What to Know and How to Prepare Yourself

Heading into the upcoming Ethereum merge this week, we wanted to give an overview on some big takeaways of the math and mechanics behind the merge, what it means for the ecosystem, and if there are any potential plays associated with it- please note though that everything Black Mountain puts out is the cumulation of our own research, opinions, and perspectives that is not and should not ever be considered financial advice.

First and foremost, it seems there has been quite a bit of confusion around the up-and-coming ETH upgrade. The Ethereum blockchain will not rename itself to ‘Ethereum 2.0’, change the ticker, or have any significant company re-branding. Regular users of the blockchain (those who send tokens, create decentralized apps, and trade NFTs) will not notice any meaningful change to their current user experience. The merge is only switching the way the network is secured (also called the ‘consensus mechanism’), from Proof-of-Work (PoW) to Proof-of-Stake (PoS) or from miners to people that are staking at least 32 ETH.

For the users who enjoy PoW, there will be a legacy Ethereum token, ETHW, airdropped to the holders of Ethereum one for one at the time of the chain split. Ethereum PoW (ETHW) will exist alongside Ethereum (ETH) and Ethereum Classic (ETC), similar to how Bitcoin Cash (BCH), Bitcoin Satoshi’s Vision (BSV), and Bitcoin Diamond (BCD) exist alongside Bitcoin (BTC). There will be an influx of marketing for the ETHW token as there are Ethereum miners with deep pockets that need a PoW chain compatible with ETH to mine on in the future. Many large-scale projects, such as Circle (USDC), have openly announced that they will stay on the same Ethereum chain and switch to PoS after the merge.

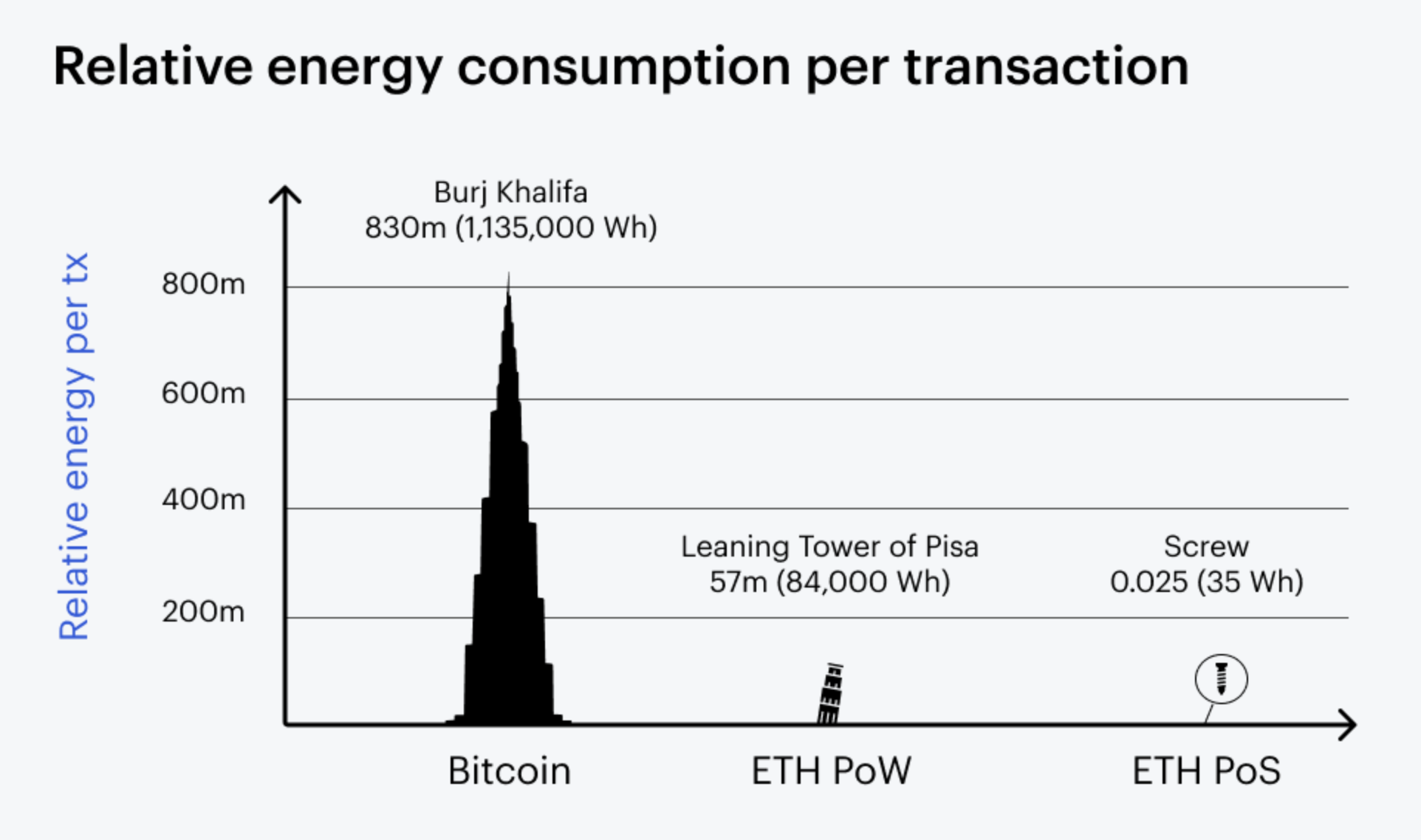

This consensus mechanism transition as a whole is in lockstep with increased environmental efforts from governments and large institutions around the world as Ethereum’s switch to PoS reduces energy consumption from validators by a factor of well over 1,000.

Graphic provided by ConsenSys

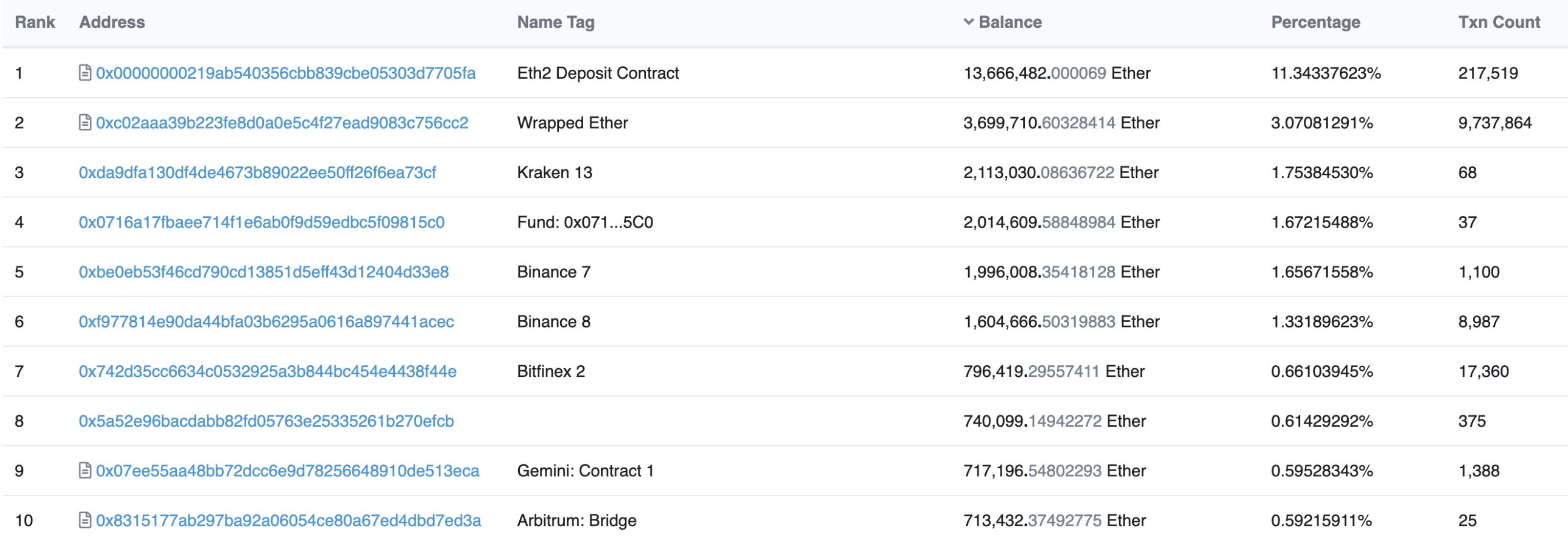

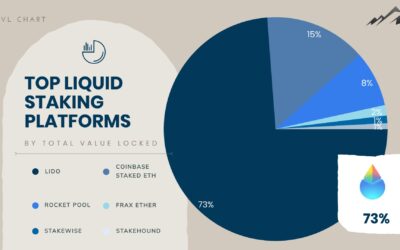

The amount of money locked up in the ETH merge staking contract has surpassed 13 million ETH so far, and there’s been ~2.6 million tokens burned since the EIP-1559 launch in August 2021, which collectively account for ~13% of the total supply. As you can see below, the “Eth2 Deposit Contract” is the largest Ethereum wallet on the chain at around $24B (at the time of this writing). We’re also seeing BitDAO, a protocol that supports builders of decentralized technologies, and other major players in this space continue to stack (but not stake) ETH.

Top 10 Holders on the Ethereum Blockchain, Etherscan

Contrary to popular belief, the merge will not enable withdrawals of presently staked Ether or reduce the gas fees. Investors are currently unable to withdraw or access their staked ETH, and as of now, there’s no announced date of when this withdrawal feature will be implemented. The development team has slated a loose time frame of anywhere between six to twelve months post-merge. In addition to this, gas fees will like stay the same on the base layer. Layer-2s (such as MATIC, LRC, etc.) already provide sophisticated users with the ability to pay essentially no transaction fees. Over time, gas is likely to go down as more users switch to layer-2 tokens or even find other, more efficient coins / ecosystems.

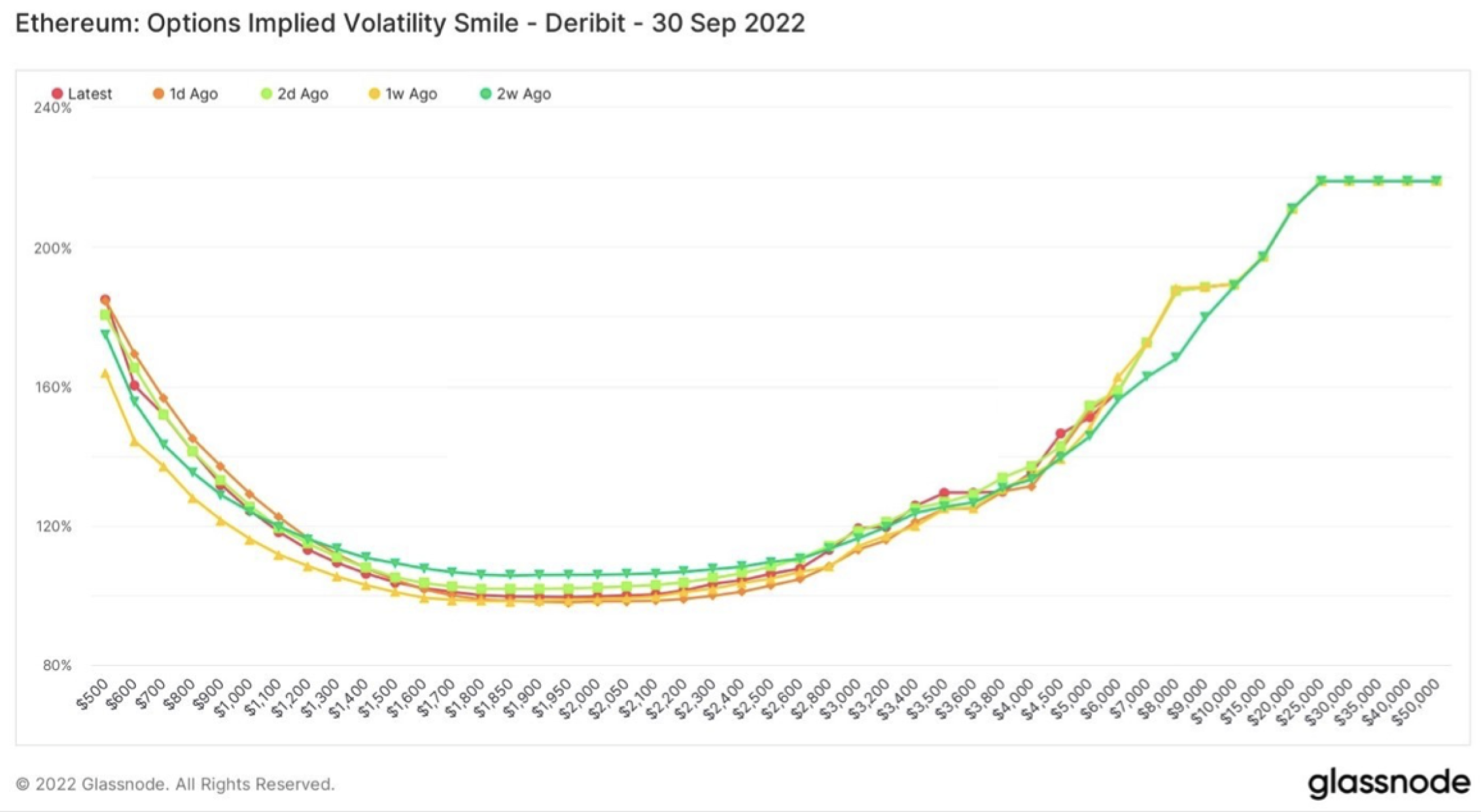

Historically, Ethereum has released major product upgrades at the market’s local top, sucking in retail investors for liquidity. The Ethereum Options Implied Volatility Smile (OIVS) image below illustrates various options’ implied volatilities with different strike prices for the given expiration date. In the example below, the smile shows a rather large buy-side demand for ETH call options expiring at the end of September, indicating that traders are paying premium for long exposure heading into the end of this month.

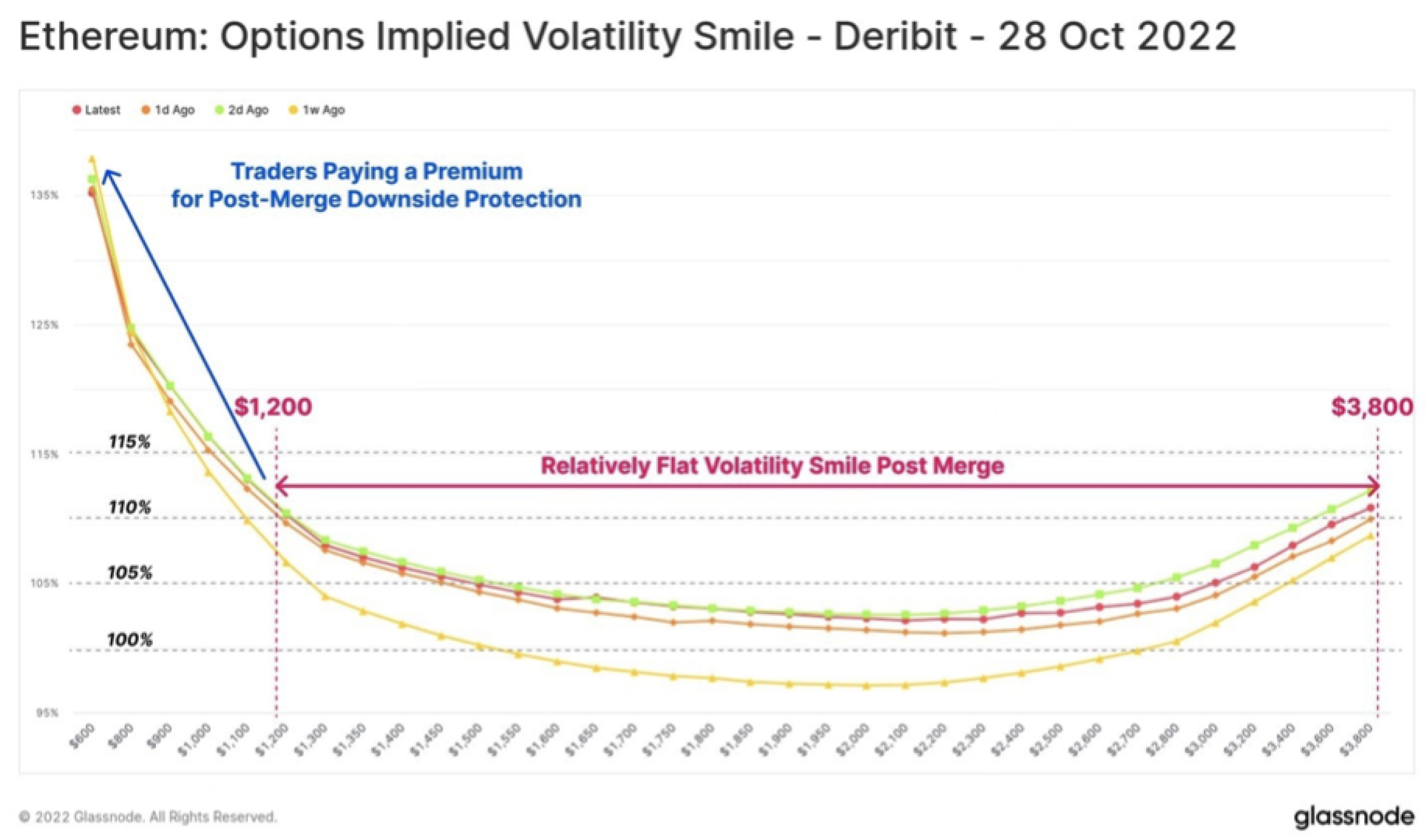

That being said, if we observe the same Ethereum OIVS chart below but with instead an expiration date of October 28th, 2022, it confirms our thesis of a ‘buy the rumor, sell the news’ post-merge phenomenon. Instead of paying a premium for long exposure, investors are paying a premium for downside protection post-merge. More thinking behind this local top is accompanied by cues of continued quantitative tightening by the FED and inverted yield curves in bond markets. The premium on downside protection illustrates that investors believe the market won’t rise significantly after the merge; this is evident by the ‘Volatility Smirk’ that’s apparent on the chart. Many market participants are expecting a great period of stability following the merge as investors re-price the asset given its new value proposition.

By analyzing this information provided by Glassnode, our team is following other large institutions and playing long into the merge as we will collect ETH PoW tokens then try swap them as soon as possible for original ETH tokens. We aren’t necessarily set in stone on a long position for the long-term, but we are always seeking to take full advantage of volatility in the markets to help juice returns for us and our investors. It’s very hard to pinpoint exact entries, but we’ve been doing our best to mitigate downside risk by active management, dollar cost averaging, and using trailing stop losses on all of our positions.

As always, please feel free to reach out to hello@blackmountainig.com if you have any questions, concerns, or feedback. Thank you for reading.

– The Black Mountain Team

0 Comments