It has already been a very eventful month in global markets with major selloffs of cryptos and equities, record-breaking economic losses in China, and the U.K. central bank’s Monetary Policy Committee voting eight to one to lift the Bank of England’s policy rate from 0.1% (a record low) to 0.25%, citing fears of persistent inflation.

This comes the day after the US Federal Reserve announces a series of interest rate hikes to happen in 2022, three to be exact- up two from their September forecast, as well as an increase in the slowdown of bond buying, significantly speeding up plans to curb the current, not-so-transitory nature of inflation happening throughout the economy, with goals of rates reaching ~2.1% by 2024 and central bank bond purchases coming to a halt by as soon as March (instead of June which was the goal as of their November plan).

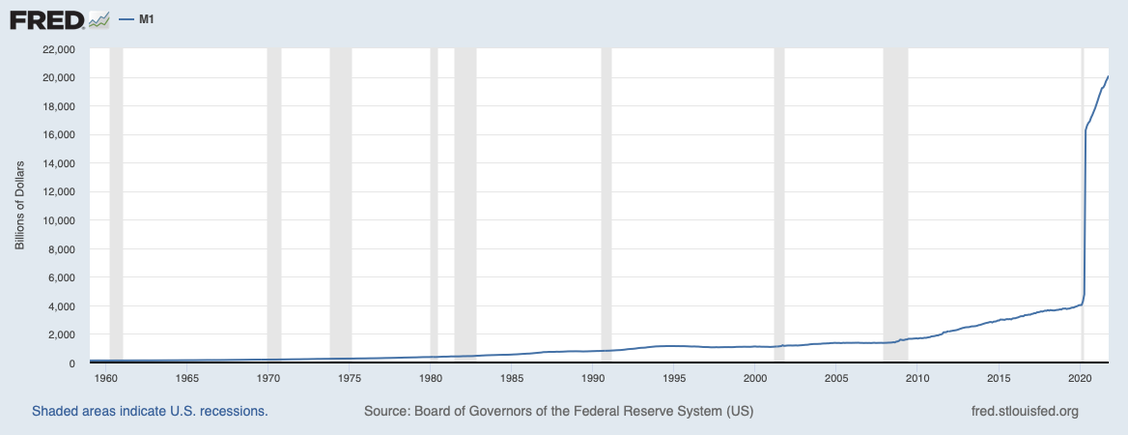

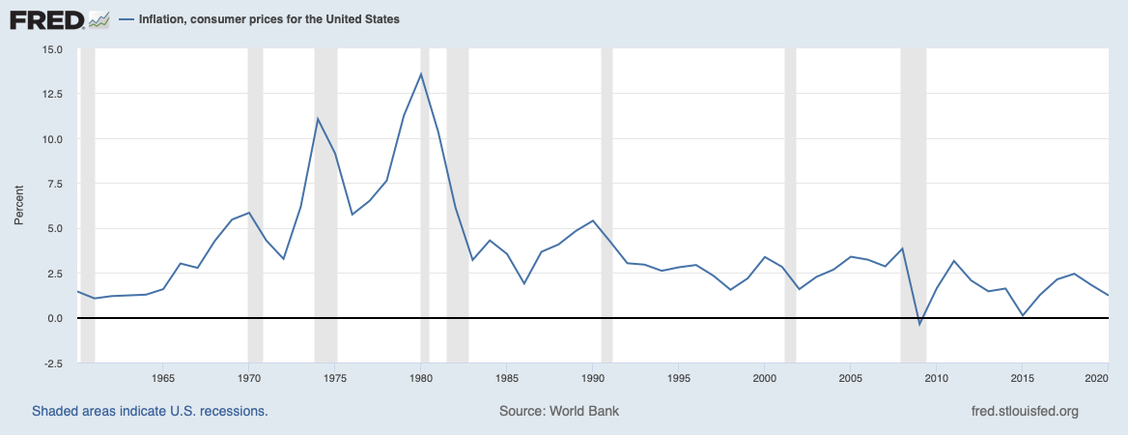

Of course, inflation and global interest rates are two things we, and it seems like everybody else, have been keeping a very close eye on in the face of historically low interest rates and historically high amounts of money in the economy. To put this in perspective, see the below graphs from the Federal Reserve Economic Data (or FRED) showing M1 ( the most liquid form of money in the economy) over time, compared to the graphs of interest rates and inflation over similar time periods… (note these graphs do not reflect the most recent data, in or around summer 2021 is where the most recent data point was collected from).

As predicted in our last update email, the latest CPI report from the Bureau of Labor Statistics was even higher than the last, reporting a 6.8% increase in prices YoY from November 2020 to November 2021 (much higher than what the outdated FRED graph above shows, but still meaningfully lower than in the 70s and 80s). Although this is the largest increase since 1982, we still believe this number is falling short of the actual inflation happening broadly and aggressively throughout the economy. Besides the above graphs, the simplest example/observation to justify this statement can be found in the Producer Price Index (or PPI), which has been considered a guide to future inflation, being up ~9.5% YoY from November 2020 to November 2021, the largest number on record.

Furthermore, if we look more closely into a certain component of the government’s latest CPI report (linked above), we see that the increase in the cost of “shelter,” (which is comprised of “Rent” and what’s called “Owners’ equivalent rent,” or “OER,” which is what owners think they could/would be able to rent their house out for if they did not own it) was reported to be ~3.8% more than last year. It should also be noted that OER and Rent have the two largest weighting out of the 211 item categories that make up the CPI market basket.

The BLS “calculates” Rent and OER by surveying a small number (compared to the massive datasets that are widely available to the public and being updated every month, if not more frequently) of owners and renters throughout the country every six months (versus every 1-2 months for most other CPI calculations, they claim this is to allow a greater sample size). The question for owners is: “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?” The questions for renters are: “What is the rental charge to your [household] for this unit including any extra charges for garage and parking facilities? Do not include direct payments by local, state or federal agencies. What period of time does this cover?”

If this sounds totally informal and out of touch, well, it’s because it is, but unfortunately it is not a joke, and even more unfortunately, it yields some pretty inaccurate information… ApartmentGuide, a Zillow/Airbnb competitor, released this extensive November report which shows meaningful and expansive data that rents across America have actually increased well into the double digits YoY, and predict that trend is here to stay, despite some recent rent decreases nationwide as of last month.

Needless to say, it appears that the government is either pretending not to know how bad inflation is, or they just truly don’t know. Either way, their recent actions of tapering clearly show that they are at least starting to take it more seriously. Fortunately (or unfortunately), it seems like everybody is starting to take inflation more seriously, with even the Democratic West Virginia Senator Joe Manchin blocking Biden’s Build Back Better Plan this morning. We will be very curious how the FED continues to balance trying to get inflation under control without bringing the economy to a grinding halt.

Bitcoin Market Update

At the moment, Bitcoin is trading in a downtrend as the price continues to create lower highs (bearish indication of momentum). Our Partner Thawon noticed the untested liquidity area for Bitcoin around the $40,707 region as well as the 1.618 Fibonacci Extension level placed at $39,696 that has not been backtested as a level of support yet. Shortly after analyzing this, Thawon placed Bitcoin orders at $39,696 which are still yet to be filled. Although the spot price of Bitcoin hasn’t dropped quite as low as those levels, we are hopeful that we can fill another quick wick for the fund and juice these long-term holds from a great entry price. Heading into the end of the year, we will be watching how prices react to these levels to see if we can switch the market sentiment into bullish/bearish rather than a stalemate.

|

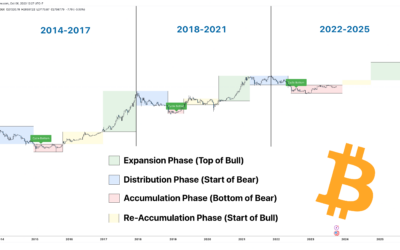

Another key factor to look at on the Macro for Bitcoin are the bull market support band, 50-week Moving Average (MA), as well as the logarithmic regression band. The chart above illustrates Bitcoin on the weekly time frame using all three of those indicators. To start it off in no order of importance, the bull market support band is the 20-week Moving Average combined with the 21-week Moving Average. Now it is ideal to hold above these to confirm we’re still in a bull market, but it does not have to. Like we saw in the summer, Bitcoin was below the bull market support band for some time but bounced off the 50-week moving average and created a new all-time high at $69k. Finally, the logarithmic regression band shows if the current price of Bitcoin is overvalued (red), fair valued (yellow), or undervalued (green). Since Bitcoin is already under the bull market support band the next moving average to look at is the 50-week. As of Sunday 7pm EST, the price closed below $47,548 on the weekly timeframe. Not a great sign, but we will be keeping our eyes on the undervalued zones according to the logarithmic regression band. During the crypto crash in the summer, prices went below both bull market support bands as well as the 50-week MA but retested the top of the undervalued zone of the logarithmic band. This will be the main range we will be targeting if price fails to close above the 50 Week MA.

|

|

As we roll into the end of the year, Bitcoin continues to trade around the $47,410 level and is currently in what we like to call “No Man’s Land”. No Man’s Land is a range in the market where the price is neither bullish or bearish, typically a period of accumulation before the next leg upwards, also properly known as capitulation. The fund has been dollar-cost-averaging back into our main long positions after the scam-wick on December 3rd with an average Bitcoin buy price of $46,083 and Ethereum at $3,731. In addition to these positions, two great projects that we’ve been dollar cost averaging and adding to our staking positions are Polkadot (DOT) & Oasis Network (ROSE). Last week we posted our insights on Oasis Network to our website, you can check out this short report & analysis (here), where we dive into data privacy features, tokenomics, and more. |

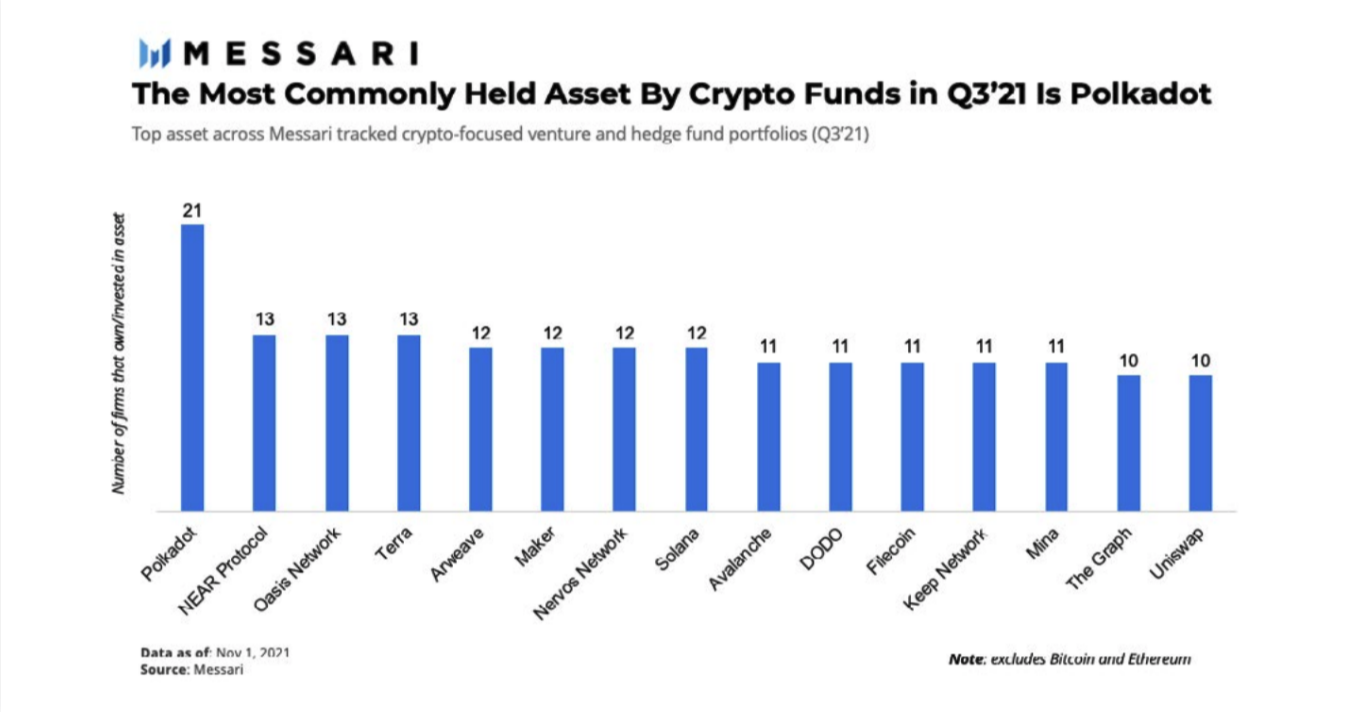

In this Messari Research report, they analyzed the most held asset by crypto-focused venture and hedge fund portfolios in Q3’21 and got a clear answer of Polkadot. Tied for 2nd place in the top holdings is Oasis Network (ROSE), which only confirmed our investment thesis. Polkadot & Oasis Network are the fund’s biggest positions besides Bitcoin & Ethereum, and we couldn’t be more excited about what their vision of building better blockchain infrastructure technology for the future of us all. You can view all our analyses on our Website’s Insights page and go into depth there, but here is a quick elevator pitch of Polkadot to help familiarize yourself with the project as well as explain it with ease to friends and family.

Polkadot was created by Dr. Gavin Wood, the Co-founder of Ethereum & the Founder of the Web3 Foundation and is an open-source sharing multichain protocol that facilitates the cross-chain transfer of any data or asset types, not just tokens, thereby making a wide range of blockchains interoperable with each other.

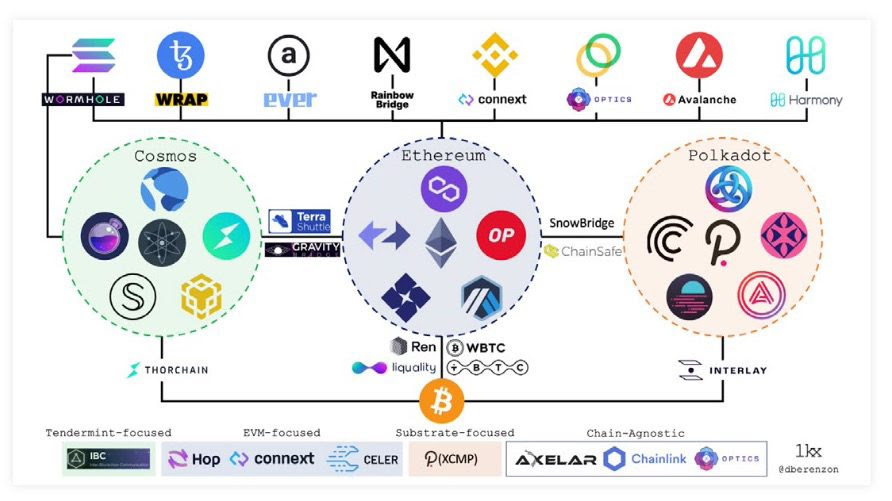

Ethereum will be the dominant smart-contract layer 1 blockchain, however, it will not survive alone as it needs bridges and multi-chains to help mitigate the high transaction fees. That’s why there are amazing projects like Polygon, Loopring, and Terra that do just that, as well as phenomenal other leading layer 1 smart-contract blockchains such as: Cosmos, Solana, Tezos, Binance Smart Chain, Avalanche, Harmony and others. Blockchains right now are like isolated nation-states, with limited transportation systems between each other. As the multi-chain economy grows, it’s inevitable that cross-chain bridges will facilitate an enormous amount of asset and data transfer volume. Polkadot will have a key role in facilitating these cross-chain transfers, as its blockchain lays the foundation and represents the sewage, electrical, and water pipes of the crypto ecosystem, always running without being in sight.

Another quick two takeaways from the above graphic are: Bitcoin being the medium of exchange between all of the Layer 1 smart contract blockchains, and Chainlink being the chain-agnostic solution respected by the community. This week there were multiple instances of companies and government websites falling short due to Log4j zero-day vulnerabilities. Yahoo picked up this story on how CoinmarketCap briefly minted many crypto billionaires and even some trillionaires due to a glitch with their API, and this instance alone proves why a decentralized oracle network like LINK or BAND is needed in the ecosystem.

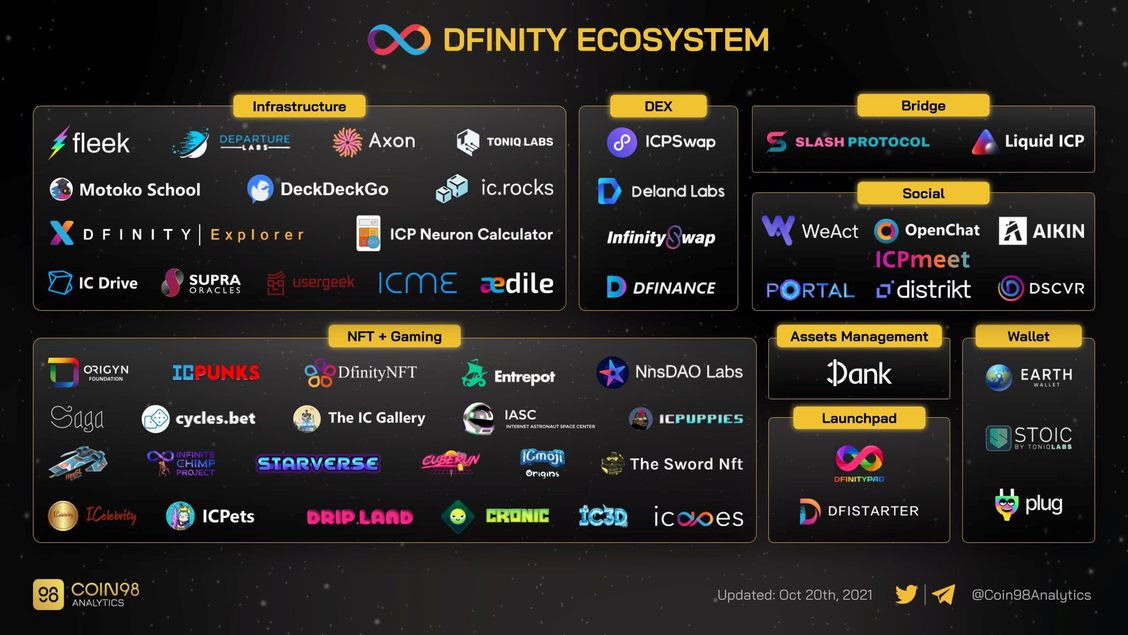

Stepping outside of that ecosystem and into the Dfinity Ecosystem, we can see that this new project has significant infrastructure being built on top of it, Decentralized Exchanges (DEXs) coming to market, and a countless number of NFT + Gaming projects currently being created on Entrepot, the leading Internet Computer NFT Marketplace.

The Internet Computer is the world’s first blockchain that runs at web speed with unbounded capacity. It represents the third major blockchain innovation, alongside Bitcoin and Ethereum, and was founded by Dominic Williams, a cryptography technologist & crypto theoretician who previously worked on Ethereum alongside Vitalik Buterin. The scientific breakthrough called Chain Key Technology allows the Internet Computer to run at web speed – where query calls execute in milliseconds, and update calls take 1-2 seconds to finalize.

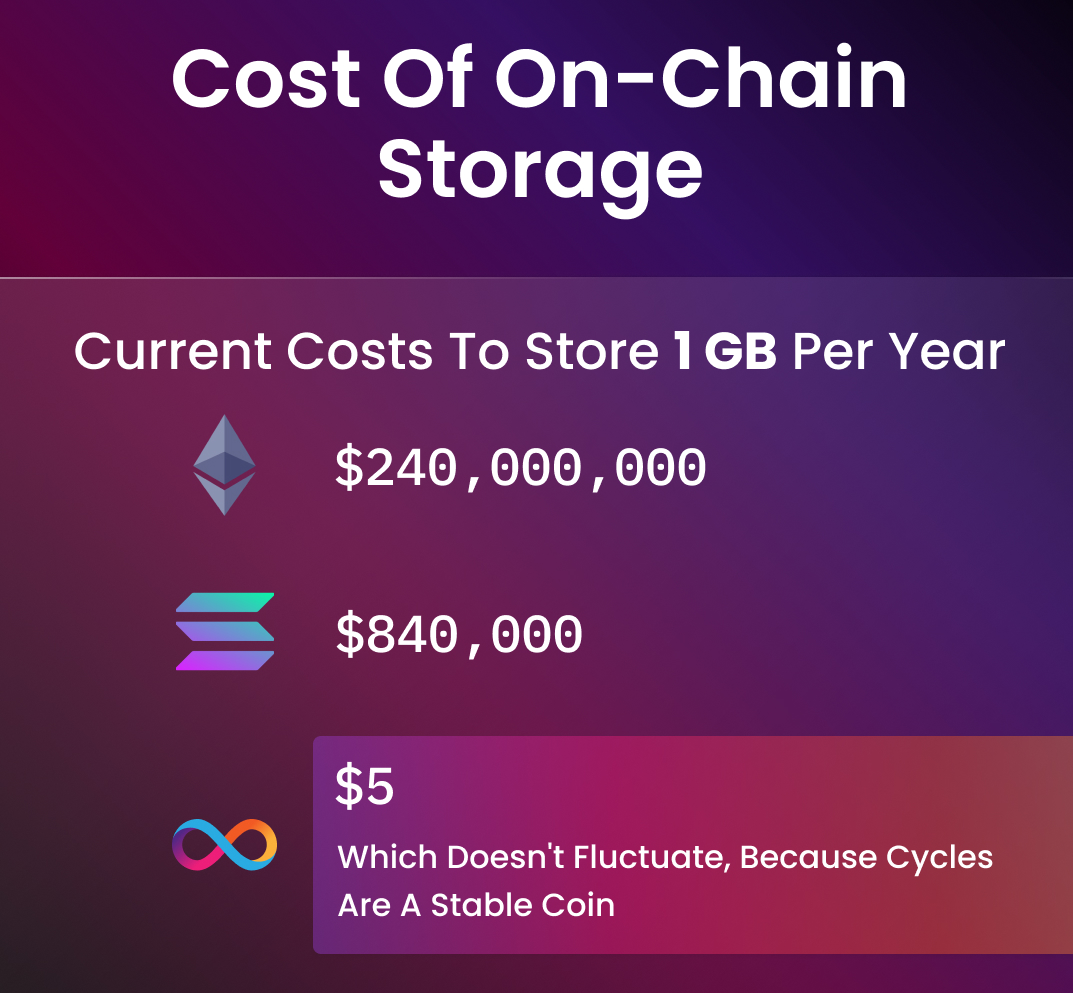

The current cost of on-chain storage is a definite conversation starter with investors and developers familiar with the matter and is a major flaw in Ethereum’s vision of becoming the world’s decentralized computer. Let’s create an example and say that you have 2 GB’s of precious photos that you’d like to store on-chain. We are all major fans of Ethereum, however, we don’t have an extra $480m laying around to dish out for photo storage (see above graphic). Not to mention the ever-increasing gas fees, originally this is what prompted our investment in Dfinity’s Internet Computer. To store that same 2 GBs of photo storage on Dfinity’s blockchain, in contrast, would cost you only $10.

More so, this price of $10 never fluctuates, because Cycles are a stable coin. Cycles power computations by acting as fuel for those computations. Stable coins have a constant value over the long term, which contrasts with ICP, whose value will naturally fluctuate over time. Moreover, Cycles are pegged to the SDR, which is a logical currency unit defined by the International Monetary Fund, and 1 SDR worth of ICP can be converted into exactly one trillion Cycles to power computation.

The Jupiter Fund is actively watching the markets and is waiting to get the best entry with the remaining capital that is sitting cash. As we’re stated earlier in the email, the crypto markets are in “No Man’s Land” right now after a ~30% pullback across the board. The Fund has tried its best to mitigate the losses of that drop and has managed to come out unscathed. We understand this downturn in the markets is unenjoyable, but on the bright side when the markets come back, they will come with momentum and surpass their previous highs with ease and into price discovery mode.

Our institutional brokerage, FTX, that is widely regarded as the most reputable centralized crypto exchange for institutions, has been a confusing and frustrating place to trade. We actively observe where orders aggregate in order to find the best places to set our orders. Unfortunately, however, it appears that Sam Bankman-Fried, the CEO of FTX who we have texted with personally numerous times, including when we first set up the fund account, is giving our competitors lower fees and front running our orders.

This is analogous to being both the dealer and a player in a poker game, so not only does he have access to all order books on both sides of the markets (including what institutions are trading what), but he has his own hedge fund called “Alameda Research” that activity trades on his centralized exchange as well that nobody else can identify. Needles to say, a couple red flags here and it’s pretty surprising that this is the most well regarded centralized exchange in the space for institutions. We believe this is an indication of how much of a “blue ocean” the crypto space is on a long term timeframe.

As always please do your own research, this information does not constitute as financial advice.

0 Comments