|

We’ve recently seen the ban of centralized staking services and unregistered yield farms targeted and shut down by the SEC, something we have been publicly warning about since September of last year. In terms of decentralization and the true nature of cryptocurrencies, this type of activity is massively positive for the coins. Now we’ll start to see more decentralized staking services, such as Lido, grab hold in the market and individual operators buy/build rigs to stake their coins. Ethereum has its Shanghai upgrade coming up, which we wrote about in more detail recently and will allow stakers in the ETH2 contract to withdraw their tokens as well as general network improvements including several Ethereum Improvement Proposals (EIPs). This act alone will destroy any narrative about Ethereum being illiquid, which is a current narrative against ICP- and their lowest lockup period is six months (ETH’s is currently indefinite). |

|

|

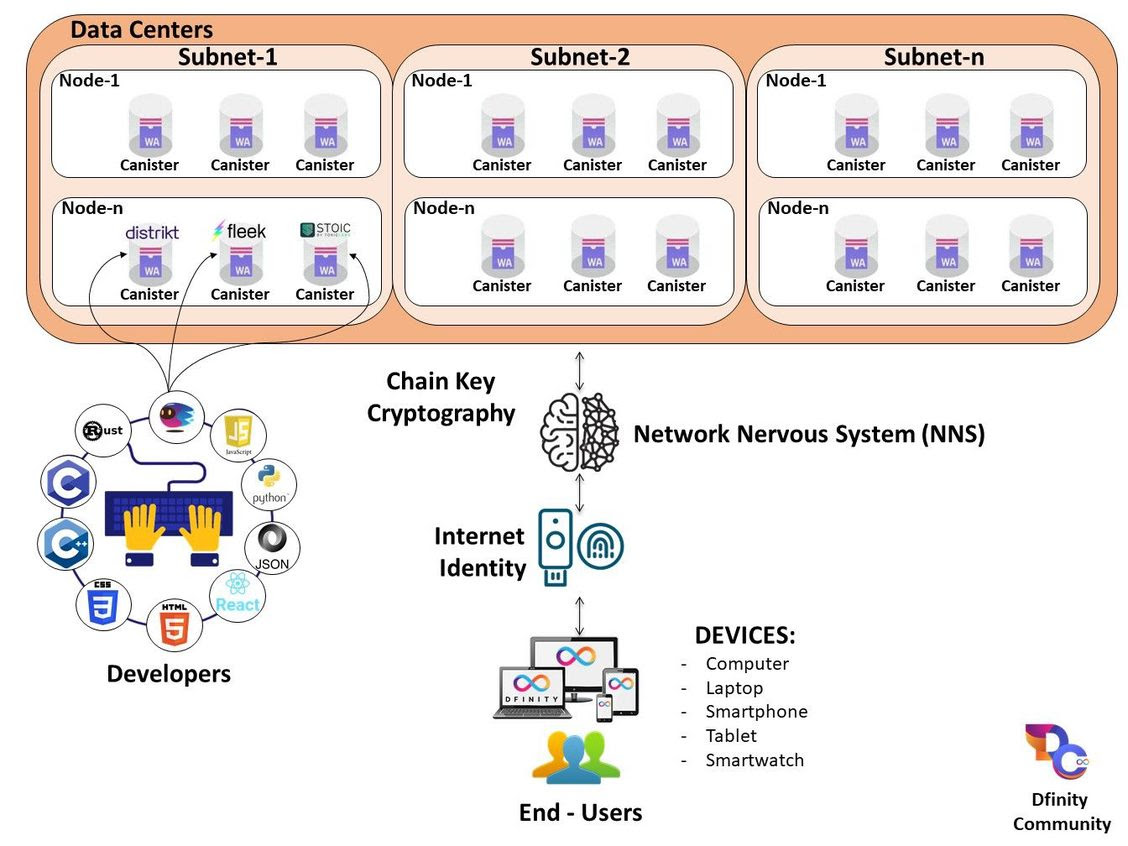

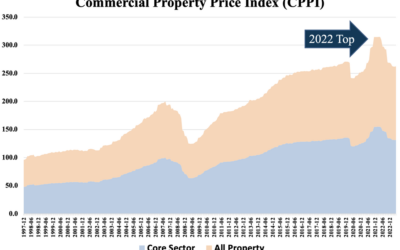

We’ve seen the net issuance of Ethereum supply drop negative (become deflationary) and hold steady for the first time since the implementation of EIP-1559. Unlike Bitcoin, which has a set supply of 21M coins, Ethereum’s monetary policy is to deflate the supply over time. This incentivizes value creation of the newly issued supply. Overall, the fundamentals of Ethereum look very strong and the current market environment feels similar to that of 2019 before the DeFi summer. This time, though, we’ll have a different iteration of the DeFi summer that uses the newest EIPs to create a new token category altogether… We have no crystal ball, but our best guess would be security token offerings (STOs) or Layer 2 DApps, both of which are showing meaningful early signs of life across industry applications. Recently, we saw the Arbitrum Layer 2 token release with a spike upwards to $11 before crashing back down to around $1.40. zkSync’s airdrop is coming this spring and more layer 2 tokens will have their offerings, garnering more hype around the ecosystem’s new technologies. We do believe that we’ll have multiple blockchains in the future. However, that does not mean all of them are necessary or that we must invest in them all. In fact, we take an opposing view and only invest in coins that we understand thoroughly and have clear product/market fit. In 2016-2017, when Kyle first bought Ethereum, he understood the product/market fit of creating a cryptocurrency you could build and issue your own smart contracts on. Online sellers accepted Ethereum (in addition to Bitcoin) as payment because they believed it to be an internet store of value, or digital commodity, they could then use later to purchase other goods/services. Kyle understood that this coin will have intrinsic value in the future. Therefore, he kept buying all the way up until summer of 2019. Throughout the entire last cycle, we didn’t understand what many of these other coins/projects were offering besides a cash grab for the founders, so we didn’t invest in their products. We get told all the time about how we missed Solana or could’ve invested in Shiba Inu, but that’s fine, you don’t have to hit every opportunity out there, and you shouldn’t try to unless you understand them well. In the last cycle, Ethereum was the big winner just as Bitcoin was in the first cycle. This cycle both of those coins are dinosaurs in terms of the technology that makes them work. Therefore, a new king will rise to #3 in market cap during the next cycle. In 2009, the 1st invention in cryptocurrency was Bitcoin, playing the role of digital gold. In 2015, the 2nd invention was Ethereum, which gave birth to the DeFi movement and smart contract technology. An equidistant six years later, in 2021, the 3rd iteration of the blockchain, ICP, is reimagining how you build (and experience) everything. Although this is a very audacious goal for such a new blockchain, this is the only project of its kind and is infinitely more scalable than any other Layer-1 chain we have seen. In addition to creating the Network Nervous System (NNS) and the next generation of smart contracts, Canisters, the team also invented Chain Key Technology. Chain Key Technology is how the Internet Computer Protocol (ICP) can run at web speed– where update calls take 1-2 seconds and query calls finalize in milliseconds. For example, let’s say a user views a decentralized version of Instagram running on the Internet Computer. When that user opens the app, just like the original, web2 Instagram and its AI formulas dishing you the best content, the decentralized Instagram serves user-specific views of the content which is calculated into your web browser by query calls, finalizing in milliseconds. However, when a user wants to publish a post, make a comment, give the creator a tip, like a post, or interact with the platform in any way, this update to the hosted content would require the use of update calls. With ICP, this all happens instantly. With a project such as Ethereum, these same query calls would cost $5-10 in transaction fees and finalize in around 2 minutes. It obviously wouldn’t make much sense to browse Instagram and wait 2 minutes for every picture to upload. While more and more platforms establish blockchain integration, users are going to want a seamless experience. |

|

|

We touched on this topic in a previous letter where we were browsing a forum talking about ICP and didn’t even realize that we were using decentralized blockchain technology hosted on Dfinity’s servers until we researched the company, DSCVR. Shortly after, we logged back in with our NNS (Network Nervous System – ICP blockchain ID) and were able to like and comment on users’ content with less than 1 second response times- all using blockchain technology. The difference between DSCVR (true web3) and a company like Instagram (classic web2) is that there is no email, password, or any other personal information required to sign-up, and you can use your NNS ID on any Dfinity App as the same account. The newly invented Chain Key Technology allows for this activity and no other blockchain has this feature, let alone can run applications at web speed. Ethereum and Internet Computer are the only two coins in our longer-term holdings that we continue to build up a portfolio of with trading profits. We are holding a very strong cash position and don’t see anything else that we truly like right now in the crypto markets- hence the recent micro-VC activity. We’re going to sail through some choppy waters this year but we’re making the most out of that volatility with our trading accounts. Heading into the end of this quarter, we’re steering the ship in the right direction as the balance sheet is looking very strong. We have no leverage and will continue capitalizing on spot opportunities to mitigate against crashing into any icebergs. As always, thank you so much for reading. Nothing in this letter is or should be considered financial advice. We are not financial advisors and everything we share is only our perspectives. Always do your own research. |

Blockchain Technology Disrupting Real Estate

Blockchain can truly touch all aspects of real estate. That said, some touchpoints are inevitably more valuable than...

0 Comments