The last few weeks we saw some very interesting (and perhaps unusual) things throughout crypto, stock, and of all things, bond markets as The US Treasury Issued a Series I Savings Bond initially offered at 7.2% (with a maximum contribution of $10K/year). Because they are limiting annual contributions to $10k/year (for electronic bonds, $5k/year for paper bonds), this might make it seem like it’s not much of an attempt to get money into the government’s hands, but is not to be underestimated as if even 5% of US citizens (which is conservative as ~7.5% of Americans own Savings Bonds, versus the over 50% of Americans investing in the stock market) were to max out their investment into these electronic bonds, that would be about $165B of cash coming in every year for Uncle Sam (or a bit less than 12.1% of what the top 1% of Americans pay in taxes every year).

Although this could end up being a tactful play, it is likely more out of necessity to provide American savers with a place to keep their money (somewhat) safe from inflation as the latest government report dropped a YoY inflation number for October north of 6% (something the BMIG team has been calling out for quite some time, and don’t see ending anytime soon, which is why we are constantly looking for the best possible hedges). High inflation combined with the proposed trillion-dollar infrastructure bill that Biden is to sign on Monday (which marks significant bipartisan efforts and will be one of the largest of its kind at least two decades) make this an especially interesting macroeconomic indicator for us. We will be curious to see what happens to the interest rate on the Savings Bond (and the inflation rate!) over time (and we will be closely watching).

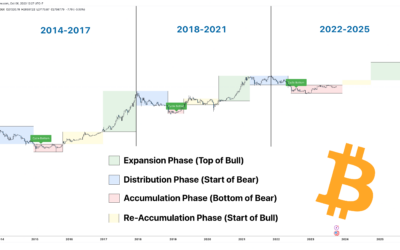

Diving into the cryptoverse, Bitcoin and Ethereum have both surpassed their previous all-time highs this week at $65,000 & $4,500, respectively. Shortly after finding these new highs, Bitcoin lost its momentum and began to sell off. We understand that this movement in the market was created by whales (big players) as it happened in about a 15-minute period. We saw Bitcoin and other assets start to sell off as the SPY & DJI looked a bit overbought with a fear /greed index of 84.

The BMIG Partners have also been continuing to look into GameFi, Metaverse, NFT, and in-game governance tokenssectors that seem to be getting a lot of attention lately, in large part due to Mark Zuckerburg’s announcement that Facebook is rebranding to “Meta”. We personally think this is because Zuck is facing heavy heat for knowingly progressing FB’s famous algorithm that explicitly detroeriates people’s (especially young children’s) mental health. The Metaverse has been around for quite a while, and lil Zucky definitely wasn’t the one to invent it, pretty weird that he’s taking credit for it honestly, but some names that we found a white ago like ALCX, GALA, and more, recently got listed on Coinbase after (and are) seeing massive gains.

As Ethereum continues to grow in market cap, the community moves in unison. Throughout 2021 we’ve seen explosive growth in the ETH ecosystem, with growing active development on lots of new and exciting play-to-earn games like Axie Infinity, on top of all the NFT mania. Beyond all the hype, we believe that Ethereum is going to be useful for real world applications such as: the tokenization of real estate, personal assets, digital identities, unstoppable domains, and much more. Just this week there was the ENS Domains Governance Token airdrop for all the early holders of ENS domains (that have had their domains registered before 10/31) with an airdrop structure according to how long you have been holding your domain. The DAO (Decentralized Autonomous Organization) is currently worth $5.5b with a fully diluted market cap.

As always please do your own research, this information does not constitute as financial advice.

0 Comments