In the world of cryptocurrency, we are currently seeing seismic shifts that are reshaping the landscape, influencing trading preferences, market dynamics, and the very fabric of blockchain technology. From the rise of decentralized exchanges and the intricate dance between Bitcoin and interest rates to the fierce competition in stablecoin transfers, each facet unveils a unique narrative in the ongoing crypto saga.

This exploration delves into the multifaceted trends, challenges, and opportunities that define the current state of the cryptocurrency ecosystem. As we navigate through the intricacies of these developments, the overarching theme is one of transformation, maturation, and adaptation within the dynamic world of digital assets.

DEX volume will outperform CEX volume

In the evolving landscape of cryptocurrency trading, there’s a noticeable shift in sentiment towards decentralized exchanges (DEXs) over centralized exchanges (CEXs). The traumatic experience of Mt. Gox in 2013 continues to cast a long shadow, leaving cryptocurrency investors new and old alike wary of centralized platforms, with lingering concerns about the security of their assets in a centralized, custodial exchange.

FTX, often seen as the elephant in the room as this crypto cycle’s Mt. Gox, symbolizes the dominance of some centralized exchanges and the potential risks associated with them. The aftermath of Mt. Gox has created a cohort of risk-averse traders who are now turning to decentralized alternatives. Even well-established and audited exchanges like Kraken are not immune to regulatory scrutiny, as evidenced by SEC lawsuits.

The shift in dynamics between DEX and CEX platforms can be attributed to several factors. First, the growing interest and adoption of decentralized finance (DeFi) have fueled the usage of DEXs. DeFi applications, which operate on blockchain networks and are often facilitated by smart contracts, offer users decentralized alternatives to traditional financial services. As more users engage with DeFi protocols, the demand for decentralized exchanges naturally rises.

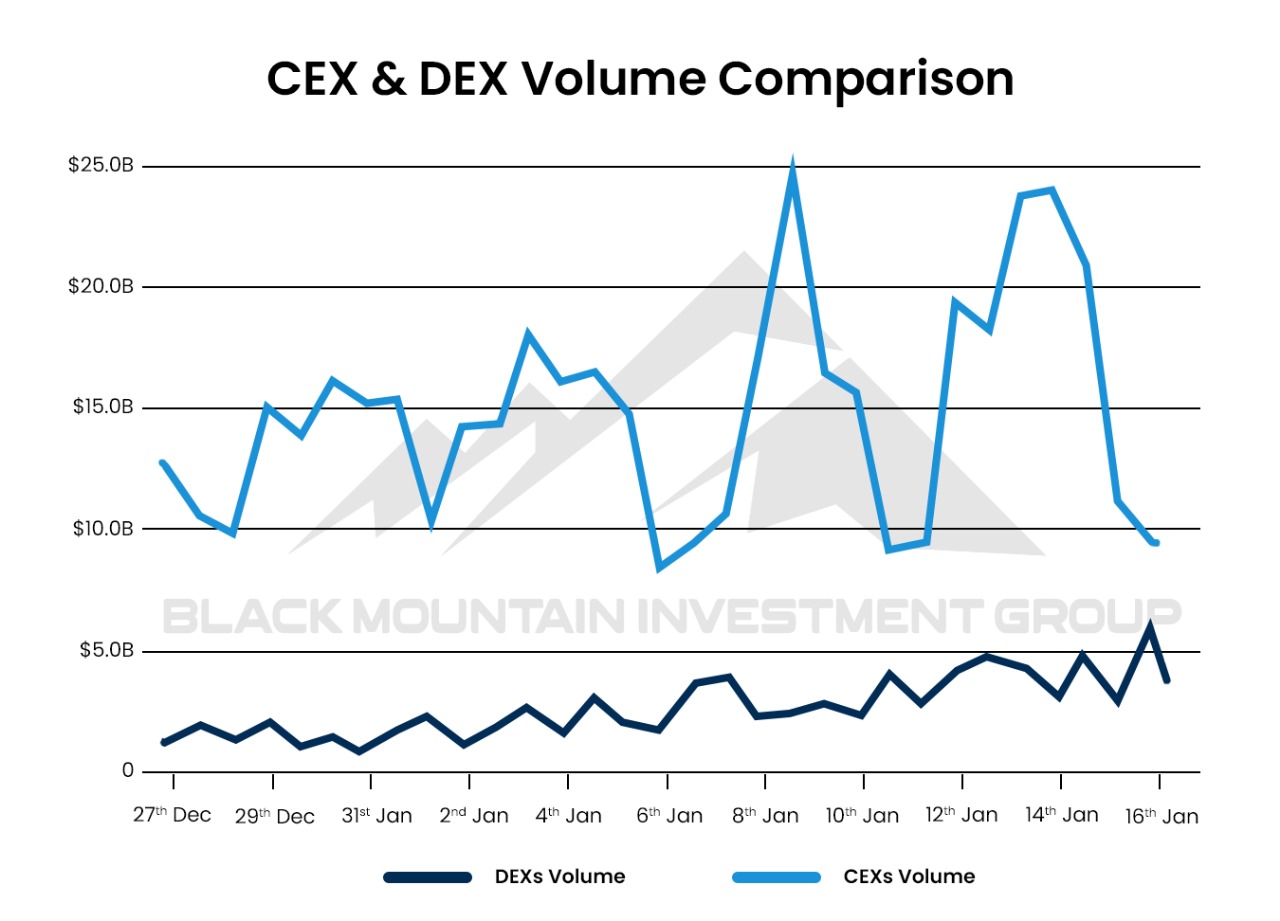

The decentralized exchange (DEX) landscape has been witnessing a notable trend as DEX volume gradually catches up to centralized exchange (CEX) volume. In recent times, CEX trading volumes have exhibited a range fluctuating between 10 to 20 billion USD. Meanwhile, DEX platforms have been making significant strides, steadily increasing their trading volumes and currently standing at around 5 billion USD.

As DEX growth has been consistently rising linearly, it is expected to catch up to CEX volume this year. CEX volume has high swings up and down due to apparent wash trading across those platforms to create volume, while DEXs have a more natural adoption feel to them, albeit they do exhibit some wash trading as well. The way the chart is moving, DEX volume should reach $10 billion by the Bitcoin halving, or Q2 2024.

While DEX volumes continue to exhibit significant fluctuations within the 10-20 billion USD range, the steady ascent of DEX volumes to 5 billion USD signifies a changing landscape in the crypto trading ecosystem. This trend is indicative of the evolving preferences of market participants, with a growing number of users opting for decentralized alternatives that align with the core principles of blockchain technology. Users are increasingly valuing the autonomy and transparency offered by decentralized systems, moving away from the centralized structures that dominate traditional finance. As the DeFi space continues to mature, it will be interesting to observe how the balance between CEX and DEX volumes evolves in the future.

Switch to Risk-On

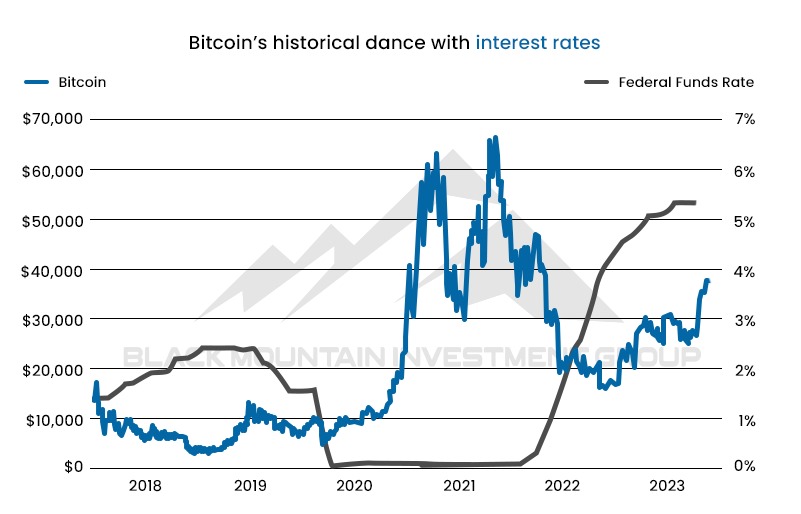

As interest rates are anticipated to decrease in the current economic landscape, there’s a notable expectation of a shift towards risk-on assets, and Bitcoin stands out as a compelling choice. Core believers in Bitcoin and decentralized currencies boast about not being correlated with traditional assets, but everything is tied together.

When the Federal Funds Rate peaked at 2.5% in 2019, Bitcoin was at its lowest point, trading below $5,000. The following year after the Fed Rate dropped to ~0%, Bitcoin hit new all-time highs around $65,000. Now that the Fed Rate is over 5% and Bitcoin is trading at its lowest local point, akin to 2019. As soon as the rates lower, that shifts the environment from risk-off to risk-on and if history repeats itself, Bitcoin should see another all-time high in the year following.

In a climate where traditional safe-haven assets like treasuries are likely to see diminished returns due to declining interest rates, the comparatively higher staking yield on Ethereum becomes increasingly appealing to investors. The attractiveness of Ethereum lies in its staking yield, which currently offers a competitive 4%. This potential switch to risk-on assets reflects a strategic move by investors seeking greater returns in a low-interest-rate environment.

Beyond Ethereum, several other cryptocurrencies offer attractive yields, providing investors with alternative opportunities in the ever-expanding landscape of decentralized finance. Polkadot (DOT) is another notable example, with its proof-of-stake consensus algorithm enabling users to stake DOT and earn staking rewards.

Increase in Stablecoins

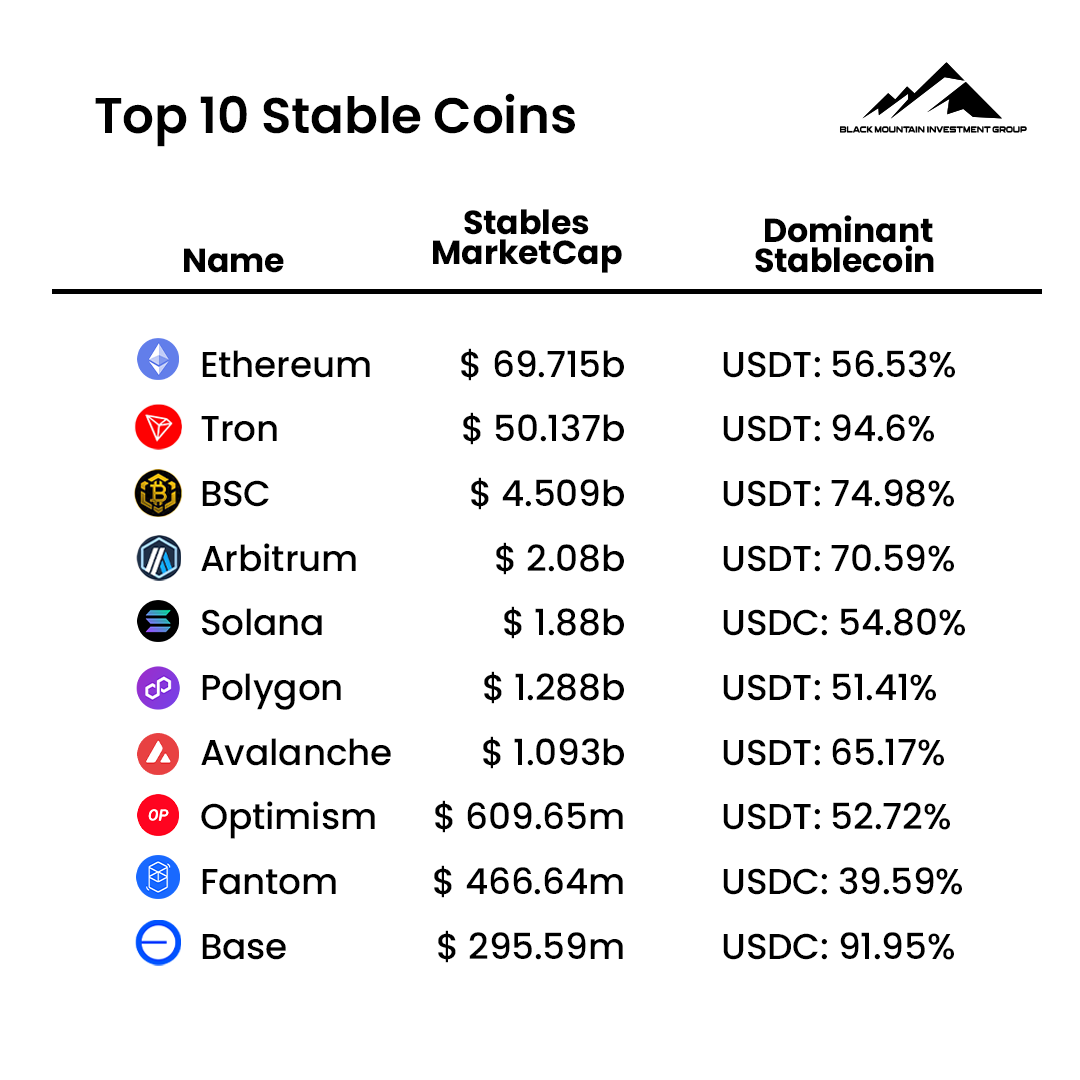

The landscape of stablecoin transfers is undergoing a significant shift as Ethereum faces increasing competition from Tron. Ethereum, the dominant platform for stablecoin transfers, is witnessing a challenge to its supremacy. Tron’s rise to prominence in this arena can be attributed to several factors, notably its low transaction fees, which appeal to users seeking cost-effective and efficient transfers.

Tron and Ethereum emerge as frontrunners in the realm of stablecoin transfer chains, with Ethereum boasting a substantial stablecoin market cap of $69.715 billion, closely followed by Tron at $50.137 billion. The competition lags significantly behind, with Binance Smart Chain (BSC) holding a market cap of $4.509 billion, Arbitrum at $2.084 billion, and Solana securing $1.884 billion. This notable discrepancy underscores the dominance of Ethereum and Tron in the stablecoin landscape.

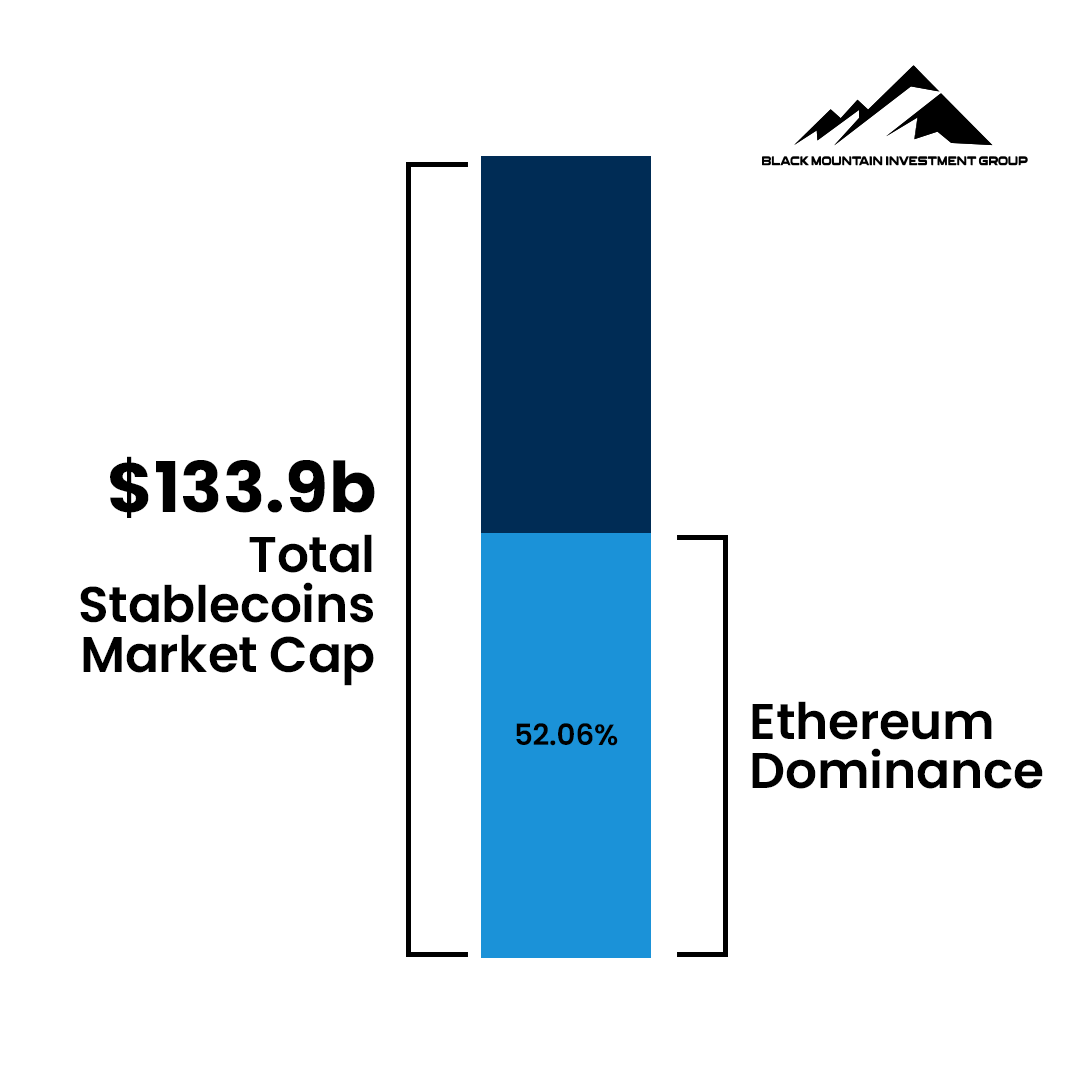

Total Stablecoin Market Cap

Ethereum and Tron together make up $119.9 billion out of the $133.9 billion total stablecoins market cap. Combined, they control 89.5% of the stablecoins market. Ethereum is losing it’s dominance, and will lose the greater than 50% this cycle at this rate, but that doesn’t take away from the fact that it is still the number one stablecoin transfer blockchain.

Tron is coming close and has a chance at stealing some more of Ethereum’s market share this year. The East has embraced the Tron network, further propelling its ascent to the top. The preference for Tron in this region is indicative of a broader trend where users prioritize platforms that offer affordability and accessibility.

However, Tron’s potential to surpass Ethereum lies in its advantageous features, including high throughput, low transaction costs, and scalability. To outpace Ethereum, Tron could focus on further enhancing scalability, fostering developer adoption, promoting interoperability, nurturing community support, and consistently innovating and upgrading its platform.

The second crypto ETF will be Ethereum

With the recent approval of Bitcoin spot ETFs, the cryptocurrency market is poised for significant developments and fresh capital injection. As attention gravitates now towards the second-largest cryptocurrency achieving an ETF, Ethereum, anticipation is high for it to catch up to Bitcoin.

The green light for Bitcoin spot ETFs reflects a growing institutional acceptance of digital assets. This move is expected to not only bolster Bitcoin’s position as the leading cryptocurrency but also catalyze increased interest and investment from investors that don’t want to open a Coinbase or Kraken account to be exposed to cryptocurrency. There is a large number of Americans who are now exposed to owning Spot Bitcoin in their retirement accounts.

If an Ethereum spot ETF is approved, this would provide investors with a more direct and regulated way to gain exposure to the price movements of Ethereum without having to directly own the cryptocurrency, just like Bitcoin. This development reflects the maturation and increasing institutional recognition of Ethereum as a valuable and influential player in the cryptocurrency ecosystem.

As the industry continues to evolve, the potential introduction of an Ethereum spot ETF could further contribute to the mainstream adoption and integration of digital assets into traditional financial markets.

NFT market bounce back

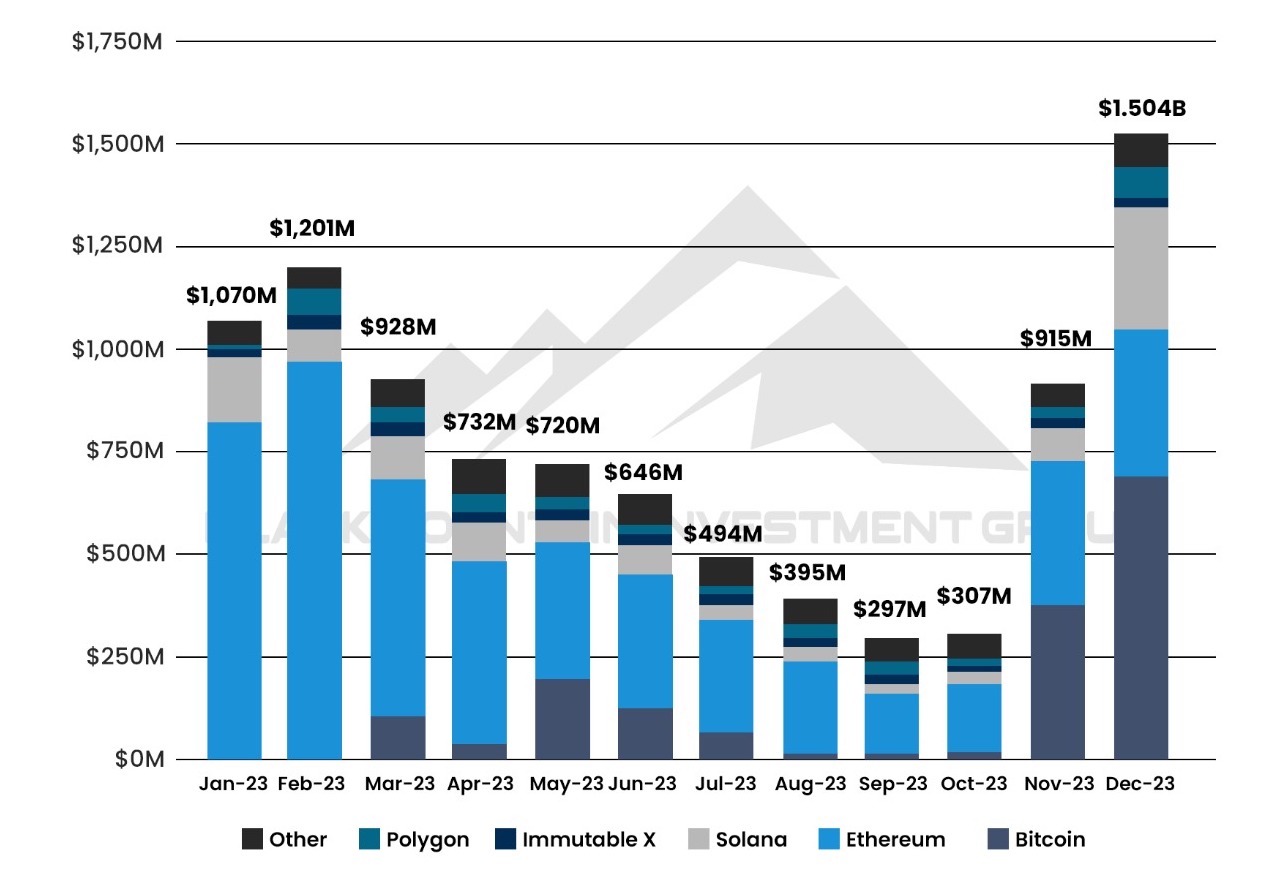

The NFT (non-fungible token) market is on the brink of a notable resurgence, with an anticipated blue-chip bull run that holds promise for both investors and enthusiasts. This optimistic outlook is underpinned by a series of compelling factors, chief among them being the remarkable surge in trading volume within the NFT space.

The renewed interest in non-fungible tokens signals a revitalization of the broader crypto market, and it is the established and high-profile NFT projects, commonly referred to as blue-chip NFTs, that are expected to spearhead this resurgence.

NFT volumes have reversed back up to 12-month highs with the pivot point being in September. Since then, the NFT volumes have been increasing every month, with December being parabolic.

Adding to the optimistic narrative is the influential role played by Bitcoin’s market dynamics, particularly its ordinals. In the past month alone, Bitcoin ordinals have recorded an impressive $880 million in trading volume, indicating a robust and sustained growth trend. This surge in Bitcoin ordinals not only reflects the overall strength of the cryptocurrency market but also serves as a major catalyst for the anticipated resurgence in the NFT space. The interconnectedness of these markets suggests a synergistic relationship, where the success and growth of one significantly impact the other. Without Bitcoin ordinals or inscriptions on-chain, the NFT volume wouldn’t be as high as it is today.

As the momentum continues to build, it is reasonable to expect that this positive trajectory will extend throughout the year and into 2025. The convergence of hightened NFT trading activity, the prominence of blue-chip projects, and the ripple effect from Bitcoin’s ordinals all contribute to a compelling narrative for the resurgence of the NFT market, painting a picture of exciting opportunities for participants in the digital asset ecosystem.

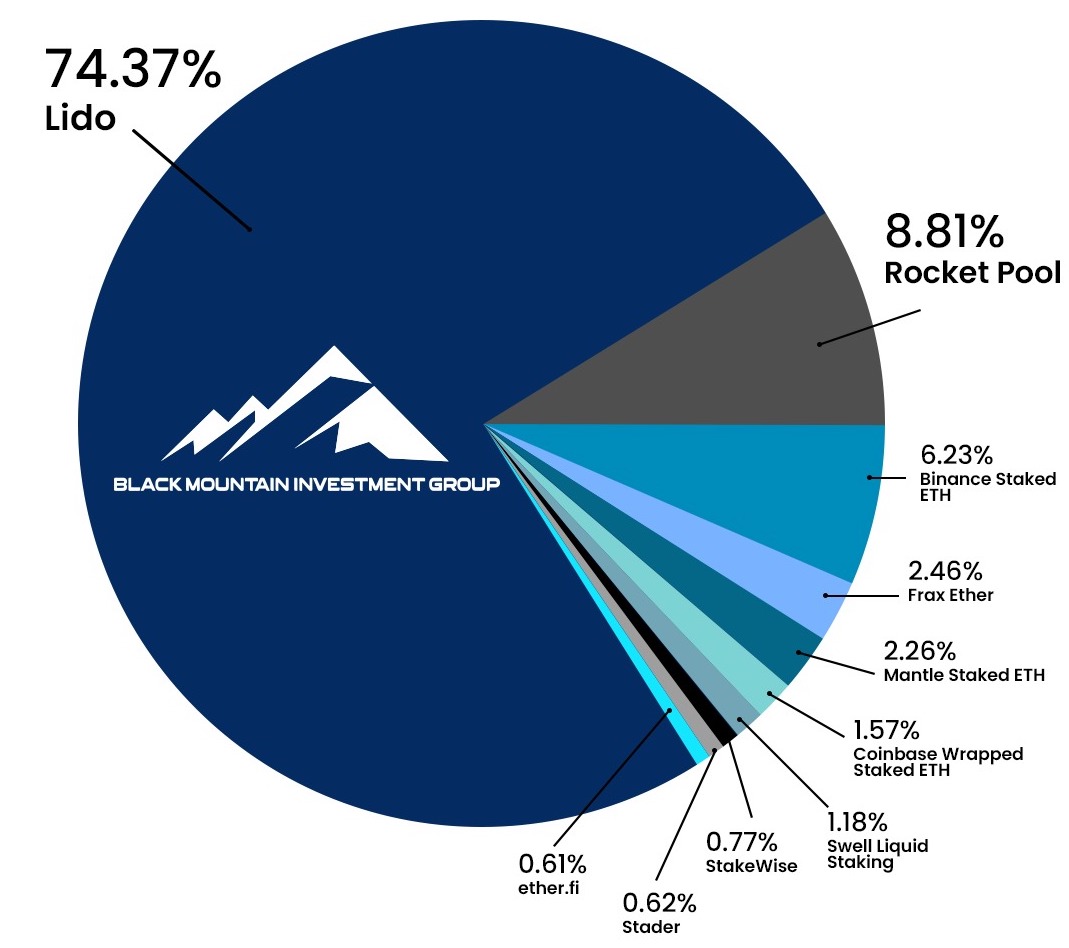

Liquid Staking Derivatives by ETH Held

Competition Between Layer 1s

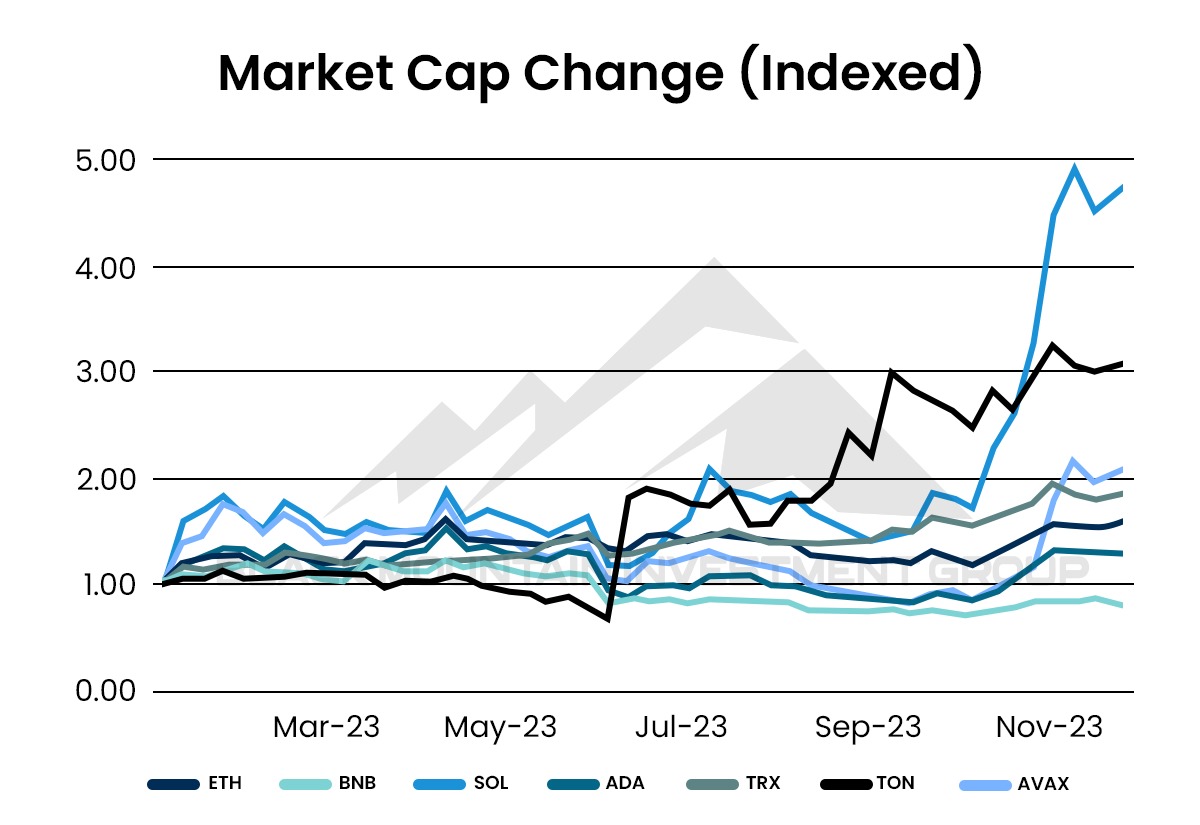

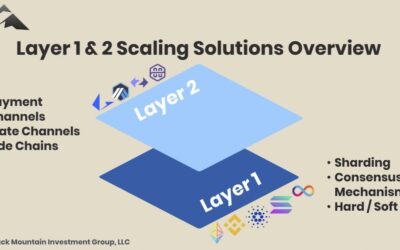

The competitive dynamics within the Layer 1 blockchain space are entering a phase of heightened intensity, and a discerning analysis suggests that platforms currently lagging behind Ethereum in terms of performance may encounter hurdles in outpacing ETH during the impending bull run. This prevailing perspective implies a scenario where Ethereum and other established leaders in the ecosystem maintain their positions, both in terms of performance metrics and widespread adoption.

The layer 1 blockchains that are charted out are: Ethereum (ETH), Binance Coin (BNB), Solana (SOL), Cardano (ADA), Tron (TRX), Toncoin (TON), and Avalanche (AVAX). At the end of 2023, the only coins to underperform Ethereum were Binance Coin and Cardano.

Both coins were released before the last cryptocurrency cycle in 2017 and are struggling to keep up with the newly released coins that’ve come to market later. The newer coins, SOL, TON, and AVAX all outperformed Ethereum in 2023 with flying colors, with Solana being the biggest winner of the year. These coins have more developer activity and more users flocking to the network than the older chains, therefore a higher nudge to the upside on price.

The observation that new altcoins released in the last cycle may outperform old altcoins like ADA and XLM introduces an additional dimension to the competitive landscape. The cyclical nature of the cryptocurrency market suggests that emerging projects may carry a momentum advantage over their predecessors, potentially leading to a shift in investor interest and flow of capital.

The tapestry of cryptocurrency unfolds with a myriad of threads, each representing a unique aspect of the industry’s evolution. From the growing influence of decentralized exchanges, the symbiotic relationship between Bitcoin and interest rates, to the imminent approval of Ethereum ETFs — these threads weave together a narrative of resilience, innovation, and adaptability.

As the cryptocurrency ecosystem matures, the interplay of market forces and technological advancements continues to shape its trajectory. The future promises a landscape where decentralized ideals, institutional acceptance, and dynamic market shifts converge to redefine the boundaries of traditional finance.

The journey ahead holds exciting prospects, marked by the ongoing exploration of novel applications, the integration of blockchain into traditional finance, and the ever-present pursuit of a decentralized and inclusive financial future.

0 Comments