|

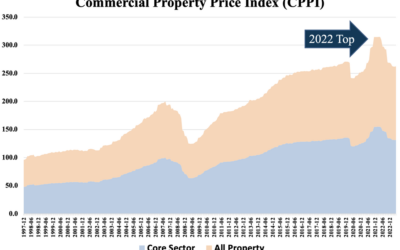

Written by Kyle Niedzwiecki, edited by Elijah Levine. Amid this cryptocurrency bear market, The Jupiter Fund is not only positive and highly liquid, but steadily holding a long-term outlook and well prepared for the next cycle. Cryptocurrencies as we know them are nascent technologies and are the most susceptible to heavy corrections in prices, as we have clearly seen over the last decade plus. That said, they have a distinct pattern to their cycles, with the same but different price action occurring during each one. After the initial 2013 Bitcoin cycle, we had a deep, two-year bear market from 2014 to 2016. After the 2017 cycle, we had a deep two-year bear market from 2018 to 2020, and in this most recent 2021 cycle, we are similarly in the middle of a deep two-year bear market shaking out the weak. Despite massive asset price deteriorations, The Jupiter Fund remains well-capitalized; we returned positive in one of the worst market years in recent history, and I have full confidence in myself and our quantitative trading team that we will come out victorious this next cycle, targeting a 100x on the entire portfolio. I was around and fully invested in the markets during the 2017 cycle when I watched my personal portfolio drop 80%. Instead of panicking, I doubled down and watched my positions reverse up 50x. The 2018-2020 cycle was much worse than what we’re dealing with now when it comes to overall sentiment in the markets. At that time there was grim hope in the future of blockchain and cryptocurrencies, let alone any major institutions taking them seriously. In the present day, we have large financial institutions and even central governments investing their balance sheet in Bitcoin and other cryptocurrencies. Some are even building their own blockchains as we have discussed in past public literature on our website. I learned my lesson from the last cycle of letting my portfolio drop that hard, and in turn, The Jupiter Fund’s biggest dropdown in 2022 was ~25% with an eventual positive return to close out the year. Another interesting synchronicity few have observed between cycles is that there is always a new paradigm shift in the markets. The first major paradigm shift was decentralized, peer-to-peer financial transactions, Bitcoin. The second major paradigm shift was smart contracts, Ethereum. The third major paradigm shift is a blockchain that can operate at web speed, storing data and conducting actions on-chain. Enter the Internet Computer Protocol (ICP). In 2013, Bitcoin was the clear winner and, over time, found itself as and continues to be the dominant player in the market. In 2017, Ethereum was the big winner and turned out to be an even bigger winner in this most recent 2021 cycle. Now, Ethereum is on par with Bitcoin, together known as the king and queen of the cryptocurrency markets. |

|

|

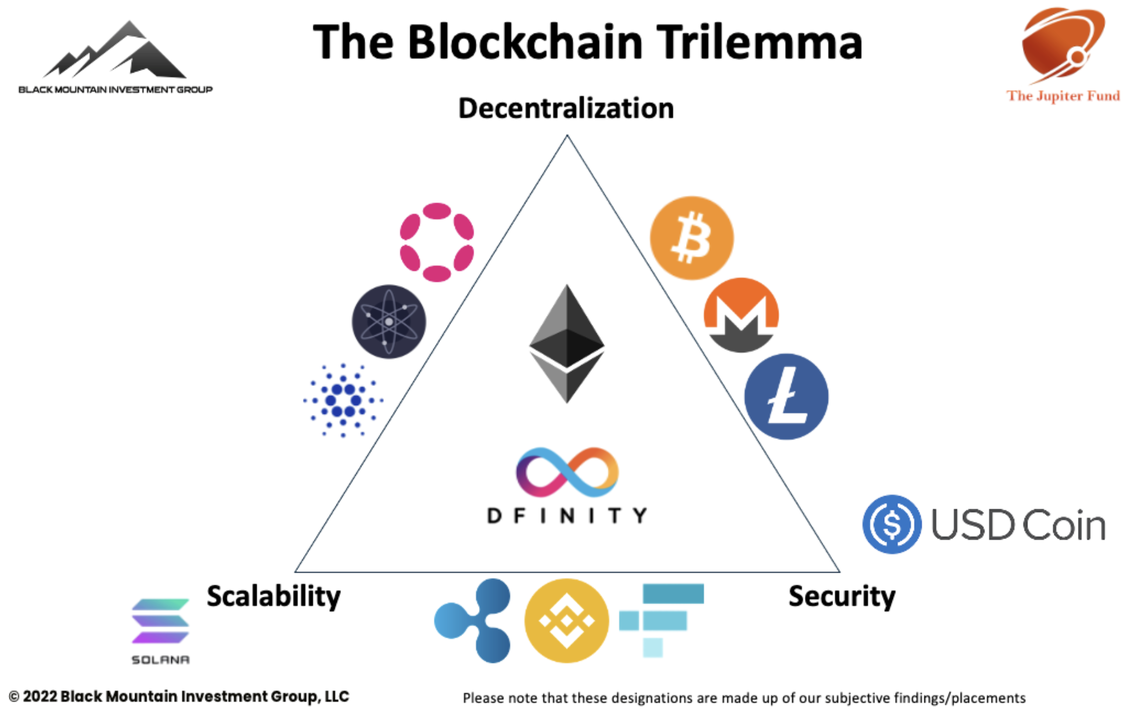

The king and queen are all grown up now, they aren’t going anywhere and will hold steady for a gradual increase in value over time. If we want to capitalize on cryptocurrencies for outsized returns like ETH and BTC have seen in the past, we can’t target a 5-10x return for the next cycle on just those assets, we need to look elsewhere. I invest in the underlying technology, not any Layer 2s, projects, or platforms built on top of the underlying tech (Layer 1s). Someone asked me if Avalanche will ever see business adoption. If we are talking about the public Mainnet version of Avalanche with public nodes, then good luck, it won’t happen. If an organization wants to use Avalanche or Ethereum, they can just fork it, grab a copy on GitHub, and adjust the parameters to their needs. This sort of thing we are seeing gain major traction with those big institutions as private chains for organizations are not only economical, but make sense. The validators within the organization are known and trusted. Fewer nodes mean fewer validators to certify transactions, and therefore a much faster throughput. It makes no sense to transmit private transactions on a public ledger. ICP is different, it stands apart with its unique features and purpose, catering specifically to businesses. It distinguishes itself from other protocols by requiring businesses interested in using the chain to actually acquire ICP tokens. Unlike many other blockchains, ICP cannot be forked or replicated, adding to its distinctiveness. One of the remarkable things about ICP is its exceptional scalability when it comes to smart contracts. This allows a transformative shift in software design paradigms. As far as my knowledge extends, ICP is the sole protocol that possesses this capability. Sidechains and rollups, despite their advantages in scalability, do not inherit the robust security of a Layer 1, as their execution occurs independently on the Layer 2 which most, if not all, are inherently centralized. |

|

|

It’s worth noting that Layer 2 solutions, whether they offer distinct functionality like IPFS for storage, Chainlink (an ERC-20 token) for oracles, or a scaling solution like Polygon (again, an ERC-20), exhibit centralized characteristics, which can be perceived as a limitation. Even more importantly, and what has seemed to go over everybody’s head, is that all of their data is stored on Amazon Web Services (AWS), a completely non-decentralized, non-blockchain, publicly traded enterprise cloud solution. Over two-thirds of Ethereum nodes are hosted on centralized services, with AWS accounting for just over 30% of that running total. Decentralized applications built on Dfinity’s Internet Computer can benefit from direct integration with blockchain technology. This offers a more secure and reliable alternative to traditional IT infrastructure. The platform’s programming language, Motoko, allows developers to create dApps with ease, taking full advantage of the Internet Computer’s features. As the cryptocurrency market develops, the decentralized network of ICP offers a promising alternative to the Bitcoin and Ethereum networks. ICP offers unbelievably fast transaction speeds and the ability to host dApps at fractions of the cost of any other Layer 1 network. Earlier this year, ICP integrated the entire Bitcoin blockchain on-chain, which means that it can fully run transactions, store Bitcoins on-chain as ckBTC (chain-key Bitcoin, utilizing chain-key cryptography), run NFT collections on Layer 2s, as well as any token built on top of the Bitcoin network. This was a stunning feat that the industry previously deemed impossible. This upcoming quarter, the ICP network will allow for full Ethereum functionality on-chain, utilizing the same chain-key cryptography and be able to engulf the entire network as ckETH. This would once again be completely revolutionary in the sense that it allows both Bitcoin and Ethereum to run at web speed, where update calls take 1-2 seconds to finalize and query calls finalize in milliseconds, rather than tens of seconds or even minutes at their current network capabilities. This is one of the fundamental concepts behind the Internet Computer, allowing blockchains to have a single public key as compared to owning multiple Ethereum addresses. As the Internet Computer continues to grow and mature, it has the potential to revolutionize the way we build and interact with software. With its unique features, scalability, and focus on security and privacy, the Internet Computer could, and likely will, become a critical part of the entire internet’s infrastructure, empowering developers and users alike. The future of this coin depends on its ability to gain traction in the public markets and establish itself as a reliable platform for building and deploying dApps. As the ecosystem gains more users, the demand for ICP coins may increase, creating a reflexivity in token value. For these reasons, ICP represents a massive threat to the entire industry, which is exactly why FTX only offered levered short exposure to the asset and why it’s one of The Jupiter Fund’s largest holdings. |

|

Blockchain Technology Disrupting Real Estate

Blockchain can truly touch all aspects of real estate. That said, some touchpoints are inevitably more valuable than...

0 Comments