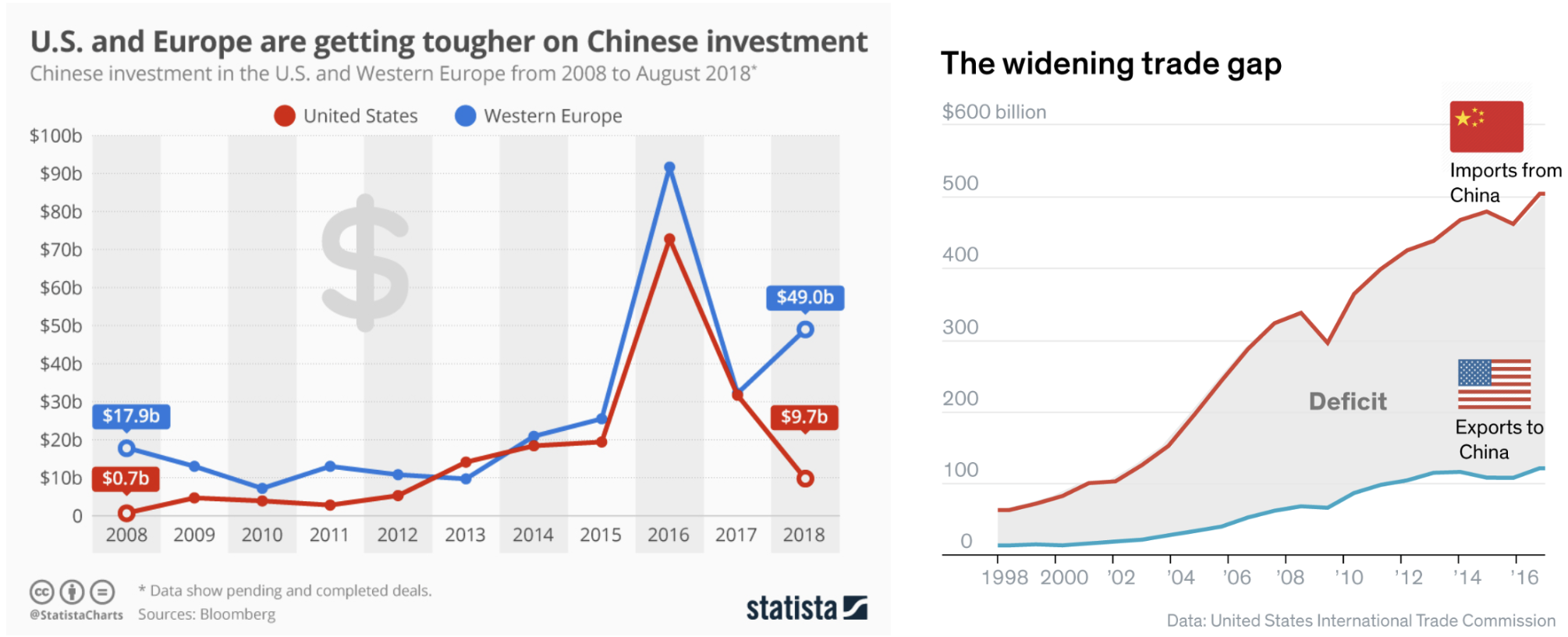

Foreign exchange rates are driven by trade surpluses and deficits. China has a large trade surplus with the United States which serves as a prime example of foreign exchange appreciation and depreciation. United States companies purchase Chinese goods using the dollar, in turn creating a surplus of United States Dollars. To book a balance, billions of United States Dollars are then invested into United States government bonds and other US assets by Chinese companies, overall increasing demand for the dollar and the resiliency of both economies (but currency-wise, particularly the USD).

Because China is using dollars to invest, there is an excess supply of Chinese Yuan, further depreciating the currency with respect to the dollar. China is attempting to bring as much trade as possible to their own currency, evident in their recent trade deals with various Latin American countries, in an attempt to strengthen the yuan.

Still, one Chinese Yuan is only worth $0.14 (notice how nearly every currency in the world, including cryptocurrencies, is still denominated in USD). Chinese investment in the US would have likely still risen as the trade gap widened if the Fed did not intervene… China has a history of making it difficult to take yuan out of the country in attempts to artificially hold up its value and “resiliency.”

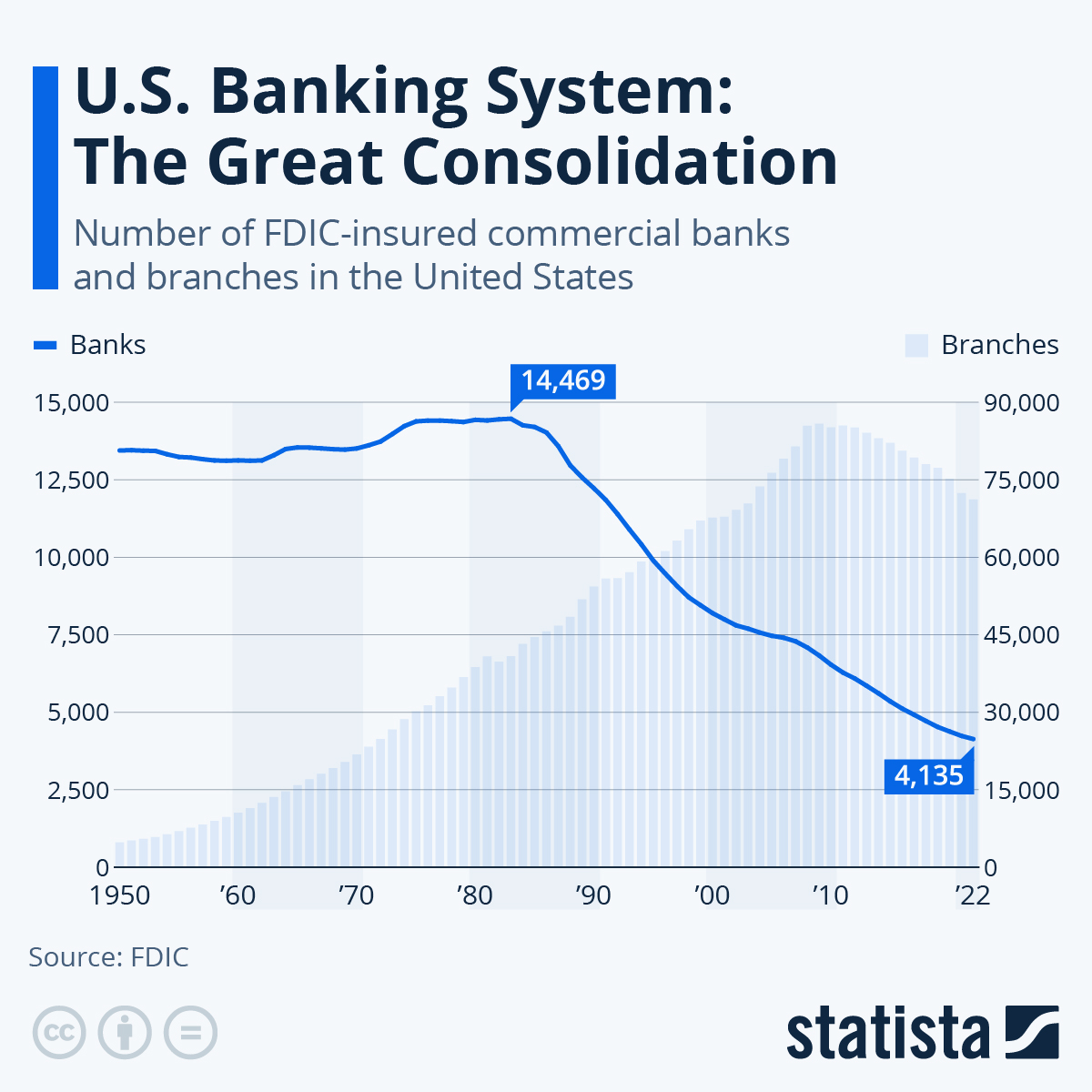

Statista and Seller Accountant

A country’s monetary and fiscal policy, economic environment, and trade regulations all have implications on their currency’s relative value, and we see macroeconomic news shift exchange rates all the time. That said, more valuable questions do arise:

How can companies mitigate foreign exchange risk when selling internationally?

How should two countries with equally powerful currencies choose which currency to conduct trade with?

How do entities end up on the right side of the lending and borrowing equation in FX markets?

How can people leverage their purchasing power cross-border during times of economic uncertainty and even disaster?

How can trade partners ensure fair terms of trade?

With the rise of hedging and financial derivatives, companies can mitigate a portion of the risk that comes with producing in countries that have poor outlooks on their country’s currency strength. Another partial solution is to produce goods in each respective market, but this stretches management thin and increases PP&E on a company’s cash flow statement. Of course, whether you are lending or borrowing comes to play a very important role as well.

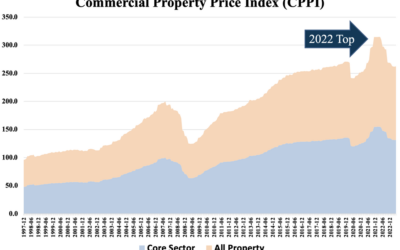

The Swiss Franc and the Euro are almost on par with each other, but the trade is not done in one specific currency or the other. Euros are constantly being converted into francs and vice versa. Numerous trade agreements are being written and overturned as international trade desires become disputable. Now, with trade being more valuable for either Switzerland or the European Union if it were conducted in their respective currency, trade issues are bound to arise. This is truly evident by looking at this year’s exchange rate:

Decide where you are bullish and bearish based on historical data, reliable projections, and as much boots-on-the-ground data you can gather to get a reliable pulse on the local markets. Finding and working with local operators is one of the best ways to get a true understanding of local market dynamics. Understanding these local market dynamics is essential for success in foreign investing, whether that be lending or borrowing. However, understanding market dynamics is easier said than done. Dynamics are ever-changing, and the right side might alter after currency fluctuations, which in today’s times, can be very unpredictable.

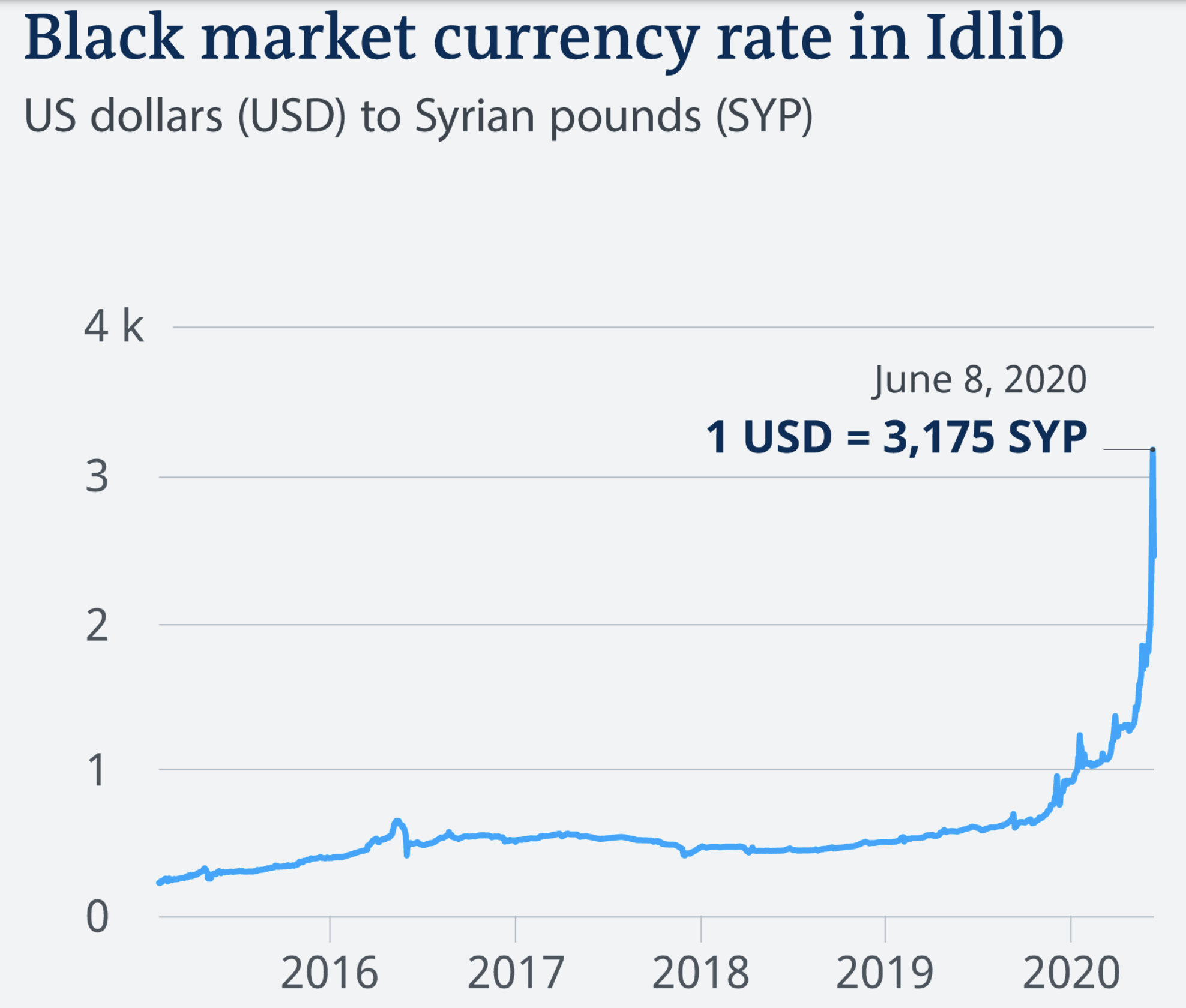

In times of economic distress, countries lose purchasing power quickly. In Syria, citizens want to flee but do not have easy access to transfer their money into euros, pound sterling, or dollars. They also have no trust in the banks. With over 100% inflation and rising political hostility, it is almost impossible for them to not lose a plethora of their savings.

Trade agreements are complex, and often broken and manipulated. Acknowledgment about correct free trade agreement frameworks is often far-fetched and companies utilize small shortcuts to extrapolate benefits from their trade partners. Investing in countries with reliable rules of law is critical, but we see this is hard to come by even in the developed world:

All these issues can be solved with a decentralized and secure form of currency for international trade. Along with the development of smart contracts within blockchain protocols, a new player in international trade will arise: cryptocurrency.

Terms of trade can be settled using smart contracts, a pioneering technology first developed by the Ethereum network that has now spread to other blockchain protocols as well. Citizens seeking refuge without trust in their country’s banks due to political instability can convert their money into cryptocurrency, and then use their key(s) to access that same wallet without the large exchange rate discrepancies. Countries can also begin to trade in neither of their currencies, reducing impartiality and the need to make uncomfortable decisions. Using a single currency throughout the supply chain, from input prices to selling goods, companies are not subjected to exchange rate fluctuations, only the volatility of the cryptocurrency (if any).

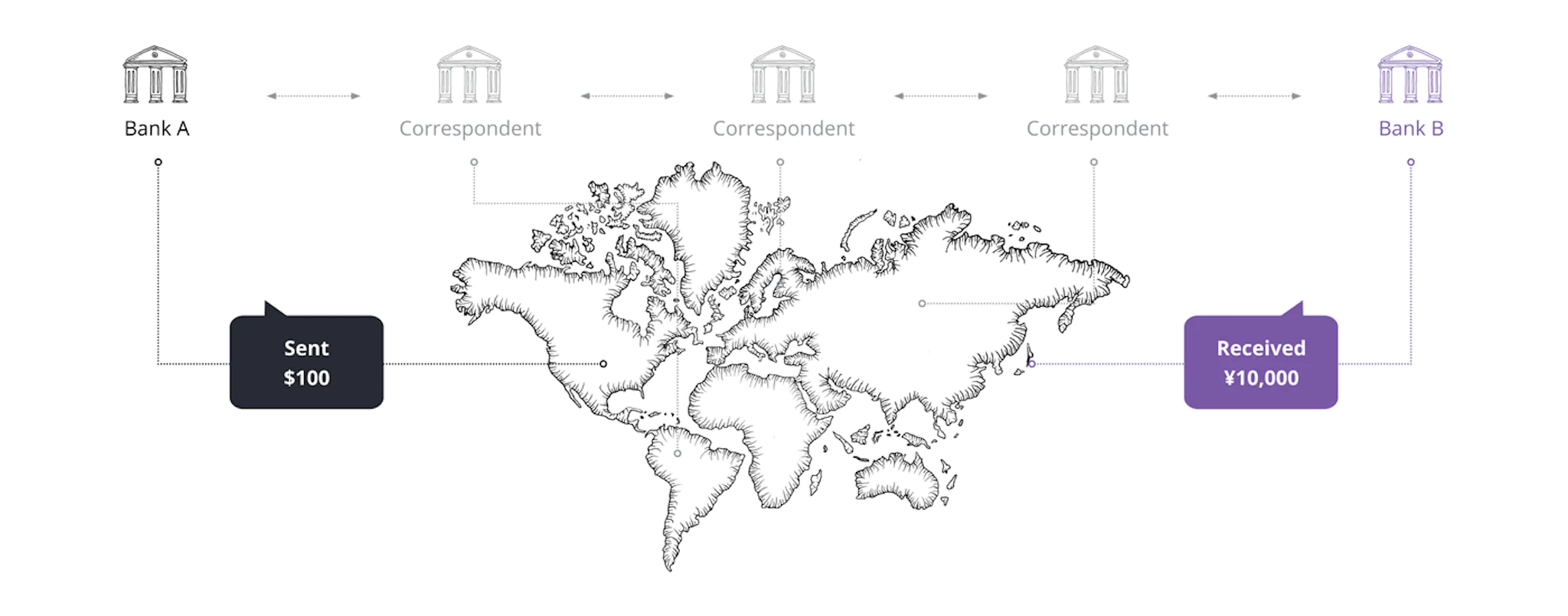

Despite the cryptocurrency hype that began with Nakamoto’s whitepaper of Bitcoin in 2008, there has been hesitation in adopting cryptocurrency for international trade, a space where decentralization and security should be at the forefront of companies’ and countries’ minds. Cryptocurrency is still not widely accepted, the coins are often volatile, and regulatory issues continue to arise. However, transaction costs have decreased, and smart contracts take away the need for expensive intermediaries to write and verify trade agreements (not to mention holding money in a mutually-trusted third party escrow account). The main benefit of implementing cryptocurrency in international trade is the reduction of both trade and currency risk, which are just two of the myriad of issues that frequently arise in foreign exchange markets.

There has also been substantial development in terms of security and regulatory solvency in the blockchain space. However, it’s still not on par with most governments’ ideals. It will be at least a few years, but when certain blockchains can rid themselves of fraudulent activities, I envision a boom in using cryptocurrency for cross-border trade. Once coins prove their security by developing fraud-proof methods of transaction, cryptocurrencies like Bitcoin and Ethereum have a chance to create a more unified world of trade, free of currency risks and intermediaries.

The American government has acknowledged two things:

- The dollar is losing ground as the common international reserve currency.

- Digital currencies can resolve a lot of issues in the foreign exchange and international trade markets.

Tether (USDT) and Circle (USDC) are the two leading cryptocurrency stablecoins that are backed by and pegged to the United States Dollar one to one. By nature, they are far less volatile than other cryptocurrencies like Bitcoin and Ethereum.

The last thing the Fed wants to do is issue a currency that lacks intermediaries and is permissionless like most underlying blockchain technologies. On the backend, Tether is even more centralized than the Federal Reserve, as there are only 13 employees, with less than half of those employees being executives or on the board of directors.

The Fed released a research paper surrounding the digital transformation of currency, titled Money and Payments: The US Dollar in the Age of Digital Transformation. Written in January 2022, the paper highlights a lot of the same currency risks discussed in this paper, and their proposed solution is a Central Bank Digital Currency (CBDC). Backed by a central bank, CBDCs can be used both by financial institutions and retailers as a digital form of fiat currency. They highlight a few potential benefits of implementing a CBDC:

- “A safe foundation for private institutions to meet current and future needs and demands for payment services.” This implies that the public will be free from both credit and liquidity risks, which has implications for most consumers and smaller businesses; they would be free of heavy costs and risks for implementing a safe venue of private money. Small, repetitive sums of money can easily be sent by the satisfaction of a smart contract.

- CBDCs imply cost reduction of remittances and other international payments. Remittances often lose 50% of their value in fees, and a CBDC could reduce this through simplified distribution channels. This applies to intranational payments as well; lower costs yield financial inclusion, especially for lower-income households.

- The developed world has drastically decreased its use of physical currency during transactions. United States physical currency only accounted for 19% of transactions in 2020, under half of transactions from 8 years prior. These transactions use nonbank money, money not issued by the central bank or commercial banks. This leaves customers with credit and liquidity risk, so a CBDC can keep customers paying with their mobile apps and credit cards without bearing this risk.

- As mentioned, it is unlikely the Fed would not propose a robust transformation like a CBDC without a currency benefit as well. The Fed’s research mentions that a CBDC in other countries would hurt the dollar due to a decrease in dollar demand, so a United States CBDC would preserve the dollar’s status as the international reserve currency. With all the recent hype, It really is a race to what country will release the best and most reliable CBDC at this point.

The irony is that digital currencies have technically been around for over two decades. That said, a CBDC could still rupture the current financial environment.

In early 2023, the lack of solvency in commercial banks caused many of them to fail, including First Republic Bank and Silicon Valley Bank and requiring a massive government bailout. Imagine the potential bank run looming in the hypothetical implementation of a CBDC. Further imagine the ability to prevent bank runs all together by technical currency systems being able to prove solvency throughout the entire system for consumers and administrators alike.

Drawing from Keynes’ liquidity preference theory, it makes sense how risk-averse investors would drive towards the easy accessibility of a CBDC and the liquidity offered due to the central bank’s backing, so CBDCs could hypothetically end commercial banks as a whole. This further centralizes our money, which impacts transaction time and could yield harsh fees for users. It also greatly impacts the control that the banking organizations have over users, which is critics’ current biggest fear. The question is if the current digital banking oligopoly in the US (and the world) will cease to exist or emerge stronger than ever before as CBDCs get rolled out.

With the lack of decentralization, CBDCs are likely not the direction in which currency digitalization is headed. Stablecoins like USDT are not necessarily the direction either because the central bank influences and fiat currencies that back them. Many have started to discuss the value and relevance of decentralized blockchains and what their role should be in solving these problems. However, most blockchains are not as decentralized as most people think. A closer look at Ethereum’s chain, for example, shows that the data is centralized, and stored on Amazon Web Services, a large publicly traded enterprise cloud solution. Transparency is vital for a cryptocurrency to emerge victorious in the international trade market.

Internet Computer Protocol (ICP) and other arising cryptocurrencies might just be a step in the right direction toward a solution for financial constraints on international trade and money movement. ICP, for example, can not be forked, is decentralized yet secure, and the transaction speeds and gas fees are the lowest the blockchain space has ever seen. Most importantly, ICP is immensely scalable, which is needed in the international trade space. ICP seems to solve the previously-unslolveable blockchain trilemma of achieving decentralization, scalability, and security at all once. The remaining factors to tackle are fraud and government confidence.

Rejecting modern-day technology would be like rejecting paper money and trying to stick with bartering goods back in the day. Although all change takes time, given the rate at which this technology is advancing, it would not be surprising if we start to see widespread adoption of digital currencies in the next five years– whether they be in the form of CBDCs, stablecoins, more standard blockchain protocols, or something entirely new. Either way, it is absolutely undeniable that this technology will bring a much needed level of transparency, speed, honestly, and efficiency to global currency markets.

Because it’s likely that already existing technologies will be the solution, large financial institutions have recognized that the infrastructure to support these technologies (wallets and exchanges in particular) will be where most of the value can be captured. Citadel, Fidelity, and Charles Schwab, for example, recently launched EDX, a centralized, non-custodial crypto exchange. They know all too well that a lot of money can be made from transaction fees. Citadel has been capitalizing on exchange fees for years, in fact, 75% of its 2022 profits came from transaction fees rather than market arbitrage, contrary to popular belief.

The day this article is being released (July 20, 2023), JP Morgan, Wells Fargo, and BNY Mellon pioneered the adoption of FedNow, the US government’s new instant payment system. Competing with the likes of Zelle, Venmo, and Cash App, FedNow offers fast money transfers across banks, a step in the right direction for a more efficient financial system. Zelle, Venmo, and Cash App have reduced the physical spending of dollars and created transfers with nonbank money, which has posed a threat to centralized banking, perhaps why FedNow is pioneering bank-to-bank instant transactions where credit and liquidity risks are minimized.

Solving foreign exchange and international trade issues are puzzles that will take time, disruptive innovations, and ingenuity. That said, it’s not that out of reach and something that the brightest minds in both technology and finance around the world are currently working around the clock to solve. Technology is changing all aspects of our lives right in front of our eyes, but very few people are realizing it, and even fewer people are going to participate in the upside. With the seismic shifts happening, those who put in the work now will be able to capitalize on the opportunity of a lifetime.

Thank you for reading,

The Black Mountain Investment Group Team

As always, the contents of this article are a cumulation of our own research and opinions; nothing put forward in this article is or should be considered financial or legal advice.

0 Comments