What is Polkadot (DOT)?

Polkadot, a project co-founded by Peter Czaban, Robert Habermeier, and Gavin Wood, is a sharded blockchain network designed to facilitate seamless communication and interoperability between multiple blockchains.

Gavin Wood is the Co-founder of Ethereum and the Web3 Foundation, Peter Czaban is the Co-founder of the Web3 Foundation and Parity Technologies, and Robert Habermeier is a Thiel Fellow with a research and development background in blockchains, distributed systems, and cryptography. Gavin Wood left the Ethereum development team to create his own blockchain, which became Polkadot and Kusama, the test network of Polkadot. Kusama is the network used to test smart contracts before deploying them on the main Polkadot network, and both are developed by the Web3 Foundation by Founder Gavin Wood.

Parity Technologies is responsible for developing a range of open-source projects, including the popular Parity Ethereum client. This lightweight, high-performance client is designed for the Ethereum network and has become a preferred choice for many developers and businesses. Parity Technologies’ commitment to open-source development has earned it a reputation as a reliable, innovative force in the blockchain space.

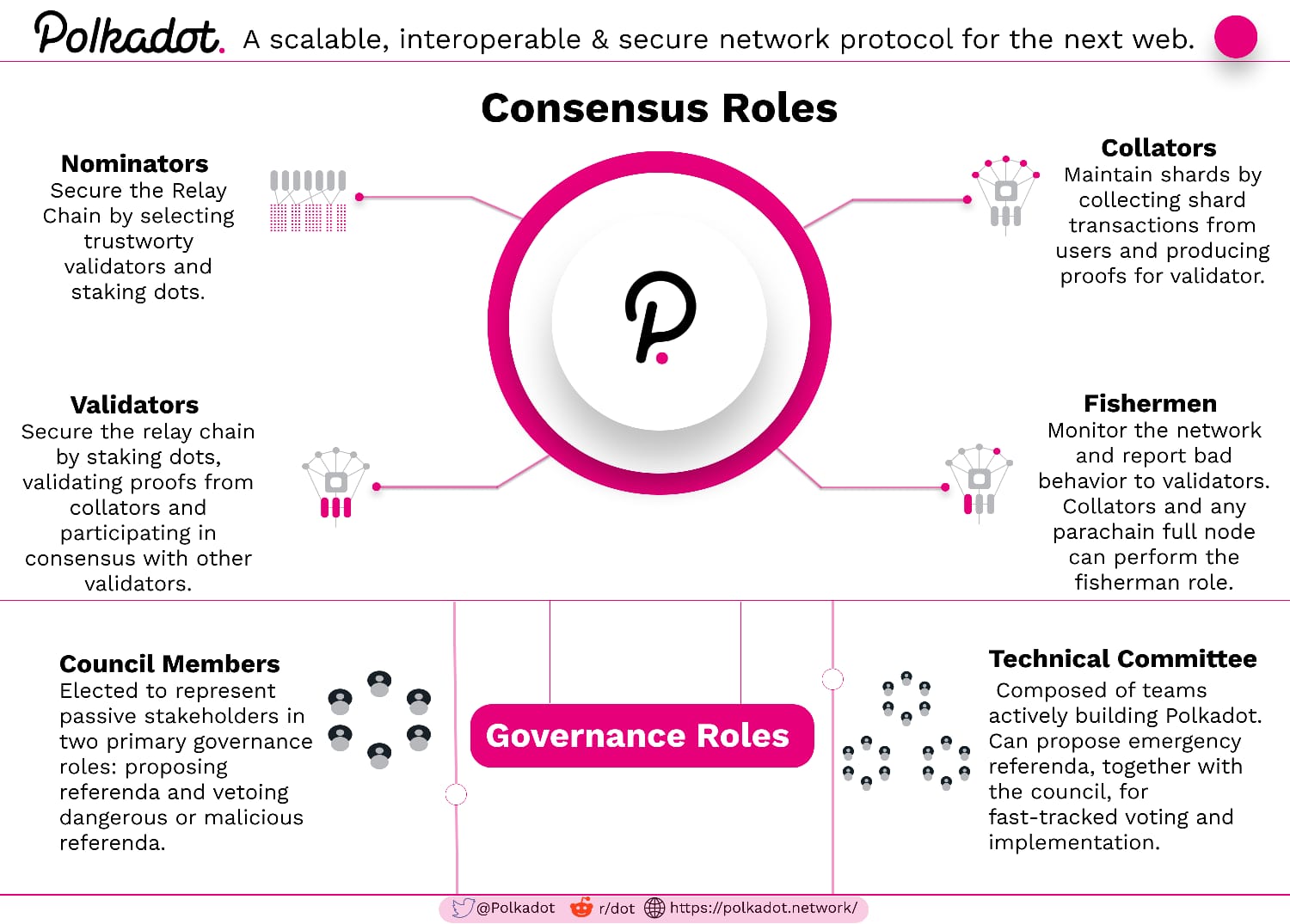

At the heart of the Polkadot ecosystem is its unique consensus algorithm, which combines Nominated Proof-of-Stake (NPoS) and GRANDPA finality for a secure and efficient network.

One of the key components of Polkadot’s consensus process is the block production slots. Block producers are chosen by the network to propose new candidate blocks in these slots. These blocks are then validated by other network participants through the transaction validation process. Validators must accept block candidates that adhere to the consensus rules and meet the necessary requirements. This mechanism ensures that only valid and secure blocks are added to the blockchain, leading to a more reliable and robust network.

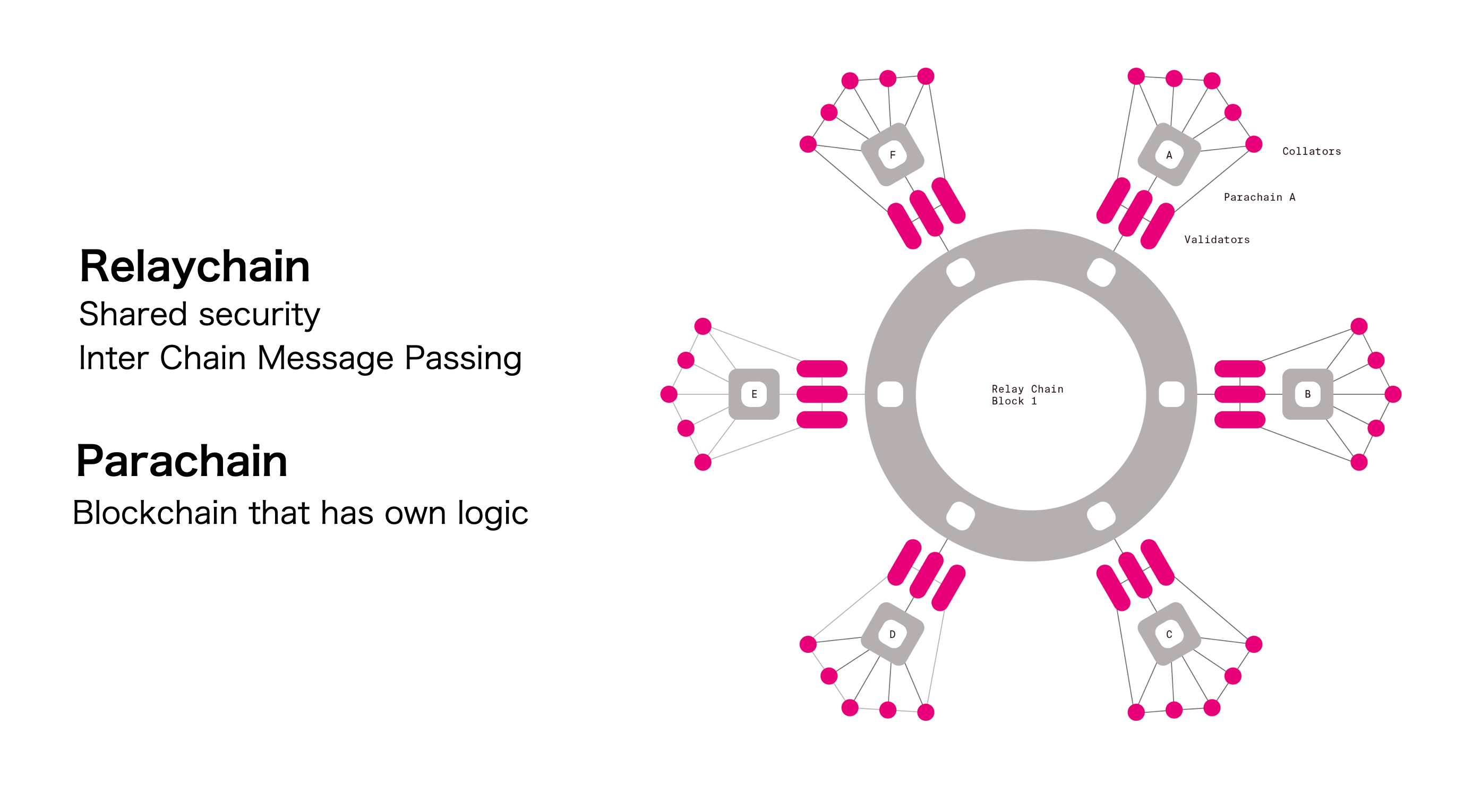

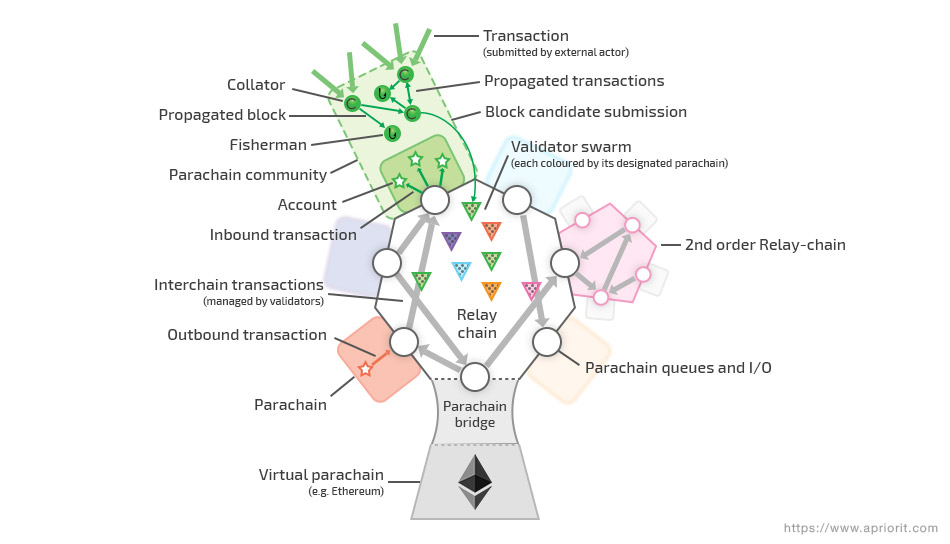

The Polkadot Relay Chain is the central hub that coordinates communication between the various parachains. It does this through a cross-consensus messaging format, which enables data and value transfers between different blockchains, regardless of their individual consensus mechanisms. The relay chain is responsible for aggregating and validating the block candidates from the parachains, ensuring the integrity of the Polkadot ecosystem.

In the Polkadot network, DOT is the native token that serves multiple purposes, including governance, bonding, and transaction fees. DOT holders, or token holders, can participate in the governance of the network by voting on proposals and upgrades. Additionally, they can nominate validators by bonding their DOT tokens, contributing to the security and decentralization of the network. Transaction fees are also paid in DOT, incentivizing block producers and validators to maintain the network’s functionality and integrity.

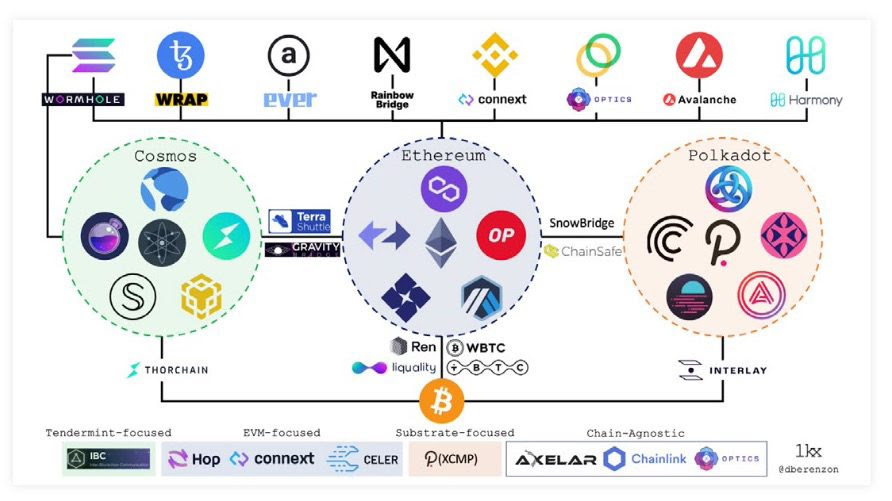

Graphic by 1kx Network

What Makes Polkadot Unique?

Polkadot is unique because it’s a Layer-0 sharded multichain network, improving scalability by processing transactions on several chains in parallel, otherwise known as Parachains.

A custom blockchain interoperable with Polkadot is easy to develop using the Substrate framework and can be connected within minutes. The Polkadot network is highly diversified and agile, allowing the sharing of data between users similar to apps on the latest smartphone.

One of the main differences between Polkadot and other networks is its consensus algorithm. Polkadot employs a hybrid consensus model, consisting of Nominated Proof-of-Stake (NPoS) for validator selection and a voting logic-based finalization process called GRANDPA (GHOST-based Recursive Ancestor Deriving Prefix Agreement). This combination allows for quicker transaction finality and a more efficient network while still providing a high level of security.

In Polkadot, the network is divided into multiple chains called “parachains,” each with its own application functionality and consensus rules. These chains operate independently, allowing for greater scalability compared to a network with just one blockchain. New blocks are created and validated through the consensus process, which involves validators producing state transition proofs for the parachain transactions. Validators are chosen through a blind assignment process, which ensures that they are fairly and randomly selected from the network.

To maintain network integrity and discourage malicious behavior, validators are required to put up a bond, known as the validator’s bond. This bond can be slashed if a validator acts maliciously or fails to perform their duties properly. The finalization process plays a crucial role in achieving transaction finality. In Polkadot, the slower finality agent, GRANDPA, is responsible for finalizing the new blocks produced by the various parachains. GRANDPA’s voting logic ensures that the blocks are finalized in a Byzantine fault-tolerant manner, providing security and confidence in the network’s transaction history.

In addition to parachains, Polkadot also features a central relay chain that coordinates the communication between the different chains. This design allows for a more efficient distribution of resources, and it enables complete control over the custom blockchains connected to the network. The relay chain is responsible for processing transactions from multiple parachains, ensuring the integrity of the network, and providing a common point of reference for all connected chains.

What is the Polkadot Relay Chain?

At the core of Polkadot’s architecture is the Relay Chain, which is responsible for the network’s security, consensus, and cross-chain communication. The Relay Chain connects the network to polkadot’s parachains, independent blockchain extensions that can host a wide range of applications, including smart contracts, token sales, and other decentralized services.

The Relay Chain is responsible for producing new blocks and finalizing them. Validators on the network propose block candidates, which contain the state transitions of the parachains. These block candidates are then processed and included in the Relay Chain blocks. Validators stake their DOT tokens as collateral, ensuring that they act honestly and follow the protocol rules. If they are found to be malicious or negligent, their staked DOT tokens can be slashed as a penalty.

Polkadot’s unique architecture enables the creation of blockchain extensions called parachains. These parachains are customizable and can be tailored to the specific needs of individual projects, fostering innovation and scalability. By connecting to the Relay Chain, parachains can securely communicate and transact with other chains in the Polkadot ecosystem.

The network’s parachains are an essential component of Polkadot’s vision for a decentralized web. Each parachain operates independently but is connected to the Relay Chain, allowing them to leverage the security and consensus mechanisms provided by the Polkadot network. This design allows for the creation of a diverse range of applications, from decentralized finance (DeFi) to gaming and identity management. These features, combined with the network’s interoperability, have attracted numerous projects to build on Polkadot, driving demand for the DOT token and contributing to the growth of the ecosystem.

The main difference between Polkadot and other blockchain platforms is its focus on interoperability, allowing different chains to communicate and transact with each other seamlessly. This is achieved through the Relay Chain, which processes and finalizes blocks leading to the creation of a unified ecosystem.

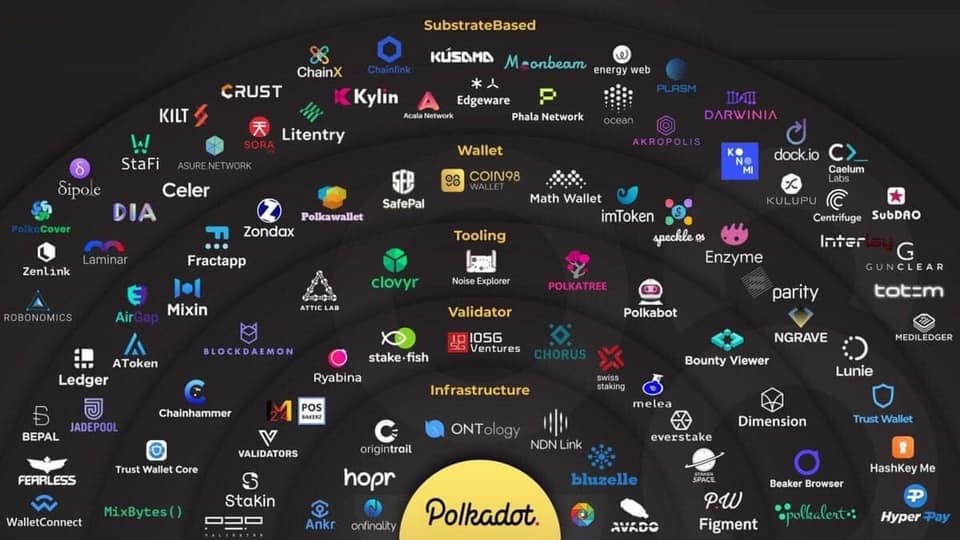

Polkadot Ecosystem

Photo by Coin98 Analytics

There is a great handful of projects underlying the Polkadot ecosystem and analyzing every one of them would take more than the length of this article, so we are going to look at a few of importance.

Reef Finance (REEF) – DeFi platform with liquidity access from CEXs, DEXs, and blockchains such as Ethereum, Avalanche, Polkadot, and more. REEF uses an AI-driven personalized engine called Reef Yield Engine to provide customized DeFi investing for users with varying risk tolerance. They recently introduced the world’s first DeFi blockchain called reef chain, built with the Substrate framework, providng a decentral hub for DeFi projects to build on.

Kusama (KSM) – Scalable network of specialized blockchains built using Substrate and nearly the same codebase as Polkadot. The network is a technical development playground for teams who want to move fast and innovate on Kusama or prepare for deployment on Polkadot.

Polkaswap (PSWAP) – Next generation, cross-chain liquidity aggregator DEX protocol for swapping tokens based on the relay chain (Polkadot and Kusama network(s)), Parachains, and blockchains interoperable with the use of bridges.

The Polkadot ecosystem is a groundbreaking decentralized platform designed to enable seamless interoperability between multiple blockchains. Developed by Parity Technologies, Polkadot has attracted significant attention in the cryptocurrency world due to its innovative approach to solving scalability, governance, and cross-chain communication challenges.

DOT Token Supply and Tokenomics

DOT is the native cryptocurrency of the Polkadot network, playing a crucial role in maintaining the security and functionality of the platform. DOT tokens are utilized for governance, staking, and bonding full nodes. In the Polkadot ecosystem, DOT holders can participate in community votes, propose changes, and have a say in the network’s future.

• Facilitating Network Governance: Users can earn economic rewards by locking their DOT to mint new tokens, participating in network governance by voting on proposals.

• Creating Parachains (Parallel Chains): Independent blockchains that have their own tokens and are optimized for specific use cases

• Rewarding Participants: The network incentivizes users that play key roles (node operators, staking validators) in helping the network function by minting new DOT.

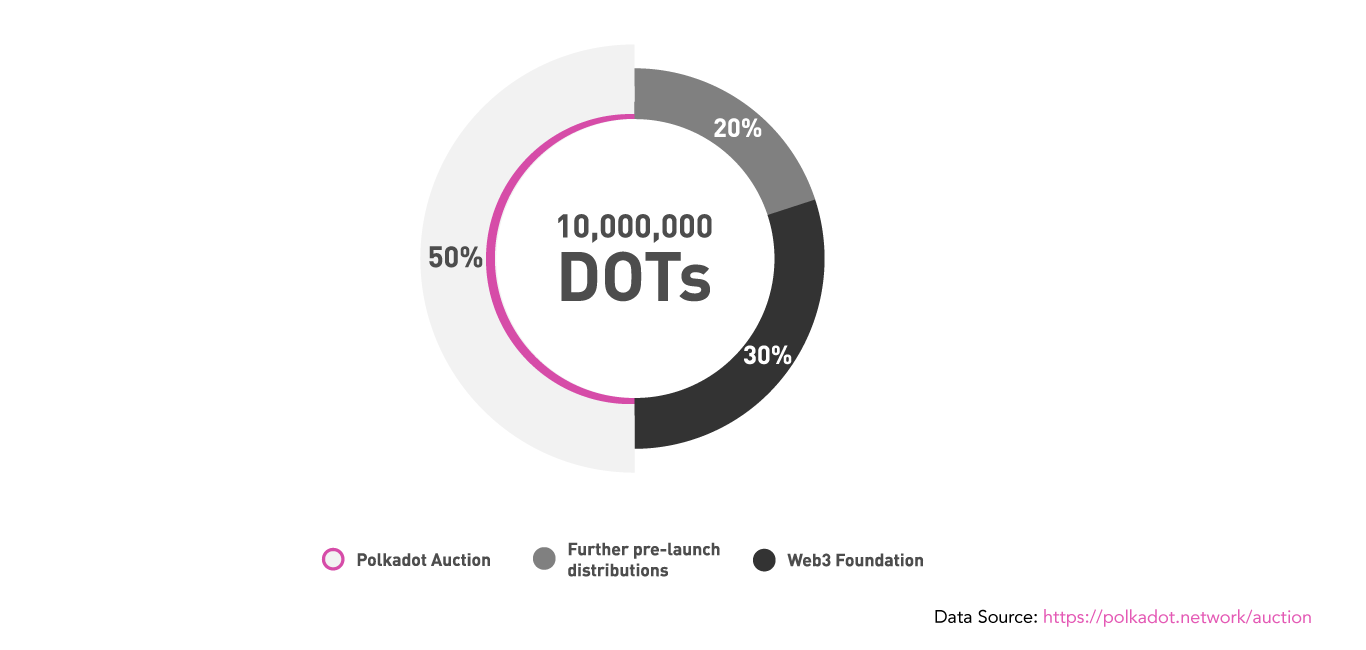

Since its inception, Polkadot has experienced significant growth in the crypto market. Its native DOT token has consistently ranked among the top cryptocurrencies by market capitalization, solidifying its position as one of the leading blockchain projects. When the token first hit mainnet in August 2020, there was a humble max supply of 10 million tokens. The first Polkadot vote took place in summer 2020 with 86% of voters holding 2.47m DOT voting to increase the total supply of DOT with a reverse split 100:1. The new circulating max supply was ~1 billion tokens and has been around that number since the redenomination vote. Polkadot is a Proof-of-Stake (PoS) cryptocurrency and is inflationary by nature with no hard cap on the supply. The annual inflation level is set at 10% now to pay out staking rewards, however, that number over time will be cut in half.

The DOT price is influenced by factors such as market sentiment, demand for the token, and the progress of the Polkadot ecosystem. The total supply of DOT tokens is fixed, with a portion being reserved for future distribution through various mechanisms, including staking rewards and treasury allocations. This limited supply can contribute to an increase in the DOT price, especially as the Polkadot ecosystem continues to grow and gain adoption.

Polkadot (DOT) Holders

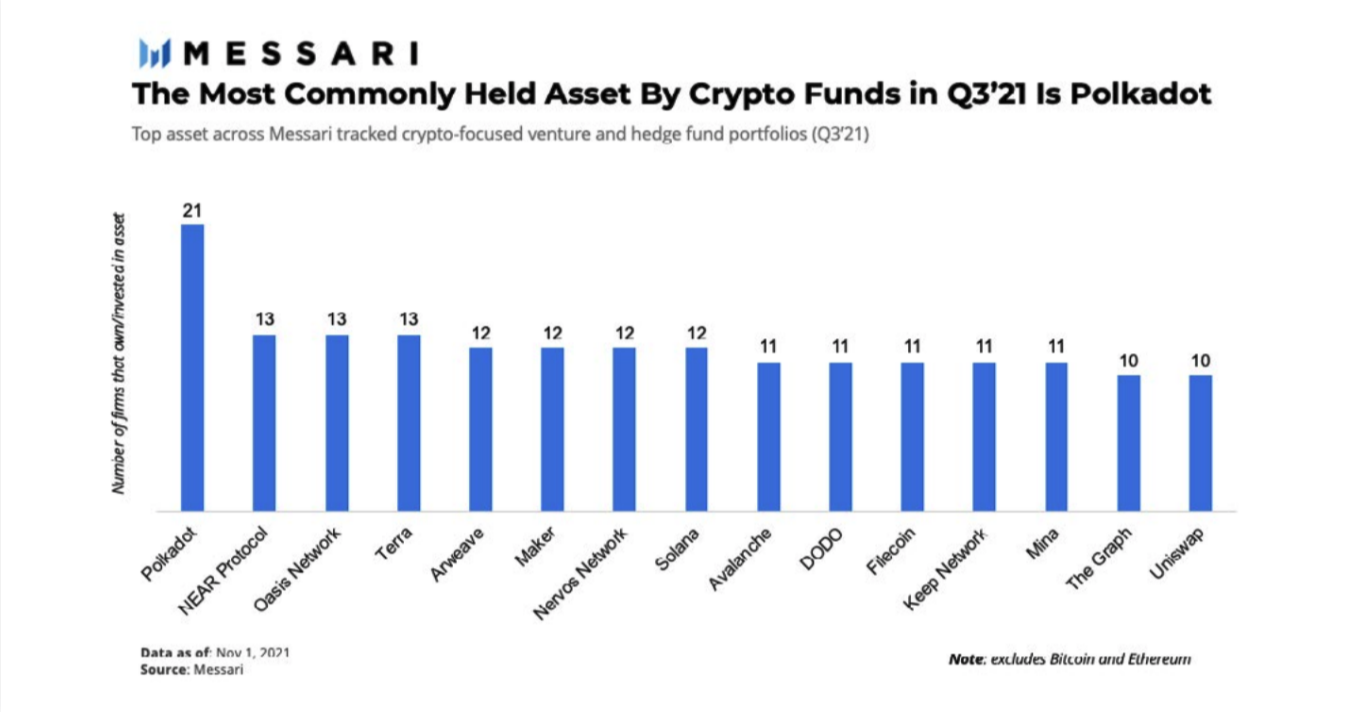

Photo by Messari

In this Messari Research report, the team analyzed the most held asset by crypto-focused venture and hedge fund portfolios in Q3′ 21 and got a clear answer of Polkadot. The biggest DOT holders are crypto-focused venture and hedge funds, meaning they must see the discrepancy between true value and the current DOT price. Investing in Polkadot (DOT) and holding DOT tokens may yield future profits active DOT holders, given the promising prospects of the Polkadot ecosystem. However, as with any investment, there are risks involved, and the potential for future profits is not guaranteed. It is crucial for investors to conduct thorough research, understand the project’s fundamentals, and be aware of the inherent volatility in the crypto market.

The market cap of Polkadot is an important indicator of the project’s value and standing within the broader cryptocurrency market. As the DOT price increases and more tokens enter circulation, the market cap is likely to grow, reflecting the growing interest in the Polkadot ecosystem. DOT owners, consisting of investors, developers, and stakers, can potentially benefit from the project’s success as the market cap increases.

Polkadot Token Analysis

The Polkadot ecosystem has experienced significant growth since its inception, with numerous projects choosing to build on its infrastructure. This increased interest has resulted in an uptrend in the Polkadot price, reflecting the demand for its native DOT token.

The Polkadot price has seen substantial fluctuations over the years, with its value being influenced by various factors, including market sentiment, overall crypto market conditions, and development updates within the Polkadot ecosystem. As a result, the DOT price has experienced both upward and downward price movements. The market cap of Polkadot, which is the product of its circulating supply and DOT price, has consistently ranked among the top cryptocurrencies.

Our analysts have given a Polkadot price prediction of $1 Billion to support the ecosystem. With all of the new projects building on the network and applying as a block candidate on the parachain (the blockchain extension), the underlying network needs value to support the growth. Not even looking at technical analysis, we believe that is a proper bottom for the network given the token sale of multiple projects.

Predicting the price of any cryptocurrency, including Polkadot’s DOT token, is a complex task that requires considering numerous factors, such as market sentiment, technological advancements, regulatory developments, and overall market trends. Although it is impossible to provide an accurate price prediction, we can explore some factors that may influence the DOT price in the future.

Network Growth and Adoption

As the Polkadot ecosystem continues to grow and attract more projects, developers, and users, the demand for the DOT token is likely to increase. The DOT token is essential for various network functions, such as governance, staking, and parachain auctions. As the platform’s adoption expands, the demand for the DOT token could lead to an upward pressure on its price.

Market Sentiment

Market sentiment plays a crucial role in determining the price of cryptocurrencies, including the DOT token. Positive news, technological advancements, and high-profile partnerships can significantly impact market sentiment, driving increased interest in Polkadot and potentially leading to price appreciation. Conversely, negative news or events can have the opposite effect, causing the price to decline.

Crypto Market Trends

The overall trend of the cryptocurrency market is another important factor that can influence the Polkadot price. Bullish market conditions can result in increased investment in the crypto space, leading to potential price gains for the DOT token. On the other hand, bearish market conditions may lead to a decrease in demand for cryptocurrencies, including the DOT token, resulting in price depreciation.

Regulatory Developments

Changes in regulatory frameworks and government policies can significantly impact the cryptocurrency market, including the price of the DOT token. Favorable regulations and policies that encourage the growth and adoption of blockchain technology and cryptocurrencies can create a positive environment for the Polkadot ecosystem, potentially leading to price appreciation. On the other hand, restrictive regulations or unfavorable policies may hinder the platform’s growth and negatively impact the DOT price.

The Future Growth of DOT

Polkadot, a revolutionary blockchain platform, has been making headlines in the cryptocurrency industry thanks to its innovative approach to interoperability, scalability, and cross-chain communication. This cutting-edge technology has led to increased interest in the future growth of the Polkadot ecosystem and the potential price appreciation of its native DOT token. In this article, we will explore the factors that could contribute to Polkadot’s growth and provide an analysis of potential price predictions for the DOT token.

Factors Affecting Polkadot’s Future Growth

Interoperability

One of the main drivers of Polkadot’s future growth is its ability to facilitate seamless communication between different blockchains. With the increasing number of blockchain networks, the need for a platform that enables smooth interoperability is paramount. Polkadot’s innovative Relay Chain and parachain structure offer an effective solution to this challenge, allowing different blockchain networks to interact with each other without compromising on security or efficiency.

Scalability

Scalability is another critical factor that could contribute to the future growth of Polkadot. Traditional blockchain platforms often struggle with scaling their networks as the number of users and transactions increases, resulting in network congestion and increased transaction fees. Polkadot’s unique architecture enables the platform to scale horizontally, allowing multiple parachains to run in parallel without impacting the performance of the entire network. This feature has the potential to attract various projects and developers to build on Polkadot, further driving its growth.

Developer Adoption

The growth of any blockchain ecosystem largely depends on the number of developers and projects choosing to build on the platform. Polkadot’s flexible, modular, and interoperable infrastructure provides developers with a robust environment for creating a wide range of decentralized applications (dApps), from DeFi to gaming and supply chain management. As more developers adopt Polkadot for their projects, the platform’s growth will be further propelled.

Governance and Upgradability

Polkadot’s on-chain governance and upgradability features contribute to its potential for long-term growth. The platform’s governance model allows DOT token holders to participate in the decision-making process, making changes to the protocol and improving the ecosystem. Additionally, Polkadot’s ability to undergo forkless upgrades ensures that the network can adapt and evolve to meet future technological advancements and market demands.

Strategic Partnerships and Integrations

Establishing strategic partnerships and integrations with other blockchain networks, enterprises, and institutions can significantly impact Polkadot’s growth. By collaborating with influential players in the industry and integrating Polkadot’s technology into various sectors, the platform can expand its user base, drive demand for the DOT token, and increase its adoption across the blockchain ecosystem.

Recap of the Polkadot Network

The Polkadot blockchain, with its innovative Relay Chain block mechanism, has successfully attracted many developers and projects to its platform. This unique architecture enables seamless interoperability between various chains digital assets, fostering innovation and scalability in the blockchain space.

As the multi-chain economy grows, it’s inevitable that cross-chain bridges will facilitate an enormous amount of asset and data transfer volume. Polkadot will have a key role in facilitating these cross-chain transfers, as its blockchain lays the foundation and represents the sewage, electrical, and water pipes of the crypto ecosystem, always running without being in sight.

In conclusion, the Polkadot network has emerged as a revolutionary platform that addresses critical challenges faced by the blockchain industry, such as interoperability, scalability, and governance. Its innovative architecture, consisting of the Relay Chain, parachains, and bridges, has captured the attention of developers, investors, and projects across the crypto space.

As the Polkadot ecosystem continues to grow and evolve, many people are curious about Polkadot price predictions and the potential future value of the DOT token. While it is impossible to provide a precise Polkadot price prediction, various factors can influence the Polkadot price, including network growth, market sentiment, overall crypto market trends, and regulatory developments.

It is essential to acknowledge that Polkadot price predictions should be taken with a grain of salt, as the cryptocurrency market is notoriously volatile and unpredictable. Instead of focusing solely on Polkadot price and Polkadot price predictions, it is crucial for investors and enthusiasts to consider the platform’s underlying technology, potential for long-term growth, and its ability to contribute to the advancement of the decentralized web.

Ultimately, the success of the Polkadot network and its impact on the Polkadot price will depend on the platform’s ability to attract developers, foster strategic partnerships, and continue innovating in the blockchain space. As the Polkadot ecosystem matures, it will be interesting to observe how the Polkadot price and our Polkadot price prediction evolves in response to the platform’s achievements and challenges.

As always please do your own research, this information does not constitute as financial advice.

0 Comments