What is DeFi Lending?

DeFi lending platforms aim to offer crypto loans in a trustless manner, i.e., without intermediaries or third parties and allow users to enlist their cryptocurrencies on the platform for lending purposes. A borrower can directly take a loan through the decentralized platform and the lending protocol allows the lender to earn interests.

The underlying technology for DeFi lending is Blockchain; DeFi utilizes all its unique features and performs exceptionally well compared to traditional lending. DeFi lending offers complete transparency with easier access to assets for every money transfer process without involving any third-party. It provides the most straightforward borrowing process; the borrower needs to create an account on the DeFi platform, have a crypto wallet and open Smart contracts. DeFi offers a censorship-free environment, meaning there is no preferential treatment while ensuring immutability.

DeFi lending benefits both lenders and borrowers. It offers margin trading options, allows long-term investors to lend assets and earn higher interest rates. It will also enable users to access fiat currency credit to borrow loans at lower rates than decentralized exchanges. The users can sell it on a centralized exchange for a cryptocurrency and then finally lend it to decentralized exchanges.

Aave (AAVE)

Price: $369.15

Market Cap: $4,853,599,992

Fully Diluted Market Cap: $5,906,457,304

Total Value Locked (TVL): $13,418,049,724

Circulating Supply: 13,147,051.20 AAVE

Max Supply: 16,000,000

Total Supply: 16,000,000

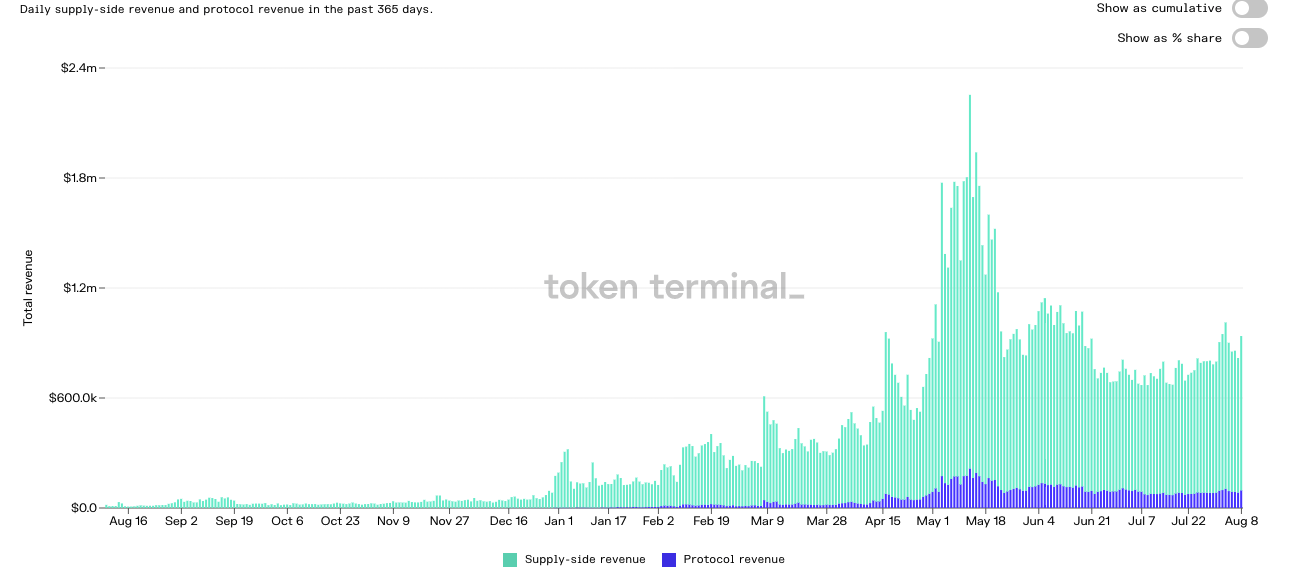

Aave Revenue Share over a 365-day trading period ranging from August 8th, 2020 to August 8th, 2021

Aave is a decentralized finance (DeFi) protocol that allows people to lend and borrow cryptocurrencies. Lenders earn interest by depositing digital assets into specially created liquidity pools. Borrowers can then use their crypto as collateral to take out a flash loan using this liquidity. Aave (which means “ghost” in Finnish) was originally known as ETHLend when it launched in November 2017, but the rebranding to Aave happened in September 2018 with a 100-1 token split (100 LEND per 1 AAVE).

Aave has several unique selling points when compared with competitors in an increasingly crowded market. During the DeFi craze in the summer of 2020, it was one of the biggest projects in terms of the total value of crypto locked in its protocol.

The project allows people to borrow and lend in about 20 cryptocurrencies, meaning that users have a greater aount of choice. One of Aave’s flagship products are “flash loans,” which have been billed as the first uncollateralized loan option in the DeFi space. There’s a catch: they must be paid back within the same transaction.

AAVE token holders own and govern the protocol. They currently take a cut of the total interest paid by borrowers & trading fees paid by traders (protocol revenue). Aave’s investors include ParaFi Capital, Framework Ventures, Three Arrows Capital, etc.

Compound (COMP)

Price: $415.21

Market Cap: $2,280,148,375

Fully Diluted Market Cap: $4,152,146,794

Total Value Locked (TVL): $10,717,715,712

Circulating Supply: 5,491,492.69 COMP

Max Supply: 10,000,000

Total Supply: 10,000,000

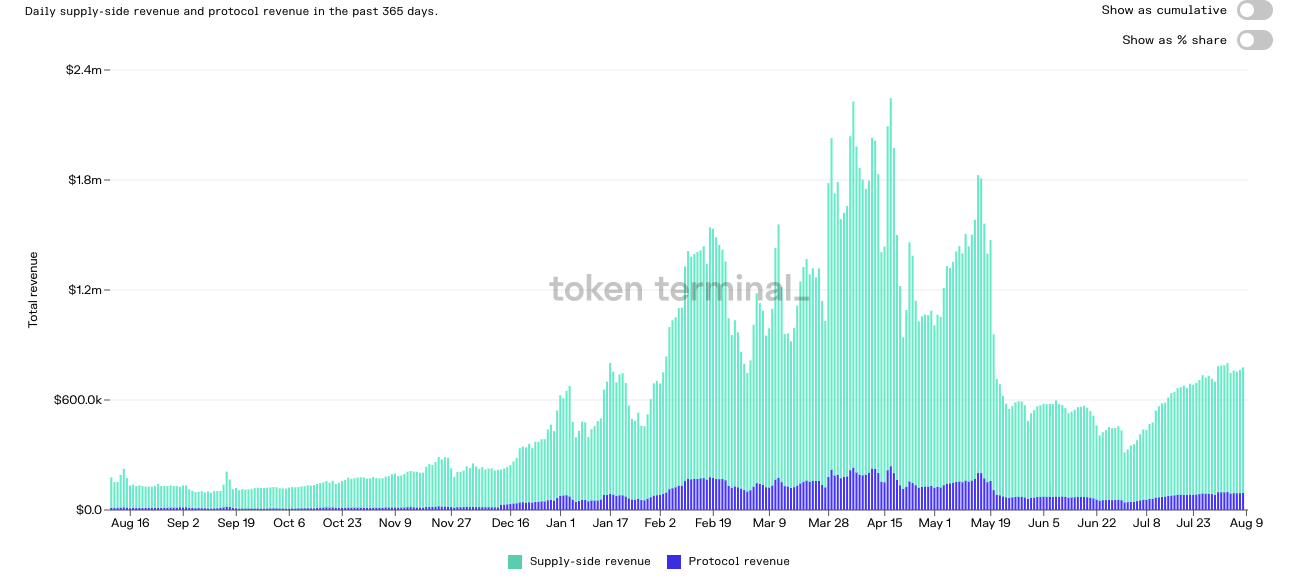

Compound Revenue Share over the course of a 365-day trading period ranging from August 8th, 2020 to August 8th, 2021

Compound is a DeFi lending protocol that allows users to earn interest on their cryptocurrencies by depositing them into one of several pool supported by the platform, built on Ethereum and launched in 2017.

Lenders deposit funds into Compound and receive interest payments from borrowers (supply-side revenue). When a user deposits tokens to a Compound pool, they receive cTokens in return. These cTokens represent the individual’s stake in the pool and can be used to redeem the underlying cryptocurrency initially deposited into the pool at any tie. For example, by depositing ETH into a pool, you will receive cETH in return. Over time, the exchange rate of these cTokens to the underlying asset increases, which means you can redeem them for more of the underlying asset than you initially put in – this is how the interest is distributed.

On the other side, borrowers can take a secured loan from any Compound pool by depositing collateral. The maximum loan-to-value (LTV) ratio varies based on the collateral asset, but currently ranges from 50 to 75%. The interest rate paid varies by borrowed asset and borrowers can face automatic liquidation if their collateral falls below a specific maintenance threshold.

According to Compound, many cryptocurrencies sit idle on exchange platforms, doing nothing for their holders. Compound looks to change this with its open lending platform, which allows anybody who deposits supported Ethereum tokens to easily earn interest on their balance or take out a secured loan – all in a completely trustless way.

Compound’s community governance sets it apart from other similar protocols. Holders of the platform’s native governance tokens – COMP – can propose changes to the protocol, debate and vote whether to implement changes suggested by others – without any involvement form the Compound team. This can include choosing which cryptocurrencies to add support for, adjusting collateralization factors, and making changes to how COMP tokens are distributed.

COMP token holders own and govern the protocol. They currently take a cut of the total interest paid by borrowers (protocol revenue). Compound’s investors include a16z, Paradigm, Polychain, etc.

Everything on Compound is handled automatically by smart contracts and allows Compound users to redeem their stake using their cTokens. The protocol enforces a collateralization factor for all assets supported by the platform, ensuring each pool is always overcollateralized. If the collateral falls below the minimum maintenance level, it will be sold to liquidators at a 5% discount, paying down some of the loan and returning the remainder to an acceptable collateralization factor. This arrangement helps to ensure borrowers maintain their collateral levels, provides a safety net for lenders, and creates an earning opportunity for liquidators.

MakerDAO (MKR)

Price: $3,787.29

Market Cap: $3,750,661,780.79

Fully Diluted Market Cap: $3,804,571,008.15

Total Value Locked (TVL): $8,753,885,947

Circulating Supply: 991,328 MKR

Max Supply: 1,000,000

Total Supply: 991,328

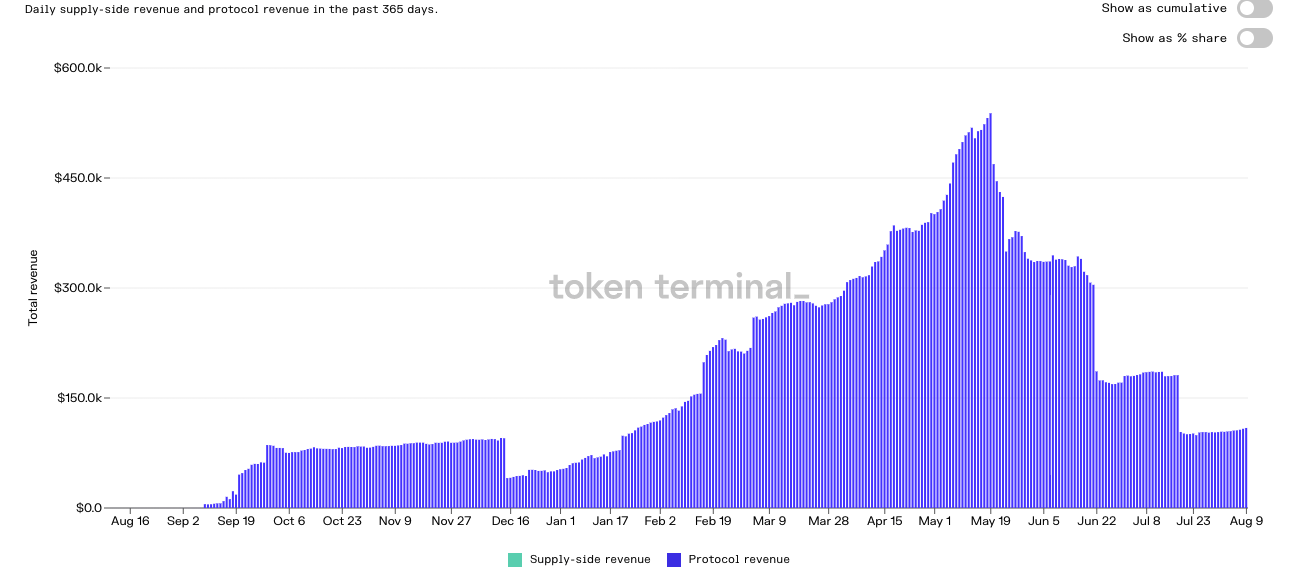

MakerDAO (MKR) Revenue Share over the course of a 365-day trading period from August 9th, 2020 to August 9th, 2021

MakerDAO is a non-custodial lending protocol for stable coins built on Ethereum. MakerDAO was founded by Rune Christensen and launched in 2015. Maker (MKR) is the governance token of the MakerDAO and Maker Protocol – respectively a decentralized organization and a software platform, both based on the Ethereum blockchain – that allows userrs to issue and manage the DAI stable coin.

Overcollateralized borrowers deposit funds into MakerDAO and receive DAI. DAI savings rate is calculated as supply-side revenue. MKR tokens act as a kind of voting share for the organization that manages DAI; while they do not pay dividends to their holders, they do give the holders voting rights over the development of Maker Protocol and are expected to appreciate in value in accordance with the success of DAI itself.

As of August 2021, DAI is one of the most popular stable coins (cryptocurrencies whose prices are pegged to the USD or another traditional central bank currency). It is the 24th largest cryptocurrency weighing in at over $5.8B in market capitalization and it has more active addresses than USDT – the largest stable coin on the market.

MKR’s unique proposition lies in the fact that it allows its holders to directly participate in the process of governing DAI. Every holder of Maker token has the right to vote on several changes to the Maker Protocol, with their voting power depending on the size of their MKR stake.

MKR token holders own and govern the protocol. They currently take all the total interest paid by borrowers and trading fees paid by traders & a cut of liquidations paid by borrowers (protocol revenue). MakerDAO’s investors include a16z, Polychain, IOSG Ventures, etc.

The issuance and removal of MKR from the system is governed by a complex system of interdependent mechanisms designed to ensure that DAI is always fully collateralized by other cryptocurrency assets and its soft peg to the USD is maintained. There is no hard-coded limit on the total supply of MKR. DAI’s value is secured by collateral – other cryptocurrencies that are deposited by users when minting new DAI tokens and stored in so-called vaults – smart contracts on the Ethereum blockchain.

During price downswings, the value of crypto stored in the vault might become insufficient to fully collateralize the corresponding amount of DAI. In that case, the Maker Protocol automatically initiates the liquidation of the vault’s contents, the proceeds of which it uses to cover that vault’s obligations. If the amount of DAI generated during the liquidation is not enough, the Maker Protocol mints new MKR tokens to sell and cover the remaining sum, thereby increasing the total supply.

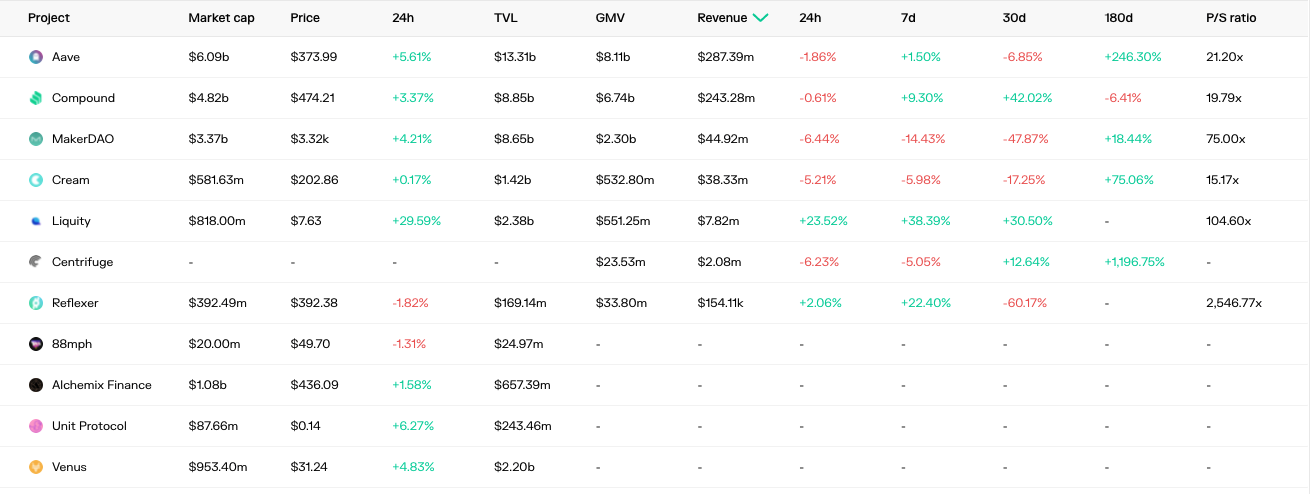

Lending Protocols sorted by Highest Revenue

DeFi Lending Protocols sorted by Highest Revenue over a 180-day trading period.

Aave, Compound, and MakerDAO seem to be the three musketeers of the DeFi Lending sector by a long shot. Taking a look at this data table sorted by highest revenue, we see that Aave / Compound both have around $250M in biannual revenue, while the next closest in revenue is $50M, which is MakerDAO. There really aren’t any other competitors to these projects yet. Aave / Compound will continue to be the Uniswap / Sushiswap of the Lending sector, and MakerDAO is the 1st decentralized stablecoin which has an ever-increasing number of DAI being circulated.

Another key column to take a look at is the TVL (Total Value Locked). This is another indicator that only confirms the bias of Aave, Compound, and MakerDAO running the show. The TVL on these 3 platforms are all around the same number, ranging from $8-13B. Next in line would be Cream & Liquidity with their $2B locked up, which is 5x less than the leading three. The other projects listed on this data table either don’t even have revenue or don’t have enough of a proven dent in the market to consider making an investment. As we head into the future, it seems like Aave, Compound, and MakerDAO are grandfathered in the ecosystem as projects are building on top of them and will continue to be these key three musketeers of the DeFi Lending sector.

As always please do your own research, this information does not constitute as financial advice.

Oh, wow!