After a long week of capital raising and portfolio construction, on Friday afternoon, we thought we had clocked out for the evening, but as we knew when we signed up for this, the job of managing investor’s money never really ends, but that’s part of why we love it.

Later that evening, Kyle and Thawon were on the phone watching the markets for signs of an impending market correction. Earlier in the afternoon, we had talked about selling some of our positions but decided to hold as the choppiness (at that time) looked somewhat sustainable with a potential bounce back to new highs. However, around 9pm MST, Kyle noticed Ethereum (ETH) lose the previous ATH level of support at $4,081 with great speed and made a split-second decision to liquidate ~45% of The Jupiter Fund’s holdings to set a buy limit order at the $3,431.59 support level (which was found on May 4th, 2021).

Unbelievably, less than 10 minutes later, our play hit and wicked exactly at Kyle’s limit order price, filled, and returned almost 11% instantly (the play is up around ~21% gross now and we are holding with a tight stop-loss).

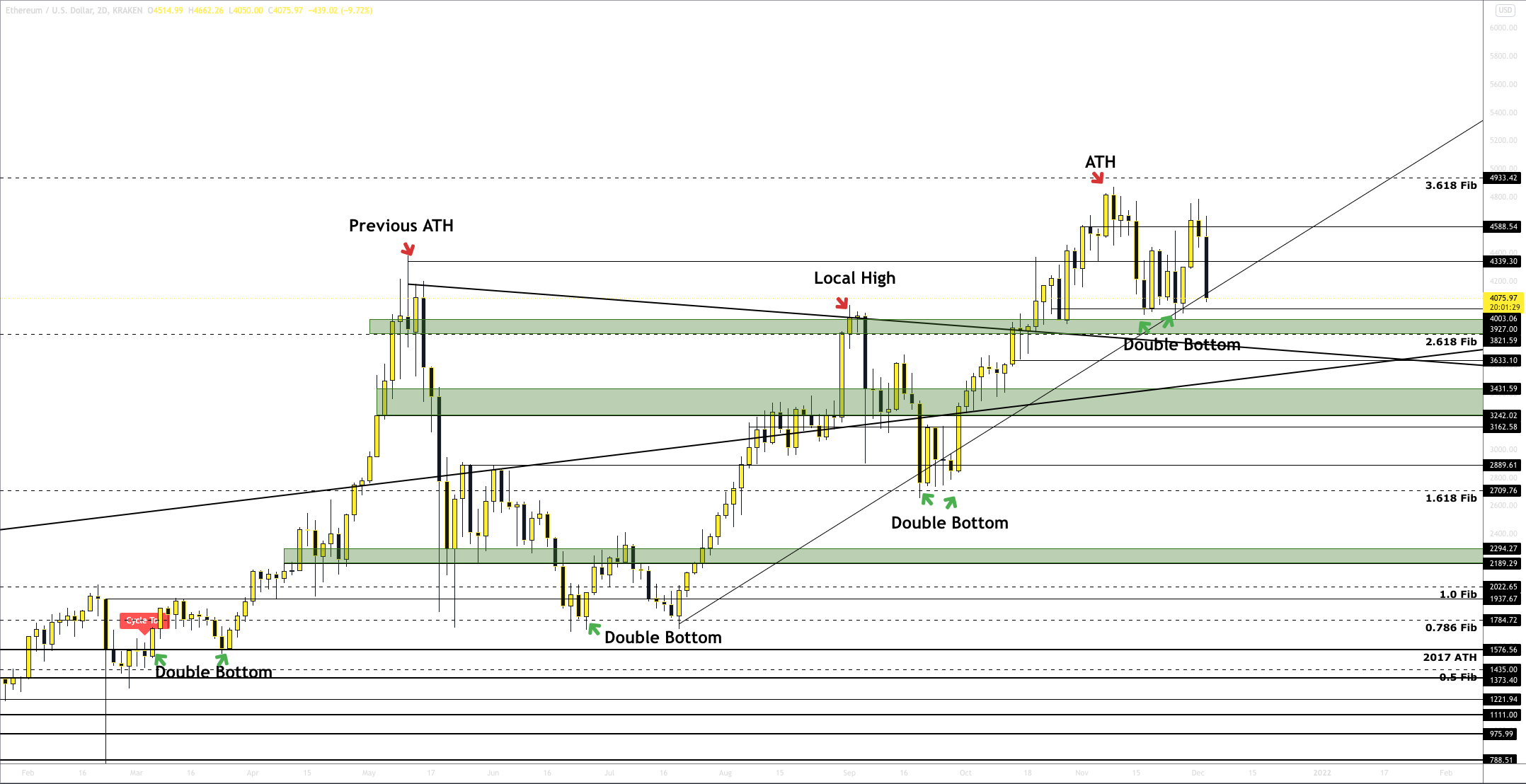

The chart below shows what Kyle was looking at while making this decision

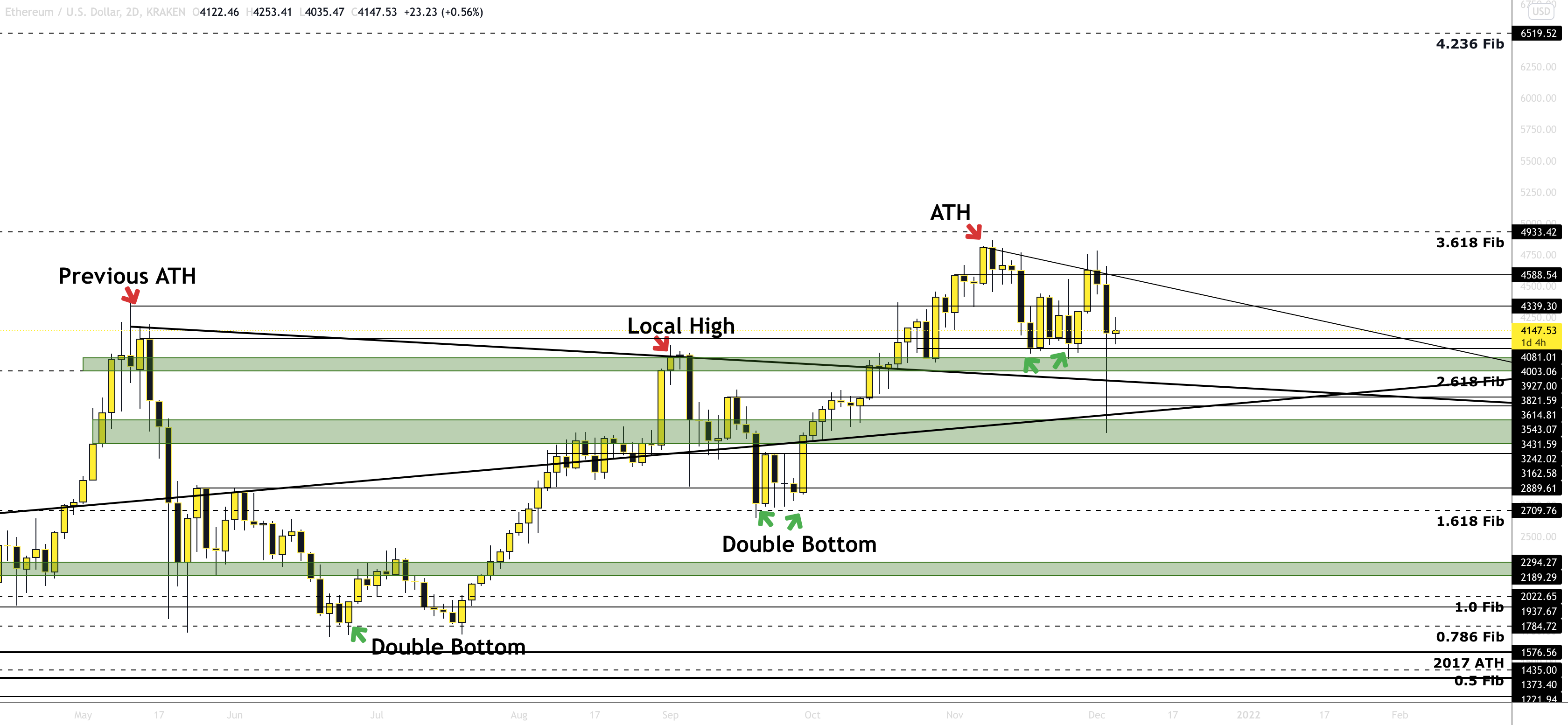

And this chart below shows the move down to $3,431.59 moments later

This move downwards happened so fast that by the time our position had already filled and ETH was back up above $3,821, our friends & family were just getting around to checking the markets and blowing up our phones about the late night volatility. It felt great to be able to tell them that we circumvented the impending 25% drop and actually managed to increase our base holdings of Bitcoin & Ethereum by ~18%*. We managed to navigate away from nose-diving the portfolio and came out virtually unscathed while a majority of the market is down significantly and seeing a whole lot of red. To put this in context, on Friday alone, there was an aggregate total of ~$2.5 billion in BTC and ETH longs liquidated, wiping out 330,338 individual trader’s levered accounts.

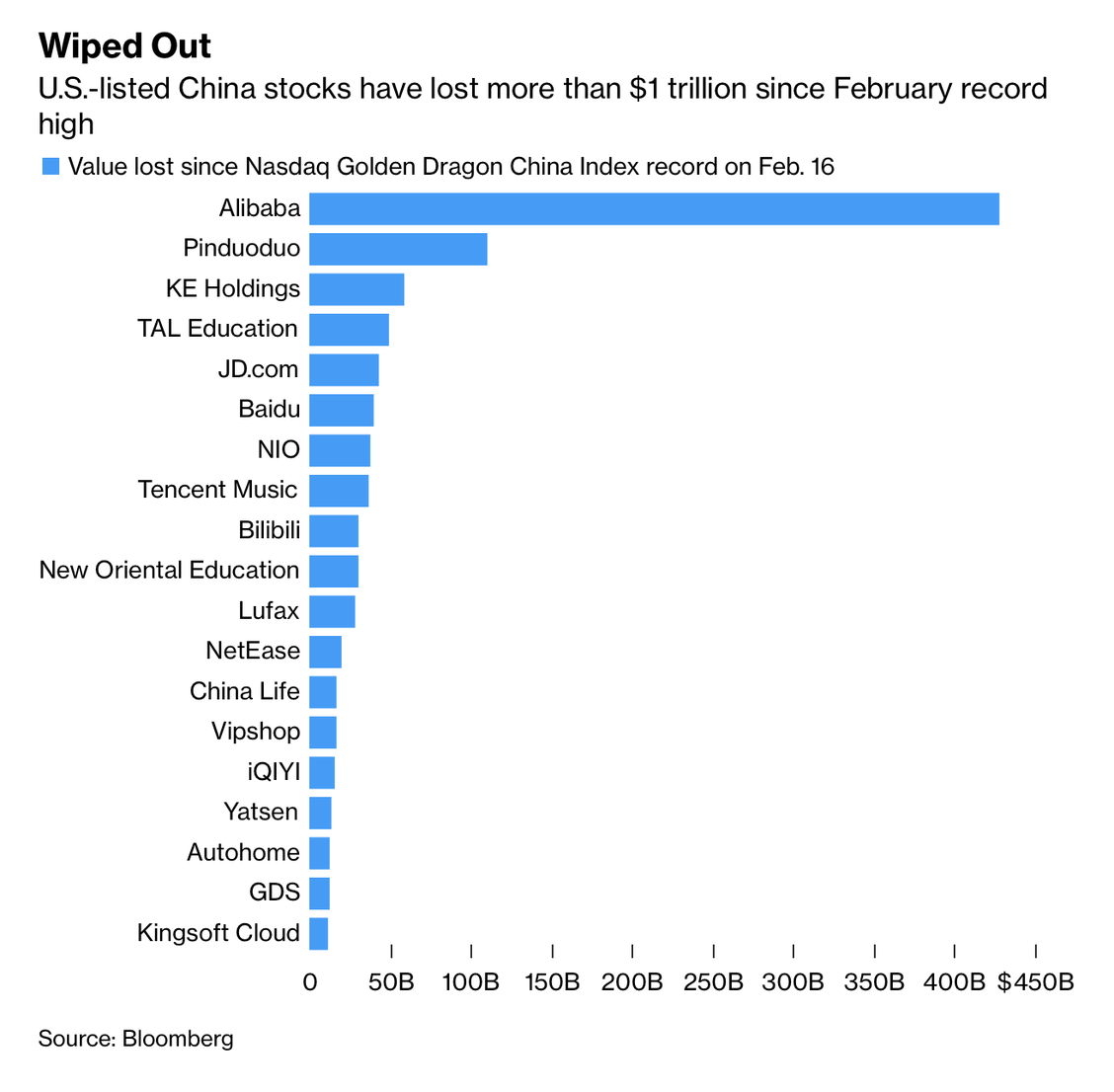

While we continue to see capitulation throughout the markets, we are actively watching the charts and confident that our positions are primed for robust growth in the coming weeks/months, many of them from a strong starting basis. We believe this latest sell off is a product of some not-so-great news of late including a meager jobs report, the latest COVID Variant, Omicron, having popped up in 1/3rd of US States now, rising US-Russia tensions over Ukraine, and massive losses in Chinese stocks, primarily over Chinese ride hailing giant Didi announcing their delisting from the NYSE and sale on the Hong Kong exchange. This comes after raising $4.4 billion from retail investors during their June IPO and reaching a $75 billion market cap shortly after. DIDI now sits at around a $30 billion market cap and investors are wondering now than ever about the future financial relationship between the US and China…

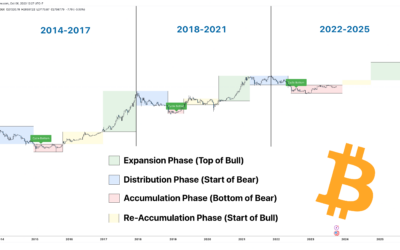

As you can tell, The Jupiter Fund GP was able to navigate these fast-moving markets and come out of a ~20% market drop relatively unscathed, but we certainly still have significant ground to make up with the positions we didn’t liquidate. We have spent a lot of time today debating whether to hold or sell every single one of our current positions, but for now we feel confident in our holdings and believe that we are primed for strong, safe, and steady growth heading into the next few months as we have numerous limit sells placed along confident resistances and we are sitting ~16% cash to be deployed into our core assets (or any newly discovered and compelling opportunities) through laddered limit buys. As many of you know, we are in the process of creating investor reports that go out every quarter (this quarter will be our first), and we look forward to sharing with those invested at the end of this month, keeping in mind that we are less than two months into operating and see the bulk of our portfolio growth happening over the coming months.

We are and will continue to curiously track the impacts of these ongoing foreign relation situations, the transmissibility and fatality of Omicron, as well as November’s soon to be released CPI report, which we are expecting to even beat October’s red hot 6.2% figure. We believe there is going to continue to be accumulation throughout markets this week and have placed limit orders with our remaining cash and limit sells for some of our current positions accordingly as we continue to carefully eye global financial markets and news heading into the rest of December.

Best,

The Black Mountain Investment Group and Jupiter Fund Team

As always please do your own research, this information does not constitute as financial advice.

0 Comments