In mid-September 2022, the Ethereum blockchain went through an upgrade dubbed “the Merge” that changed the consensus mechanism of the chain from PoW (Proof-of-Work) to PoS (Proof-of-Stake). The next step to completing ETH 2.0 is introduced in this next upgrade coined “Shanghai” (or Shanghai Capella “Shapella”) and is expected around mid-April. The Shanghai upgrade is technically only on the execution side, and Capella is the simultaneous upgrade happening on the consensus side. Since both are happening at the same time, developers have started calling it the “Shapella” upgrade. The developers have pushed back the release of this upgrade by two weeks to make sure the “dress rehearsal” on the test net that everything is working smoothly. The date for that dress rehearsal is on March 14th, and the mainnet will follow suit and release a month after.

The Ethereum Shapella upgrade introduces five Ethereum Improvement Proposals (EIPs). EIP-4895 will unlock the staked Ether (ETH) and allow stakers to withdraw their coins for the first time in over two years since staking was made available on the chain. There are mixed reactions to the staked Ether being released because, while the media and most of the community is fearmongering over a large amount of withdrawals, a majority of the stakers are likely going to continue staking and only withdraw their profits, if anything. There are currently 17.1 million Ether staked representing a sum of around $26.5 billion, or roughly 13% of the current market capitalization.

Apart from EIP-4895, which is focused on stakers being able to withdraw their tokens, EIP-3855 and EIP-3860 are focused on improving the on-chain user experience. EIP-3855 will help increase transaction speeds and EIP-3860 will help reduce transaction fees. These two EIPs will help improve the on-chain experience across all DApps (whether it be Uniswap, Opensea, or any smart contract), as all of the Ethereum ecosystem was impacted by high gas fees and slow transaction times. Many projects migrated to different chains, like Polygon, to try and reduce gas fees and speed up transaction times. With these two upgrades in particular, we should expect to see a renewed uptick in building activity on the Ethereum blockchain.

Ethereum could and likely will lead the institutional adoption of cryptocurrencies. The Merge was the first step in that direction as increasing ESG friendliness and awareness helps institutional capital feel more comfortable entering the crypto ecosystem in general. As Ether solidifies its spot as a blue-chip cryptocurrency asset, the staking yields from Ether could become synonymous to the frisk-free rate that traditional capital markets often use to price their assets.

The EIPs included in the Shanghai upgrade will be a great step in the right direction towards achieving sharding later this year. Sharding (zero-knowledge ZK-Snarks) is extremely important to achieve higher transaction throughputs. This will allow the chain to perform “parallel processing.” Vitalik has earmarked the release of this in two stages: late 2023 and early 2024. With the fundamentals of Ethereum improving through the Merge and on-chain statistics looking better everyday, the Shapella upgrade as well as the introduction of the 1st iteration of sharding in 2023, retail and institutional investors will want hop on the wagon before the action really begins and be a part of the ever-evolving Ethereum ride.

With all of this activity taking place on Ethereum, one sector in its ecosystem will be impacted the most and that is liquid staking providers. Liquid staking providers are third-party platforms that enable users to earn rewards for staking their Ether while still being able to use the staked tokens to participate in other decentralized finance (DeFi) applications. This process is commonly referred to as “liquid staking.”

The concept of liquid staking emerged since staking involves locking up tokens for a specified period of time, during which they cannot be used for other purposes. By using a liquid staking provider, users can stake their ETH and receive staking rewards, while also retaining the ability to use their staked ETH for other purposes such as trading, lending, and borrowing.

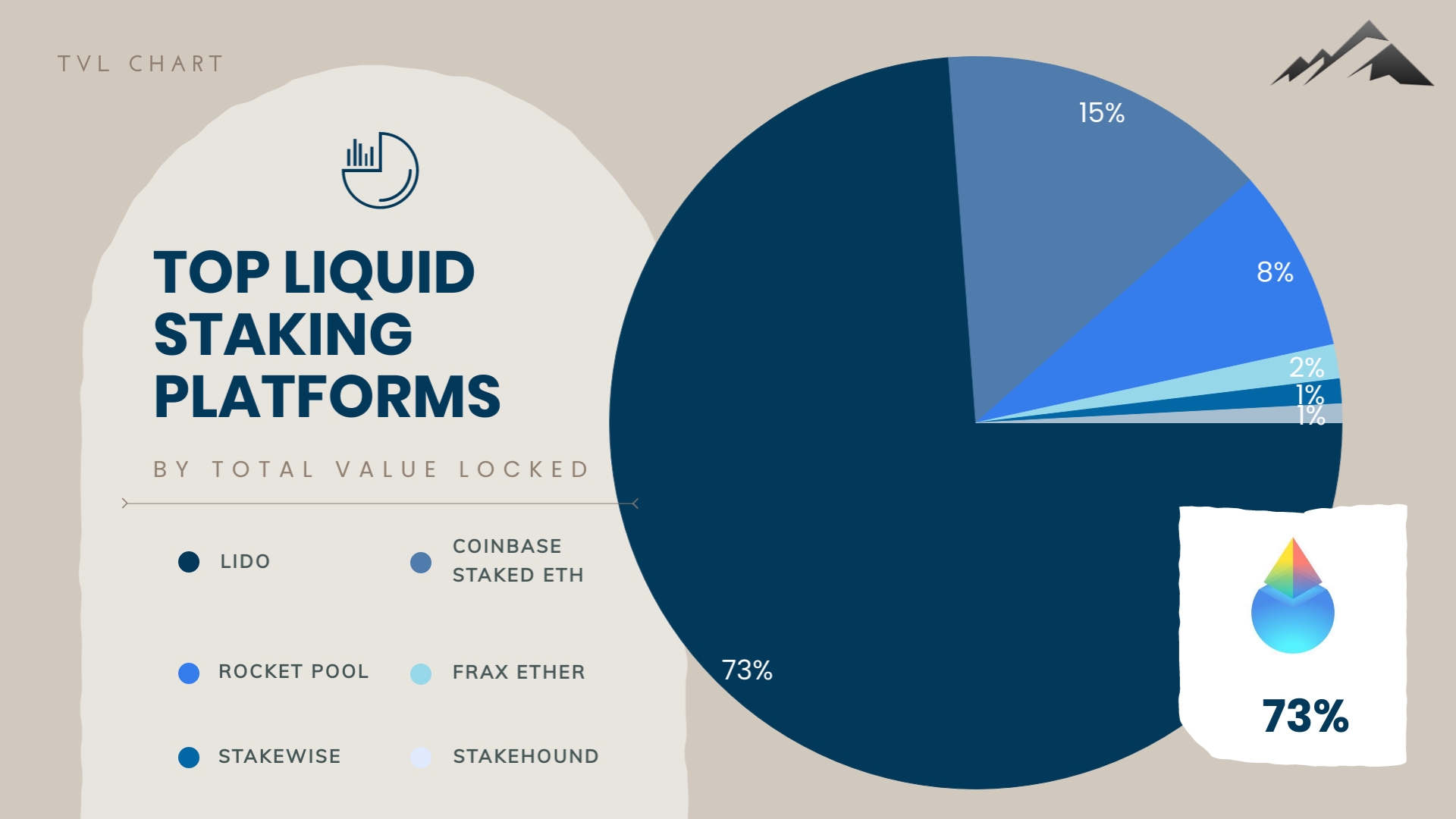

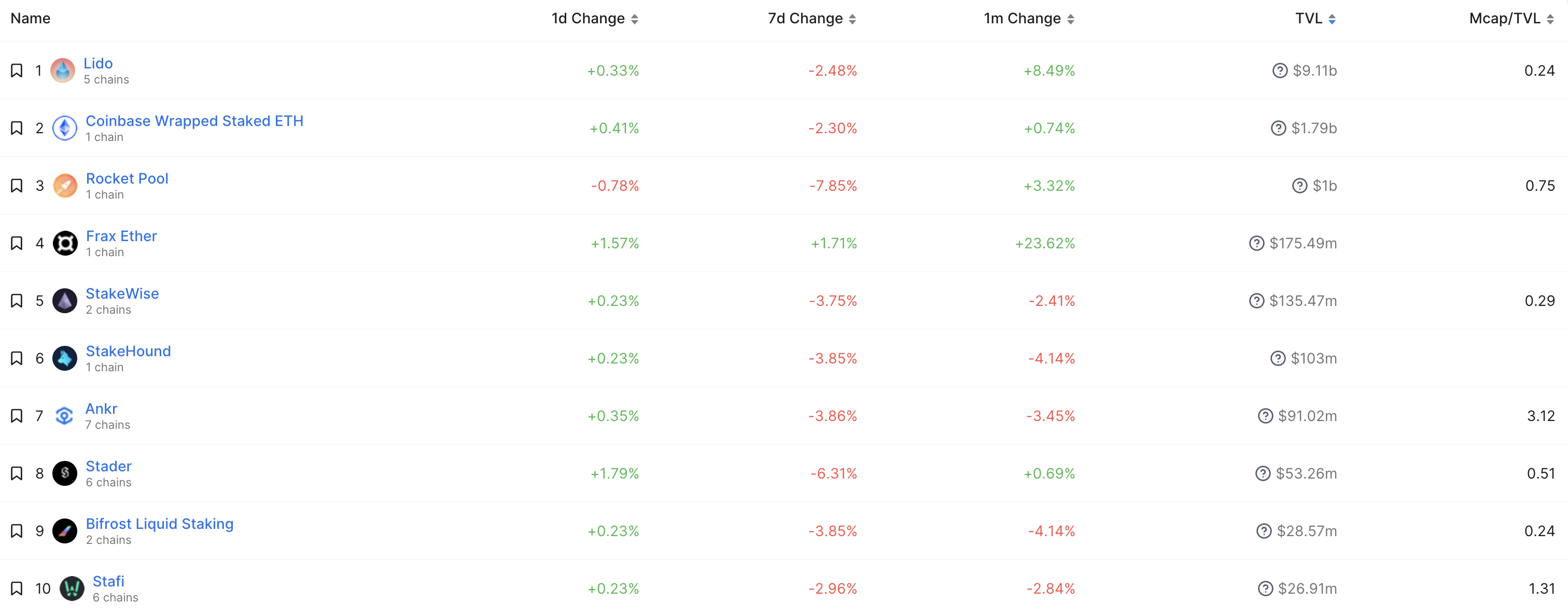

Top Liquid Staking Providers, screenshot from DeFi Llama

Some of the popular liquid staking providers on Ethereum include:

- Lido Finance – A decentralized liquid staking protocol that enables users to stake their ETH and receive liquid stETH tokens, which represent their staked ETH and can be used in other DeFi applications.

- Rocket Pool – A decentralized staking network that allows users to stake their ETH and earn rewards, as well as providing a marketplace for node operators to offer their services.

- Stkr – A decentralized staking platform that allows users to earn staking rewards while retaining the ability to use their staked ETH in other DeFi applications.

- Ankr – A blockchain infrastructure provider that offers liquid staking services for Ethereum and other blockchains, allowing users to earn rewards while retaining the flexibility to use their staked tokens in other applications.

It’s difficult to determine which liquid staking provider is the “best” on Ethereum, as they all function in basically the same way. The only metric that users should pay attention to is the TVL (Total Value Locked). However, each liquid staking provider does have its own unique features and advantages. It’s essential to research and compare different providers and consider factors such as the fees charged, the user experience, security, and decentralization of the platform, as well as the staking rewards offered. Of course, nothing in this article is or should be considered financial advice.

While the Ethereum Shanghai upgrade does not directly impact liquid staking providers, it could indirectly impact them in several ways. One of those being that it could increase competition among liquid staking providers as more providers enter the market to take advantage of the improved user experience, reduced transaction fees, and faster transaction times. This could lead to better services and lower fees for users but also increase the need for users to carefully evaluate the provider(s) they use. Another indirect impact is the fact that upon launch of the Shapella upgrade, stakers will be allowed to withdraw their Ether whenever they please, perhaps crumbling the third-party staking business air its core. There will be no more need to get wrapped Ether tokens or stETH (if you’re staking with Lido) and we believe more individuals (mainly retail) will opt for the option to stake their own Ether with the ETH 2.0 Deposit Contract.

0 Comments