The possibly trillion-dollar question that nearly every cryptocurrency enthusiast is currently trying to answer: what’s the best layer 1 blockchain? In this article, we will discuss what a layer 1 blockchain is, some of their key features, and the major differences between leading networks.

What is a Layer 1 Blockchain?

A layer 1 blockchain is a type of blockchain that is designed to provide a high level of security and reliability. It is built on top of a secure underlying infrastructure, and it has a number of features that make it well-suited for enterprise use. Layer 1 blockchains are typically used to create new cryptocurrencies or to store data, often used together with the term ‘Layer 2.’

A layer 2 blockchain is a separate blockchain that extends the initial network and inherits the security guarantees of that initial underlying network.

Unlike layer 2, a layer 1 blockchain is a blockchain that is directly implemented into the network protocol. This allows the blockchain to be used as a native protocol for exchanging information and value between nodes. Some key features of layer 1 blockchains include:

– Decentralization: Layer 1 blockchains for the most part are decentralized, meaning that there is no central authority controlling the network. This allows the network to be operated by its participants, rather than a third party.

– Security: Layer 1 blockchains are secure, meaning that it is difficult to hack or tamper with them. This makes layer 1s a trusted source of information and value exchange.

– Scalability: Layer 1 blockchains are scalable, meaning they can handle a large number of transactions at one time without slowing down (some do these things better than others, as we will discuss).

These three things play a key role when thinking about what potential value layer 1s could bring to businesses, organizations, and individuals… Nobody wants to wait 10 minutes for their ETH transaction to settle, especially after witnessing instantaneous transactions on ICP.

If you’d like to learn more about decentralization, security, and scalability of blockchains, otherwise what’s dubbed as the Blockchain Trilemma, you can check out our article “Does Total Decentralization Exist?”

Now that we have an idea of what layer 1 blockchains are, we’re going to breakdown the leading layer 1 blockchains in terms of market capitalization by: Total Value Locked (TVL), Fastest Transaction Throughput, Energy Consumption, Active Development, and more!

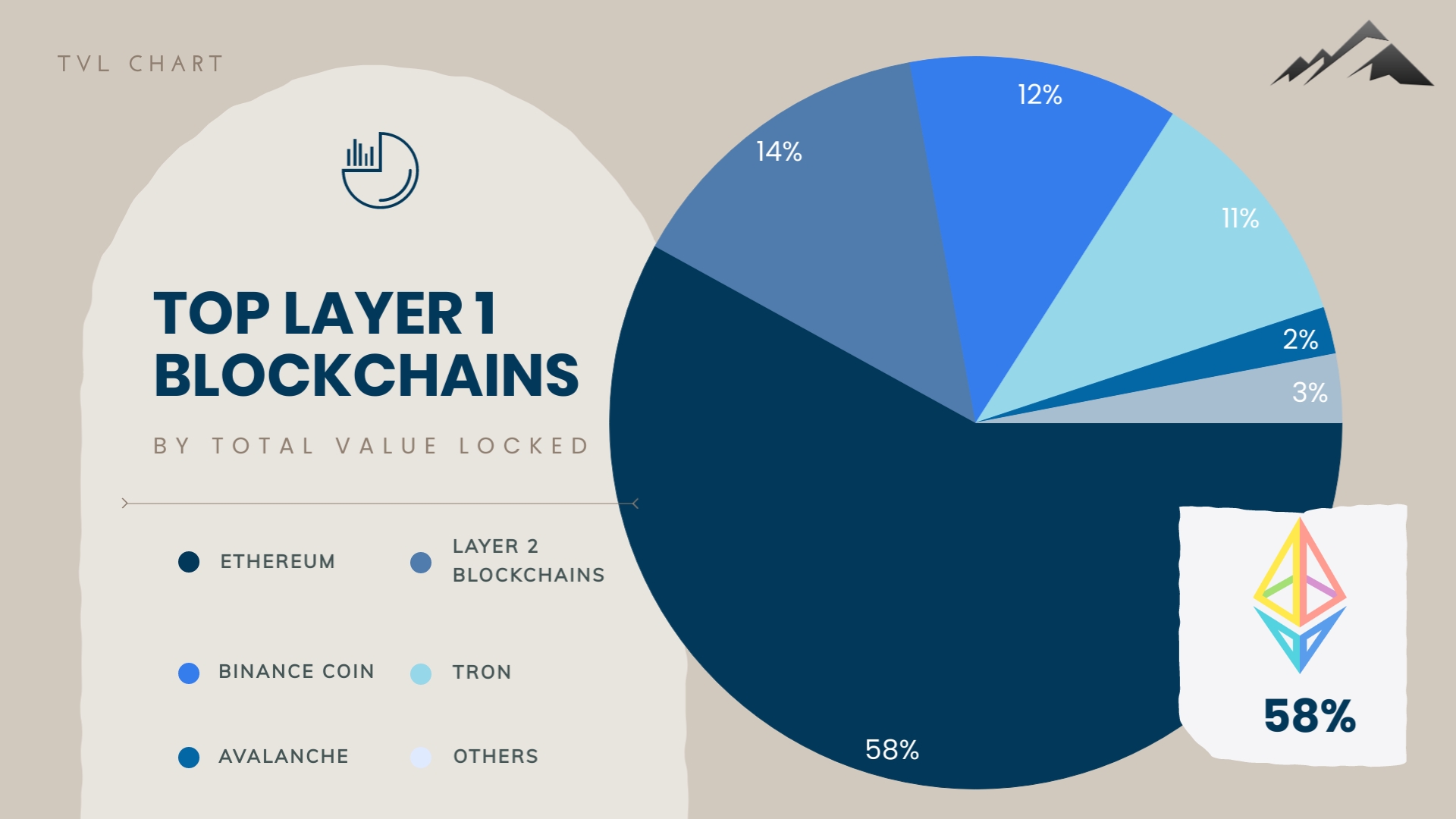

Top 5 Layer 1 Blockchains with the Highest Total Value Locked (TVL)

1. Ethereum – $24B

2. Binance Smart Chain – $5B

3. Tron – $4.46B

4. Avalanche – $846m

5. Fantom – $456m

What is Total Value Locked (TVL)?

Total Value Locked, or TVL, as the name suggests in one example, indicates how much money has been locked up for a certain amount of time on that chain.

This is usually done on Proof of State consensus networks like Ethereum and can be compared to illiquid security holdings like closed-end funds.

What is the significance of Total Value Locked (TVL)?

- It can be used as a measure of the overall health and success of a project

- It can be used to track user engagement and activity

- It can be used to measure the overall value of a network or ecosystem

- It can be used to benchmark against other projects

The total value locked in the blockchain will continue to grow in the future as more and more people and businesses adopt it. This is because the blockchain is a more secure and efficient way to store data than traditional methods, and it has several other benefits as well. As more people and businesses adopt the blockchain, the total value locked in it will continue to grow.

Ethereum might have so much value locked because of its recent attention, but it’s also because people believe in it- evident by developer activity and continued high volume, even in ancillary categories, like NFTs. A sister to Ethereum, Binance is seen as a solid #2 with a strong, active community of both developers and users pushing that TVL metric higher.

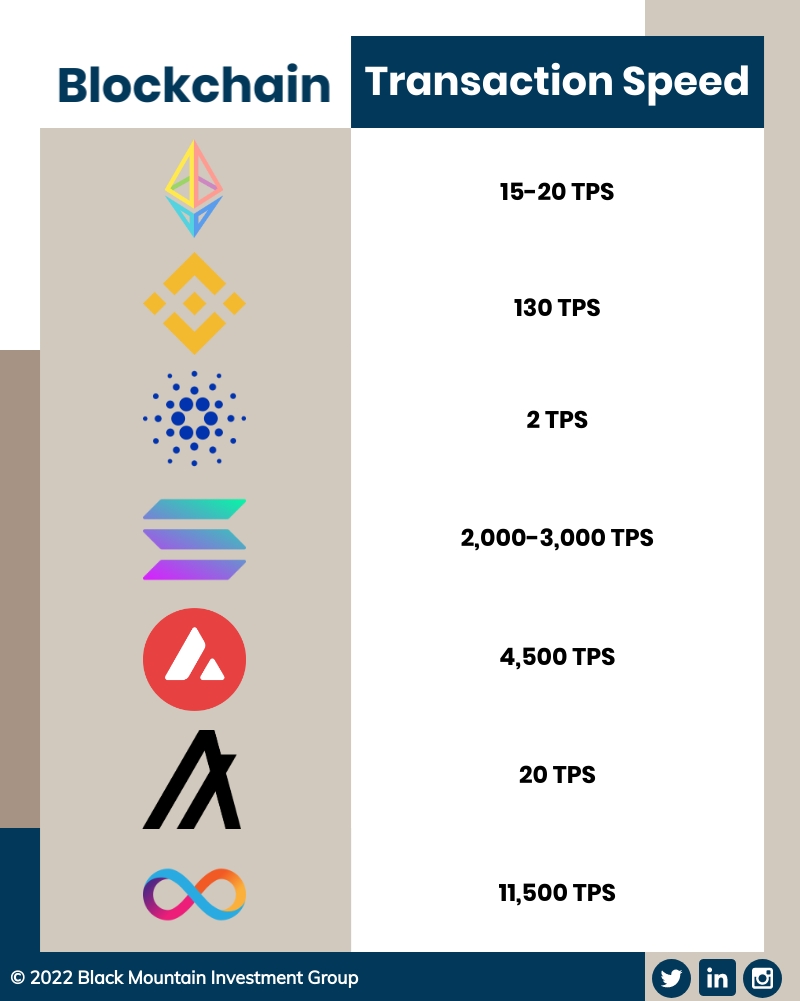

Transactions per Second

Transaction throughput is the number of transactions that can be processed by a cryptocurrency network in a given time period. The higher the transaction throughput, the more transactions the network can process and the faster the network can operate.

Transaction throughput is important because it determines how quickly transactions can be processed and how much network congestion can occur. A high transaction throughput is essential for a cryptocurrency to be used as a medium of exchange.

Our conservative evaluation of transactions per second on each blockchain demonstrated that the Internet Computer is capable of only processing transactions up to 11,500 transactions per second, with the Avalanche blockchain and Solana trailing not too far behind.

Bitcoin’s network can only handle a certain number of transactions per second. This has led to long wait times and high fees, making it difficult for people to use Bitcoin for everyday transactions. There are a few ways to improve transaction throughput, but they all come with trade-offs. At a time when 30 minutes was once revolutionary for transferring money, new alternative coins are offering that same service in seconds, and now that consumers have gotten a taste of that, there’s no going back.

One way to improve transaction speed is to increase the number of transactions that can be processed per second. This can be done by increasing the size of the blocks that are used to store transactions, or by increasing the number of transactions that can be processed in each block. However, increasing the size of blocks or the number of transactions per block comes with the risk of increasing the number of orphaned blocks. An orphaned block is a block that has been solved by the blockchain but not accepted by the network.

Another way to improve transaction throughput is to decrease the number of confirmations required for a transaction to be considered valid. This can be done by increasing the number of confirmations required for a transaction to be considered valid, or by decreasing the amount of time required for a transaction to be confirmed. However, decreasing the number of confirmations that are required for a transaction to be considered valid comes with the risk of decreased security, susceptible to what’s called a “double spend attack.”

Ultimately, the best way to improve transaction throughput is to find a way to compromise between the different trade-offs. This can be done by increasing the size of blocks, increasing the number of transactions per block, or decreasing the number of confirmations that are required for a transaction to be considered valid. However, any changes that are made to improve transaction throughput will come with a trade-off between speed and security.

Transaction Costs

The Ethereum blockchain, given its leadership and dominance in the smart contracts (layer 1) sector with , has the highest transaction fees by far. It’s not comparable to the other leading Proof of Stake chains like Binance, Cardano, Solana, Avalanche, Algorand, and Internet Computer as many crypto users choose bitcoin or Ethereum as their blockchain of choice. Please note that all these transaction fees pictured above may vary in price a bit as cryptocurrency markets are open 24/7 and prices of bitcoin are constantly fluctuating.

Ethereum, Binance Smart Chain, Cardano, and Avalanche all have fluctuating transaction fees; the fees are comprised of two lower fees as a base fee along with additional fees paid based on block demand. The cryptos with fixed transaction fees are Solana, Algorand, and Internet Computer. Algorand’s transaction fees are set to 0.001 ALGO and ICP’s transaction fees are fixed at 0.0001 ICP. Both chains’ teams stated they would reduce the fixed transaction fee if there was a substantial increase gas fees in the market, rendering the chain unusable by being priced out.

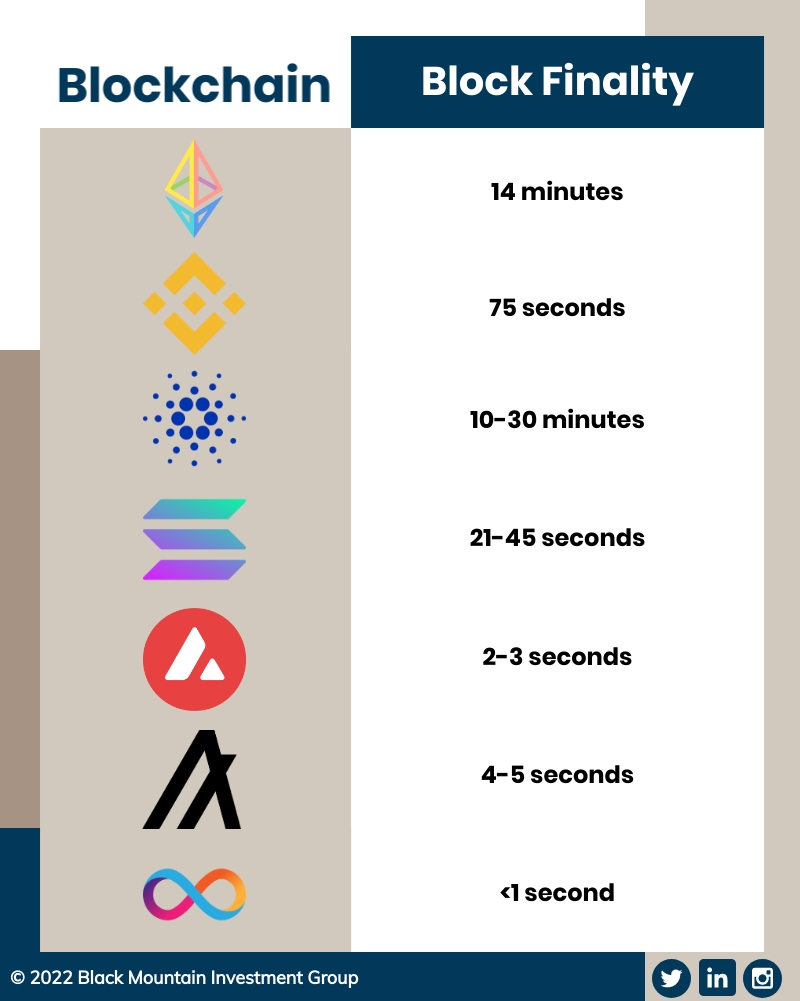

Block Finality

Block finality is the property that allows a blockchain to be immutable. In order for a block to be added to the blockchain, it must be validated by the majority of the nodes in the network. Once it is added, it is final and can’t be changed. This makes the blockchain tamper-proof and ensures that the data is not tampered with.

There are several ways to improve the finality of blocks, one way is to use a Merkle tree to verify the finality of the block. This can be done by hashing the root of the Merkle tree into the block header. This will ensure that the block is final and can’t be changed.

The two layer 1 prospects in speed of block finality are Avalanche and Internet Computer. Internet Computer uses Chain Key cryptography which is a set of cryptographic protocols that orchestrate network activity between the nodes which make up the main chain, the engine that “drives it” and the consensus mechanism that makes its incredibly fast operation possible. The Chain Key Technology is a 48-byte public chain key that renders old blocks unnecessary, enabling Internet Computer to operate at web speed.

That technology is the sole reason behind the #1 ranking among layer 1s in terms of block finality, while also onboarding millions of users to blockchain technology without them noticing.

On a chain such as Ethereum, Binance, or Cardano, that onboarding to a usable, blockchain based protocol, technology wouldn’t work and Solana goes offline too much to be used globally as a network.

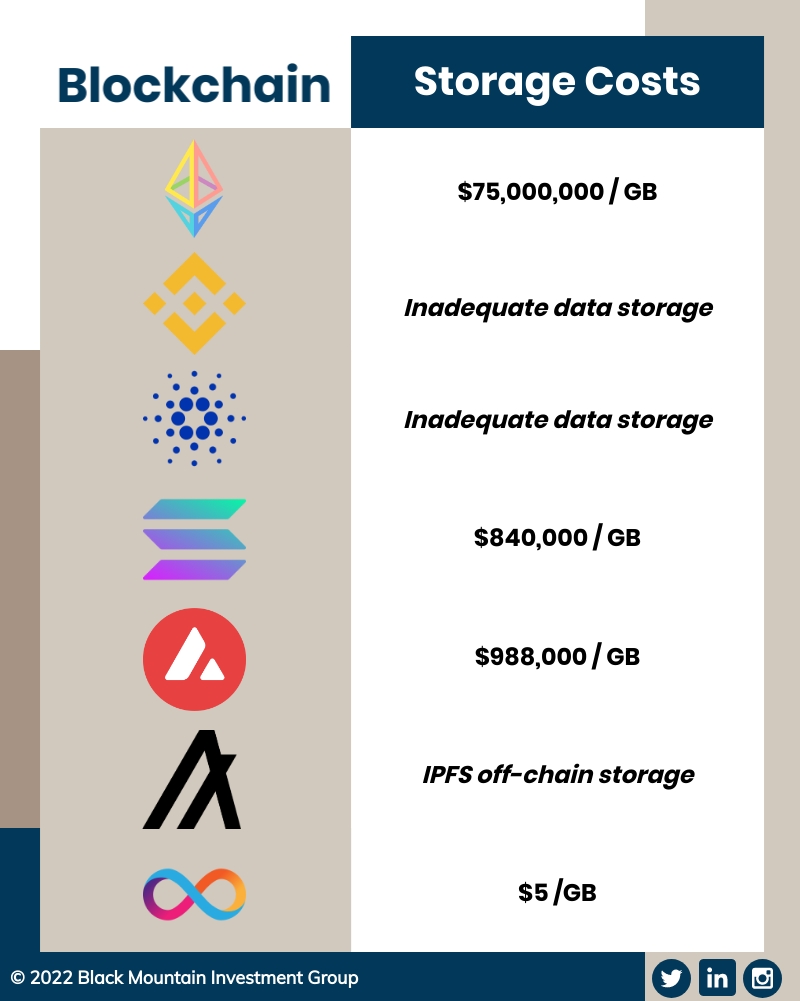

Energy Usage & Storage Costs

Miners use large amounts of energy to verify transactions and add new blocks to the blockchain. The reason some cryptocurrencies consume so much energy is because they are built on a proof-of-work system. This system requires miners to use a large amount of energy to solve complex mathematical problems in order to verify transactions. Cryptocurrency mining consumes a lot of energy, and it’s becoming a concern for many people. They argue that the amount of energy used by blockchain technology is unsustainable and that it is having a negative impact on the environment. Others believe that the benefits of blockchain technology outweigh the negative environmental impacts.

Regardless of your stance, some possible solutions to reducing energy consumption in cryptocurrency include:

- Switching to a proof-of-stake algorithm, which requires less energy to secure the network

- Using more renewable energy sources to power mining operations

- Implementing energy-efficient mining hardware

- Reducing the size of the blockchain

- Encouraging the use of lower-power cryptocurrencies

Unlike other blockchain networks, Internet Computer nodes do not run on any cloud providers such as Amazon Web Services, Microsoft, and Google — instead, over 400 nodes are running in independent data centers located around the world. No extra cloud infrastructure is needed to host and serve web content directly to users. The dependence of other layer 1 blockchains hosted on cloud nodes increases the risk to a sudden shutdown, decreases decentralization, and potentially makes them more susceptible to a takeover if validations are reduced.

Final Thoughts

There are several different layer 1 blockchain platforms available, but not all of them are equal. Some of the best layer 1 blockchain platforms currently available include Ethereum, Binance Coin, and Internet Computer. These platforms are well established and have a large user base, with Ethereum and Binance Coin dominating the layer 1 blockchain sector by market capitalization. They also have a robust infrastructure that allows for fast and efficient transactions, although as discussed some are faster and can store things for cheaper.

The blockchain trilemma discusses the inevitable tradeoffs between security, scalability, and decentralization that every layer 1 protocol faces.

When it comes to choosing a layer 1 blockchain platform, there are a few things you need to consider. First, think about what your needs are as a user of the blockchain ecosystem and what you want to use the base layer of blockchain platform for. From here, you can compare other blockchains together, analyze the strengths and weaknesses of each, and decide the best one based on your needs.

Some key factors of blockchain projects you may want to consider include the platform’s features, usability, popularity, liquidity, costs, scalability, and of course security. Ultimately, the best layer 1 blockchain platform for you will depend on your specific needs and preferences. Do your own research and compare different platforms to find the one that is right for you.

Please note though that even with the best and most reputable protocols you could still lose all of your money. Sometimes there’s a native token that acts as a decentralized blockchain protocol, however, those tokens are essentially covering for being centralized exchanges. Those native tokens, such as Binance Chain, offer a native token (BNB), and have a very centralized consensus mechanism. In Binance’s case, only 21 validators are securing the network. BNB Chain experienced very heavy traffic in the previous bull market and that is because of their consensus protocol, allowing them to bypass Ethereum’s layer 2 scaling solutions and still have high throughput. Like we talked about in the blockchain trilemma, there comes a trade off with clear block space and achieving mass adoption. It’s the fact that Binance’s DeFi protocols aren’t really DeFi at all, they’re centralized. Institutional investors understand that Binance was originally built on the Ethereum Virtual Machine (EVM) and migrated over to their own blockchain, which is still a carbon copy of Ethereum. It’s like the show Silicon Valley where Jin Yang starts Pied Piper China. Binance has essentially created Ethereum China. Their entire blockchain network and smart contracts use the same language as Ethereum, down to their blockchain layers, block rewards and the way they finalize transactions. The only major difference between the two, besides the branding, is the inflation rate, circulating supply, and their proof of stake consensus mechanisms. We’ll get into more detail about this topic in another article, however, meantime in this crypto winter, we’ll keep striving to create great content on digital assets. Please also note that nothing in this article is or should be considered financial or investment advice and you must do your own research and come to your own investment decisions.

As always, feel free to reach out to us if you have any questions, concerns, comments, or feedback.

0 Comments