Blockchain can truly touch all aspects of real estate. That said, some touchpoints are inevitably more valuable than others that can be improved with other modern technologies. For this analysis, I will focus on the main areas where blockchain can make a true value-producing impact on real estate in an irreplicable way. I will then discuss how those irreplicable attributes can add value to various real estate ecosystems and give example of companies doing so.

Capabilities That Blockchain Can Do Better Than Any Other Technology

1. Organization and verification of immutable data

Blockchains can establish one source of truth that can never be changed. When you go to diligence Apple, their financial statements have been reviewed and verified not only by dozens of lawyers and accountants, but also by the SEC. Still, those numbers can be amended after the fact. In real estate, verifiable diligence information is much more scattered and difficult to access, let alone organize all in one place and feel sure about its reliability.

From titles to materials to “knowing your customer” or “KYC,” verification of the truth throughout real estate transactions and operations is incredibly important to the success of all parties.

2. Moving money

Domestic monetarily transactions are pretty much entirely conducted using banks, which have been considered reliable since the start of financial institutions. That said, there have been times when banks are not fully trustworthy, especially as liquidity needs rise and banks do not have enough liquidity to meet the demand.

Business Models Where Those Blockchain Capabilities Can Add Real Value

1. Marketplaces

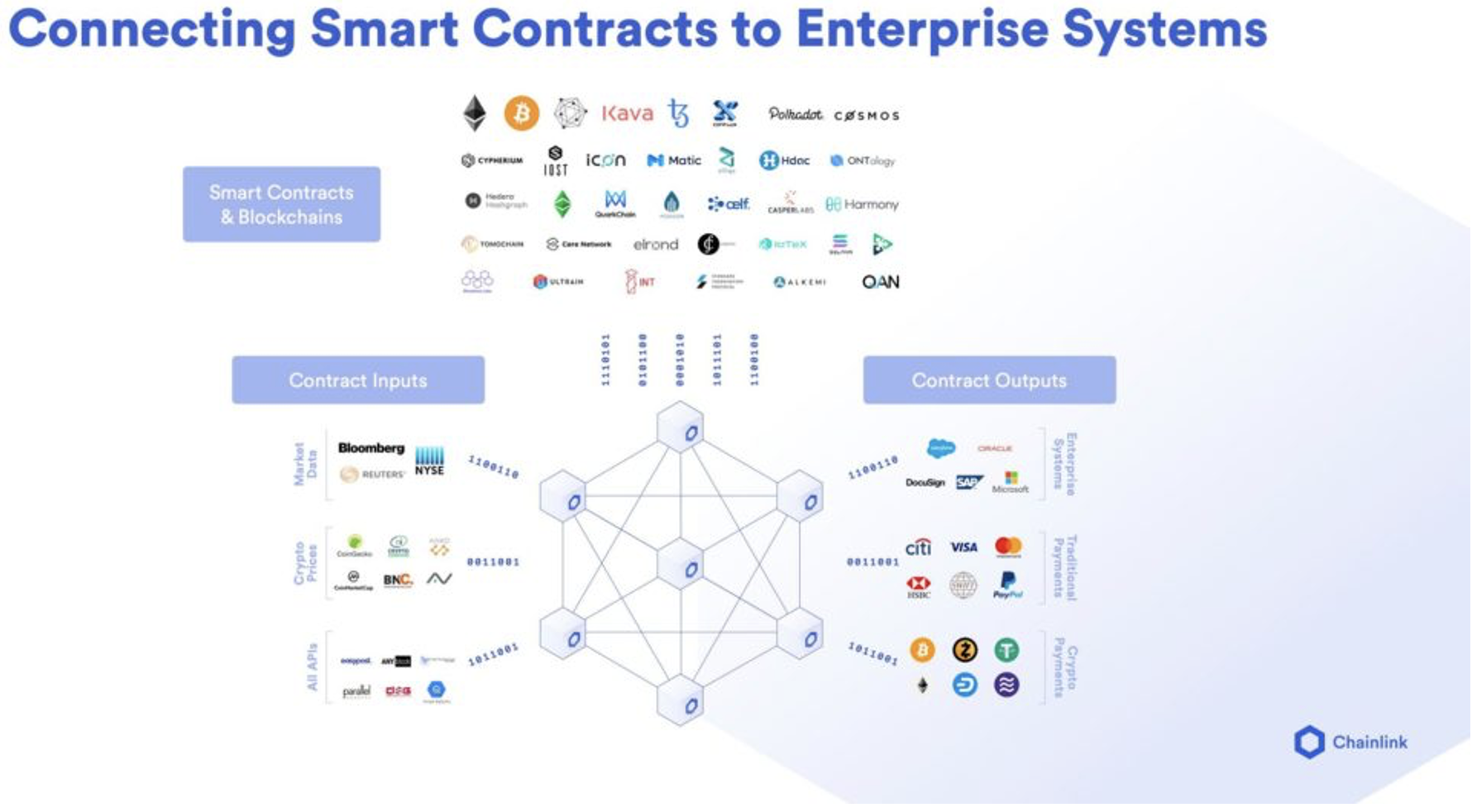

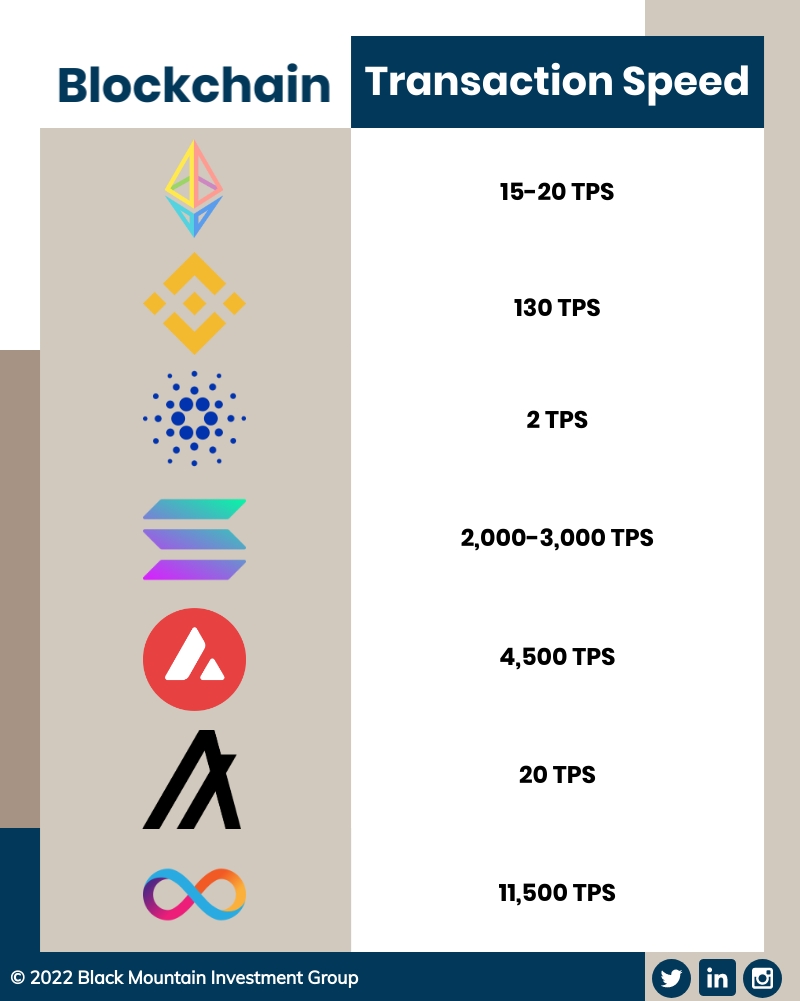

Modern blockchain technology pioneered by Ethereum (“ETH”) and further improved by dozens of other Layer 1s can provide secure, non-intermediated transactions through smart contracts. A layer 1 blockchain is a type of blockchain that is designed to provide a high level of security and reliability. They are built on top of a secure underlying infrastructure (in the case of ETH that’s Amazon Web Services or “AWS”) and they have several features that make them well-suited for enterprise use.

Different layer 1s have been developed to help improve the user experience by improving the speed and lowering fees. See some examples below and please note that while Bitcoin is a layer 1, it is considered dinosaur technology in the blockchain space because of its limited capabilities and how expensive and slow the network is. It’s important to understand how layer 1s have developed to allow for more complex and energy intensive transaction capabilities such as would be required in many contexts of real estate applications.

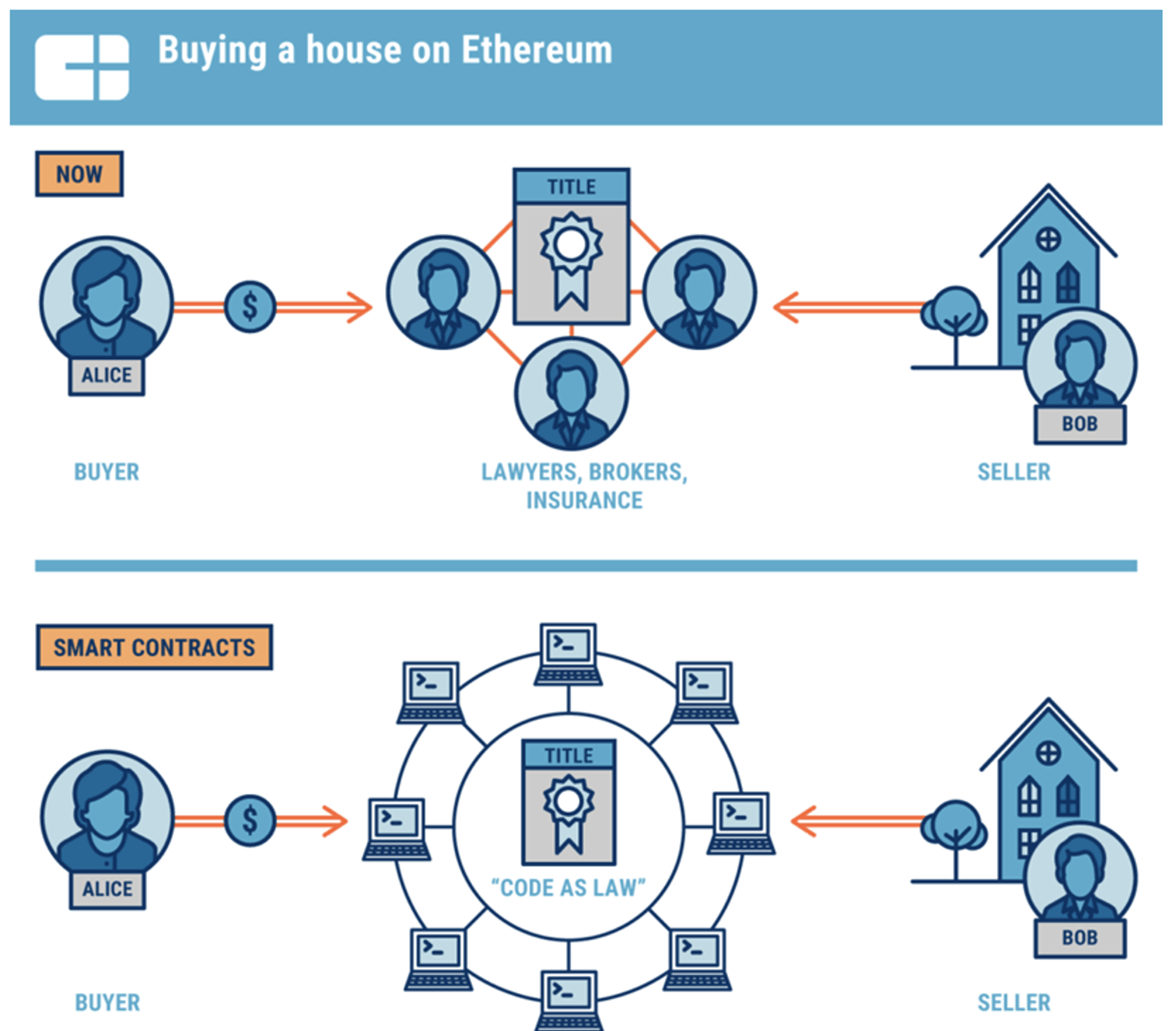

Speaking of those advanced capabilities, smart contracts are a more recent innovation in blockchain technology first released on the Ethereum network due to increased processing capabilities and more advanced technology. Smart contracts use technology to verify that both parties in a transaction do what they say they are going to do.

That said, smart contracts have been around for a while, one example being vending machines (instead of a person across from the register), and more recent examples in the context of real estate would be using blockchain-based digital smart contracts in lieu of a broker, lawyer, insurance and title agent, and/or escrow account. The fact that technology has the potential to remove these previously imperative aspects (the middlemen) of a real estate transaction gives a massive bullish indicator to the possibility of blockchain technology being able to add value to real estate marketplaces. It rolls middlemen solutions into one piece of tech that both buyers and sellers can benefit from and have transparent access to.

Fractional ownership has been discussed in the context of a “real estate disruption” for some time. Of course, many companies like Fractional.app and Fundrise have been capitalizing on the opportunity outside of the context of blockchain for some time. These companies innovate not only with legal structures by providing retail investors access to traditionally private market opportunities, but also by building and deploying user friendly technology (usually in the form of apps) that users feel empowered and inspired to use.

Even though blockchain might not be necessary for fractional investing to happen, I do believe that there are places where it can add significant value to the ecosystem. Take Balcony DAO, for example, a startup working to tokenize shares in investment properties through Non-Fungible Tokens or “NFTs.” Not only does each investor’s individual NFT represent their share of ownership in that given property, but they are building out the ability to deliver “data rooms” to investors via specific, KYC-ed NFTs.

The main benefit of this would be that groups on both side of the equation (the data viewer and the data provider) are certain of each other’s identity, and it would also create a more streamlined, secure, and organized way to view, compare, and continuously reference important diligence material. Tokenizing real assets is not necessarily something that new, but delivering, immutable, KYC-ed information through that tokenized asset (or even alongside it) is extremely novel, interesting, and promising for the space. Overall, the verification, efficiency, and streamlined organization blockchain can provide to marketplaces, from traditional brokerages all the way to modern fractional investment platform is undeniable value add.

2. Asset Management

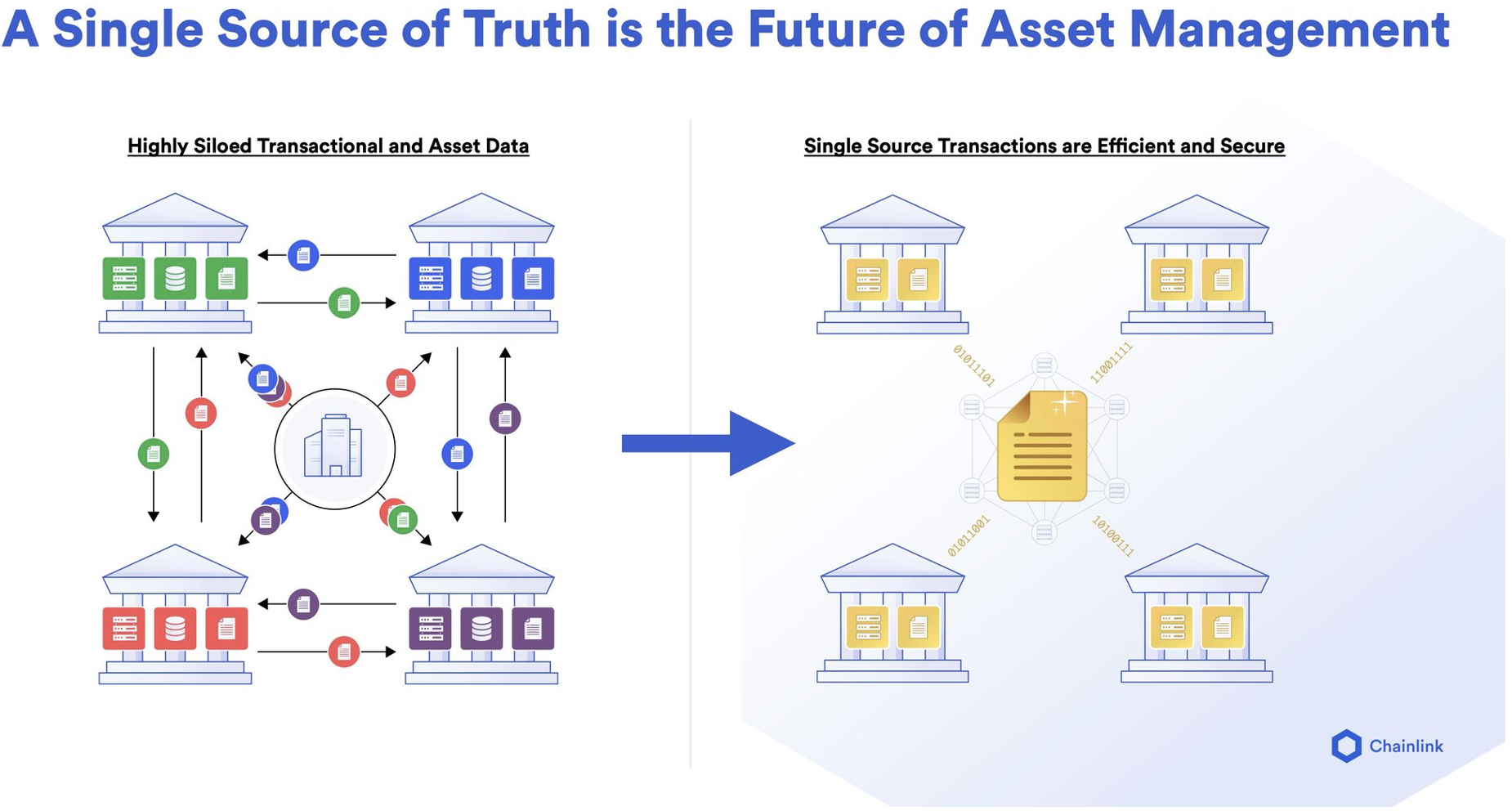

Like how blockchain technology can help make marketplaces more efficient and reliable, they can provide that same value to asset managers. Traditionally, marking assets to market has been done using large teams that require much labor to gather market comps, assess liquidity, and track depreciation of various assets using clunky and outdated systems like Excel. Well-constructed blockchain ecosystems can allow this all to happen automatically in live time, relying on technology more than people, with people still helping to aggregate data and originate the source of truth.

Out of all of the use cases, this is probably the earliest stage of development and adoption. There are many ways that asset managers can go about building something valuable for their company with this. The first would be assets onto existing chains. Of course, this comes with its own challenges such as potentially high expenses, slow verification times, and a possibility that organizational data gets “lost in the void.”

A solution to this would be building custom chains for each asset or even each asset manager. JPM already has their own cryptocurrency that they have been working on for years and we are seeing large asset managers, like KKR, tokenize funds with the main stated purpose being to expand access to their offering, but no doubt part of it also being greater organization and efficiency. With this already happening in the deepest private markets with the best of asset managers, we are surely going to see adoption from other largest asset managers with their real estate holdings in the very near future. We have already seen many startups have great success tokenizing real estate investments and large incumbent institutions are starting to catch up.

3. Property Management

The main source of possible value-add with blockchains in property management would be real time, organized, and uniform accounting of asset-level data and operations. This is extremely valuable as evident by startups like Smart Rent achieving great market penetration, impressive fundraising, and even a loftily valued IPO by simply bringing modern technology in the form of an app for tenants to pay rent and for property managers to organize it all.

Another challenge that property managers have that blockchains can solve is identity verification. This once again does not need to be done through blockchain technology, but by using an immutable technology rather than traditional software, it can provide an extra layer of trust. Perhaps more importantly is the tracking of an asset’s maintence history. While traditional software can achieve this as well, verifying work done by contractors and sub-contractors, allowing them to pay in crypto, and tracking all progress in an immutable way through the life of an asset will increase its value when it comes to due diligence for future potential buyers.

4. Development, Construction, and Urban Planning

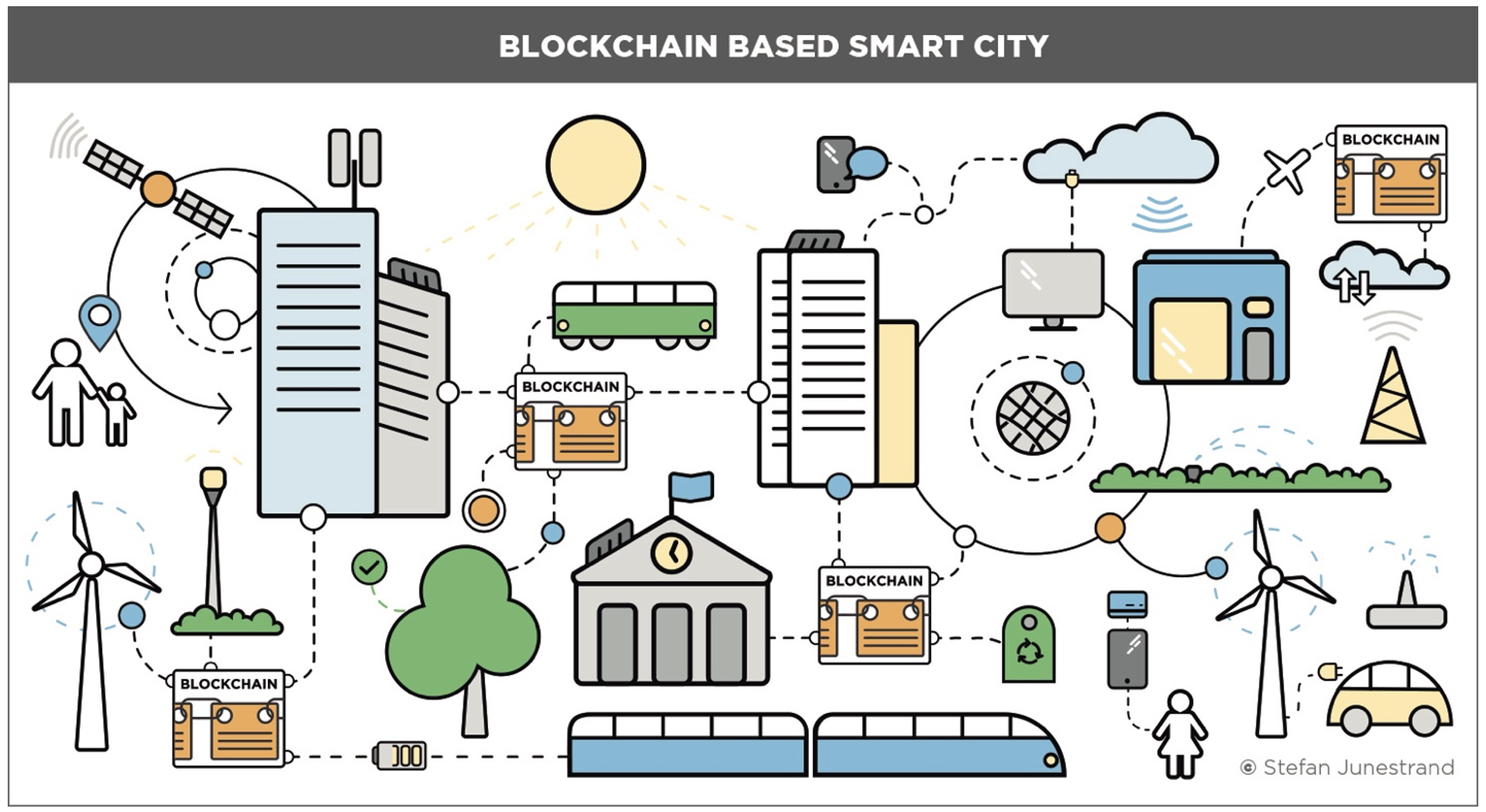

Larger construction projects have become increasingly difficult to manage with fractured sub-contracting and procurement practices and a lack of supply chain transparency. Blockchains can simplify procurement with reputation management for suppliers and subcontractors and incentivize better performance. Smart contracts can automate contract agreements and payment terms to enhance financial management. Blockchain technology can prove the authenticity of premium goods at their point of origin by associating products with non-fungible tokens and using these as digital blockchain certificates.

Additionally, property development often occurs without input from the local community. The public often feels disenfranchised from the planning processes, unable to express preferences for or make any meaningful differences in the local community. Blockchain-based planning platforms can include educational resources, token-based participation incentives, and a feedback loop between stakeholders, developers, and community members. This would encourage community engagement on a deeper level and better integrate local communities in the property development value chain, improving public confidence and developer services. While community input is not always valuable, it can be valuable for the developer to understand what’s actually happening on the ground level in a community.

5. Land and Property Registries

Similar to KYC, “knowing your assets,” and even better, being able to manage them in an efficient and organized way can be incredibly valuable. Currently, land titles, for the most part, rely on paper documentation which is vulnerable to loss, fraud, and mismanagement. In addition, property transfers and permits require a multitude of lengthy and costly legal procedures, sometimes locking land in unproductive use. Just like how not using a title agent, broker, and escrow provider (and replacing it with efficient and user-friendly tech) can make the overall process better, more efficient, and more seamless, blockchain can improve the traditional title management process in a huge way. Even more, it can create one world registry that allows all properties to be viewed and verified all in one place.

For this to happen and be truly successful, governments need to adopt these technologies, replacing outdated paper deeds with digital assets and track changes on an immutable ledger that acts as a secure shared source of truth for documents between multiple parties and organizations. Excitingly though, this is already starting to happen, for example, Sweden’s land registry authority, Lantmäteriet, along with banks and industry players, have a fully-functioning blockchain-based digital land register platform.

Challenges and Opportunities

1. Many sellers do not want increased transparency and liquidity.

Large incumbent players are no doubt the biggest barrier to the mass adoption of modern tech, especially blockchain, across the real estate space. While this shift is already happening and there is only a small probability it won’t be a major overhaul to the entire industry, one must raise the question, was it this way with bonds, stocks, etc. in their early stages before computerization? Things that are important to past generations are not always important to the new ones.

2. Expenses and technological capabilities.

Expenses are being addressed with new protocols that are simply much more efficient and cost effective like the Internet Computer Protocol (ICP), discussed more above. Historically, the technology had not been advanced enough to meet the needs of large institutions with complicated and sensitive needs. However, in the last several years we have seen many more developers enter the space and build the technology necessary to meet these needs.

0 Comments