In the last several weeks, I’ve had the privilege of speaking with Howard Marks (Co-Founder of Oaktree Capital Management) and Jeff Aronson (Co-Founder of Centerbridge). Two legends in the investing world that I have been following and inspired by for some time. I was lucky enough to get some awesome insights from them and even ask Jeff a question about the impact of technology on distressed investing. We aspire to one day write memos as famous and incredible as Howard’s.

As everybody knows, the world is in a very weird place right now. Nobody has any idea what’s going on behind the scenes in world governments, some businesses are succeeding wildly while others are flailing, liquidity is drying up across public and private markets, and people are unsure of financial (and in some cases) physical survival. Transaction volume across most private markets, but especially real estate, is significantly down. Interest rates haven’t been this high for over a decade but at the same time more capital has been poured into the system than ever before in history. This comes within the neighborhood of $300B in new government spending to bail out failed banks like SVB and $75B in aid to Ukraine since we wrote our “Macroeconomic Approach to Analyzing Volatile Markets (Pt. 1)” article over a year and a half ago in May 2022 predicting these exact sort of liquidity crunches.

Needless to say, we are in an epic economic “tug of war” that is going to result in some prices increasing but most prices decreasing- which we are already seeing. We recently underwrote a multifamily asset in Honolulu that was listed for $3.3m last year and just came back on the market for ~$2.3m. There doesn’t seem to be many markets other than global gateway cities like NYC not experiencing these sorts of price cuts. Apartments in secondary cities like Philadelphia, Salt Lake City, etc. are having trouble leasing up to full occupancy due to many new developments that might be slightly ahead of the demand (or what that demand can currently afford).

It’s unlikely but not impossible that inflation will go negative (causing deflation, like some notable investors have predicted). It is likely though that we will continue to see more illiquid assets like real estate and levered private companies have less attractive valuations from an ownership perspective (which of course means more attractive values from a buying perspective), at least as long as rates stay high. Elijah’s below macro-analysis titled “The Macroeconomic Tug of War of Today,” has also been published on the Wharton Undergraduate Real Estate Club’s website.

Right now we are in a period of “price discovery” for almost every asset in the global economy. This comes after several years of unprecedentedly large government spending followed by the steepest and fastest interest rate hikes in history. While it’s evident the FED has done a great job curbing inflation, many are now starting to wonder if they have gone too far. Is a soft landing still possible? If so, what does that look like for the prices of our favorite assets? The short answer is that it depends.

1. Government spending.

• On one hand, government spending has increased to levels not seen ever before, totaling over $5T in less than the last 5 years. This initially led to inflation across the economy, most notably seen (and experienced) in groceries, energy, and real estate prices.

• On the other hand, the federal government seems to be destroying money on a daily basis with things like the war in Ukraine and now Israel, etc.

2. Interest rates.

• Similarly to spending, interest rates have never risen faster.

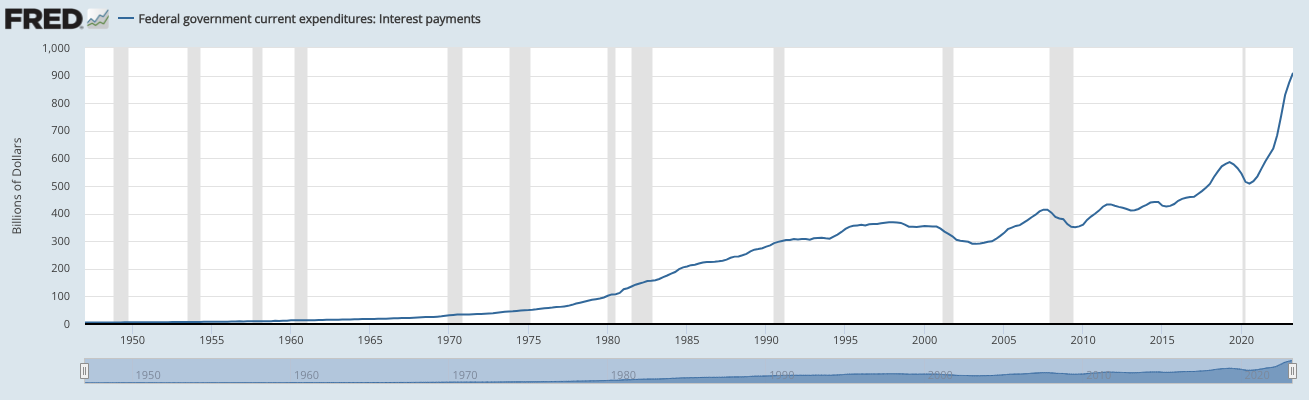

• What most people are talking about is that this means the federal government’s debt payments are now approaching $1T annually. The power of high interest rates should not be underestimated.

• What less people are talking about is businesses (and even individuals in some cases) similarly having much higher debt burdens now than in the last decade plus, and only a very small few are prepared to deal with it.

• Another factor here is investors’ perceptions of where interest rates are going and how much, if at all, those perceptions are already priced into markets. I am personally under the assumption that interest rates will likely stay higher for longer, but it appears that many others disagree with that as evident by macros falling upon the last FED meeting announcing no change in rates (indicating that a rate reduction was previously priced in).

To understand where I am going to take this, it’s imperative to understand the difference between real and nominal value. Given most of you reading this already understand it well, we will keep this explanation simple. Nominal values account for inflation (new money entering a system). Naturally, as new money enters a system, all prices in that system eventually go up. Real values adjust for inflation. A “real” price is adjusted for what an asset would be worth if no new money ever entered the system.

Currently, macros are in an interesting tug of war between real and nominal value. What I mean by this is that over the last several years we have had a tremendous amount of both value creation and value destruction. Some of this value is “real” and some of it is “nominal.” For example, some real value that has been created is AI.

That said, creating real value is oftentimes deflationary, which puts today’s world (of slowing inflation but still high interest rates) in a very interesting position. A serious source of nominal value creation, on the contrary, over the last several years has been the unprecedented amounts of money printing by governments worldwide but especially the United States (that, don’t forget, must somehow be repaid)…

FRED, Federal Government Current Expenditures: Interest Payments

While some assets have increased in price more than others, it appears consumers are adjusting to these higher prices in some instances but being more stubborn about others. The ladder markets are best defined as more decentralized markets. In essence, single family residential housing is a lot more decentralized than the food industry as one example.

This is because the SFR marketplace (although this is changing) is mostly everyday people selling to other people- oftentimes from similar status or backgrounds. Whereas when buying groceries, unless you are in a very small town or buying from a local market, there are usually only a few brands all selling the same things.

What this means for consumers is that they have more limited options (alternatives) with grocery store items as opposed houses. Of course, this all depends on the market, but what the example is meant to show is that consumers can’t fuss too much about food (or gas) prices but they can be a lot more stubborn with real estate prices- especially since many people locked in low mortgage rates.

Another way to view this is that, for the most part, nationwide rents have been real but real estate prices have gone nominal. Rather than rents going more nominal (which they started to and likely would have continued to in a much more intense way if the FED didn’t aggressively raise rates), it’s more likely that prices will move towards more real values.

What this means in broader terms is that the macroeconomy is in a massive tug of war related to where prices will land, commonly referred to as “price discovery.” What’s the most interesting thing to us is that every asset within every industry seems to have a very different profile of strengths and weaknesses on either side of the battle. Not only this, but nobody truly knows where rates are going when.

In summary, it will be very interesting to see where prices shake out over the coming years. With inflationary pressures down, interest rates still high, global liquidity shrinking, and utter confusion from world governments, it seems like we are either in for an economic meltdown or a period of massive positive disruption as tech progresses and motivated deal makers grab the economy by the reigns and start to bring it back to life (which is what we like to think we are doing). However this ends up shaking out, we look forward to playing in the chaos.

Guide to Philly, Cira Green Rooftop Park at the FMC Tower

Real estate has quickly gone from one of the easiest industries to be in to one of the most difficult. Even in New York City, the world’s most iconic city where I’ve spent the last few weekends, there are “For Lease” signs everywhere- mostly on retail and office spaces. This has become a trend all around the country from what I’m seeing, and it’s because we are experiencing a massive shift from traditional real estate asset classes being clearly divided to being more blended together.

This trend is not new but what is new is the need to diversify revenue streams on individual assets in order to survive. Prior to COVID, most retail stores could stand strong on their own and office spaces had enough occupancy and long enough (relatively secure) leases to make those asset classes interesting investment opportunities.

Today, that is changing. If your office doesn’t have state of the art amenities, the flexibility to work from home, cell towers and solar panels on the roof, a restaurant and prime retail on the bottom, and BTC miners / edge data centers in the basement, you will likely not be able to run at a meaningful profit (even ignoring increased debt loads as consumer trends are shifting in big ways). It’s a similar story for retail.

So not only is occupancy down significantly in most office and retail buildings worldwide, but operators of all commercial asset classes are all the sudden being burdened with much higher debt payments and changes in tenant preferences they have never seen before (let alone underwrote when they acquired these assets). Now operating and financing margins are lower which means survival is even more difficult and only those that go above and beyond to extract value from their assets will be able to stay afloat- at least as rates remain high.

This is precisely why we are seeing some of the biggest and best asset managers shifting focus from office and retail investing to SFR, flex-offices, and multi-use assets (improving and/or expanding the capabilities of their more traditional assets). Hospitality has already figured this out for the most part which is why that asset class is seeing a much stronger resurgence than office. Smart developers, investors, and operators are also figuring this out and raising a lot of money around it.

During COVID we would see restaurant owners turn their space into flexible office during the day for local community members. Now we are starting to see groups incorporating all sorts of creative revenue streams to their projects. One of my favorites is Philadelphia’s FMC tower, which not only has office space, hotel rooms, condos, and apartments, but a main floor and rooftop restaurant, indoor and outdoor movie theaters, and plenty of other 5-star amenities. It has quickly become a famous and vibrant place of community gathering.

To me, opportunities where this diversified “place making” can take place within assets (and even entire ecosystems like the technology ecosystems we currently build and invest in) are the best place to be investing in the uncertain world of today.

0 Comments