We are incredibly excited to share our Q3 2022 report with you which doubles as our first annual report.

As many of you know, we officially started Black Mountain and The Jupiter Fund just over a year ago and accepted our first outside investor check on October 7th, 2021.

As even more of you probably know, in the fall of 2021 the world saw record high prices in basically every asset class out there. Since these historical highs, markets have come crashing down, especially crypto markets, which is what The Jupiter Fund, Black Mountain’s pioneer fund, specializes in. Despite these record breaking crashes and wealth destruction across the board, we have been hard at work to grow BMIG as a conglomerate and to come out positive on the Jupiter Fund in our first reporting year.

Some highlights:

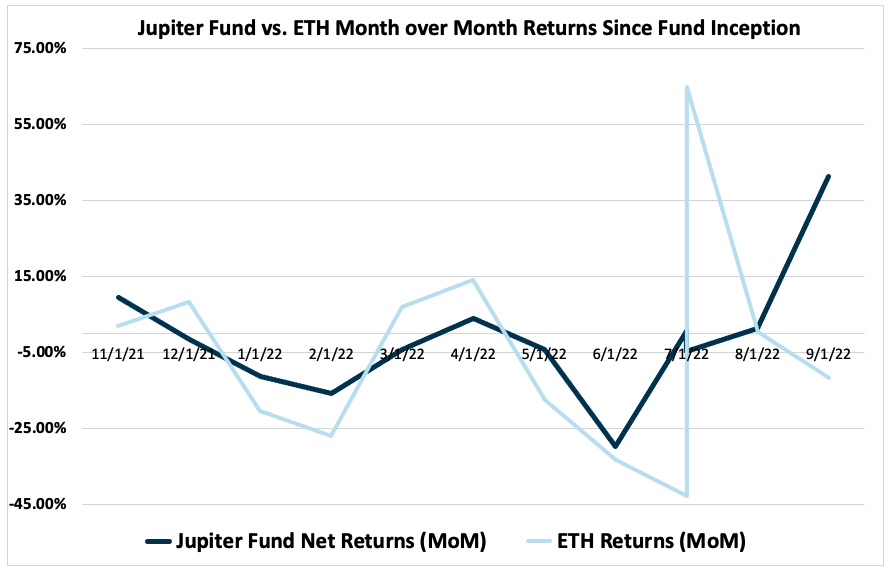

- The Jupiter Fund is now up around 3% YoY as of September 30th, 2022.

- For reference, during this same time ETH is down ~69% and the SPY is down over 18%. This means that we are up 72% as compared to our benchmark.

- Existing investors can login to our online portal to view up to date account balances; please note that depending on when you joined returns may differ slightly.

- Part of the fund’s revival (up over 40% just this month) is from Kyle hitting a 40x play- we talk to a lot of fund managers, retail traders, and other players in the space but haven’t heard of anybody hitting even a 5x or 10x play this year.

- In addition to that play, which was with a relatively low amount of capital (read Kyle’s Portfolio Manager update below for more details), Thawon and Kyle have been working hard to read and play momentum in the markets; we have been consistently making money by playing relief rallies and selling at local tops.

- While we always can and strive to be better, many people have been asking us how we are beating the markets. The short answer is hard work and paying close attention to markets all the time, but there is a lot more to it, like being developers / builders in the spaces that we invest in- we believe this greatly helps with diligence and being able to understand market dynamics in live time.

- Along those lines, we continue to diligence a myriad of deals and have our ears to the ground across private and public markets, especially early stage blockchain projects and undervalued equities as promising early-stage opportunities are increasingly blending between public and private markets.

- While we are seeing some interesting projects that we continue to diligence, for the most part, many founders continue to seek absurd valuations after burning though cash with very little if any revenue to show for it. We are seeing companies seeking to raise millions of dollars to build something we estimate could cost as little as $10K.

- We think these valuations are absurd because, as mentioned above, we keep close observation on private and public markets- where we are seeing low eight figure valuations on companies with tangibly valuable hard assets and millions in annual revenue.

- BMIG recently got a private, unsolicited offer to be purchased for seven figures. While flattering, we designed this business for cash flow, so we have no plans of selling soon, if ever. Additionally, even though BMIG’s focus is cash flow, The Jupiter Fund’s investors are our first priority. Accordingly, we have not taken a single management fee this year (as the fund has been in the negative for the most part) and continue to work incredibly hard day in and day out to increase the value of our LP’s capital.

- One example of this is continuing to allocate money into assets that are clearly undervalued, stacking for the long term while prices are so attractive. There aren’t enough good builders executing on high quality projects in the space right now, which we have recognized and are taking full advantage of by building new companies necessary to the space at incredibly low costs and uniquely structuring them to be owned outright by our investors.

- Rather than trying to squeeze on cap tables for 0.5% or less of an overvalued company hoping for a 10x best case scenario, we are using our strategic duel-company structure to give our investors 100% exposure to companies that could have 50x or even 100x outcomes with essentially negligible risk (read Kyle’s Portfolio Manager update below to learn more).

We would like to thank all of you for your continued support through the volatility we’re experiencing in the markets. From quantitative tightening by the Federal Reserve to a war in Ukraine, a global pandemic, social issues and natural disasters here at home, 2022 has brought a multitude of struggles. Nevertheless, Black Mountain has accepted the challenge of these macroeconomic factors and are taking them head on, continuing to grow our fund and conglomerate in a market where most people are not only declining, but vanishing. We are grateful to have you alongside us on this journey.

In the last few months, we have made some structural updates which we think has been the best thing to happen to our companies since we started. Kyle took over the Jupiter Fund GP and became the head Portfolio Manager, where he is focused on deal diligence and capital allocation. Eli took over and became CEO of Black Mountain, where he is focused on growth, expansion into other asset classes, and company operations.

Read on for a blip on Eli’s strategic return to school and a more in-depth Jupiter Fund update from Kyle.

Eli’s Strategic Return to School

In late August, after spending two years at Bridge Investment Group working alongside top leadership to help start five funds, the company go public, and day to day operations, I quit to head back to school to finish my undergraduate junior and senior years at the Wharton School of Business.

Reason one of three was that programming is finally back in person; the second reason is that in the last 2-3 years, Penn has established itself as a first mover in the crypto / blockchain space. One example of this is Wharton accepting cryptocurrency as payment for tuition in certain classes.

Another example is Penn Blockchain (or PB), which has grown by over 200 members in the last year alone. I applied for the club this year and not only got in but got a position on the Events Committee of Franklin DAO- PB’s sister organization that does diligence and deal sourcing on behalf of some of the most exceptional venture capital firms in the world.

The third reason I came back is because of the remarkable real estate resources here at Wharton. As a board advisor to the Wharton Undergraduate Real Estate Club, we get direct access to some of the most incredible real estate investors and operators out there through the Zell-Lurie Center.

Black Mountain is a conglomerate that was created alongside The Jupiter Fund to start and operate funds and companies. While we have been building companies, we have also silently been working on starting our next fund. More details will come on that in the following months but it will almost certainly be focused on real estate.

Message from The Jupiter Fund’s Portfolio Manager, Kyle Niedzwiecki

In 2022, my goal was to accelerate our focus on profitable companies while temporarily trimming our investments that were risk-on and prone to deep corrections. By the end of Q1, we were sitting with ~85% of our holdings in USDC and USD equivalents. Below is the chart of the US Dollar Index (Ticker: DXY); I took this trade by accident and didn’t even realize it until the time of this writing.

By sitting on the sidelines in stable coins across our brokerage platforms, whether it be USDC or actual US Dollars, not only did we mitigate downside risk and lock in profits, but we also made an 18% gain on every Dollar in terms of relative purchasing power. Although I think we’re nearing highs on the Index and a bit late to the trade, we hit one of the biggest moves up in the history of the Dollar. Everyone puts emphasis on creating a complex algorithm for navigating the bear market like buying defensive stocks or shorting the SPY, but sometimes the best trade is to sit on your hands and not make a trade at all.

I went to Europe in April after accumulating as much US Dollars as I could, let the markets capitulate, and now we’ve had an increase of ~70% in our capital accounts in terms of buying power relative to ETH since that time.

Meanwhile I’ve been actively looking to buy profitable companies that are experiencing drawdowns in prices to add to our balance sheet for long-term diversification as it’s rare to be able to grab such interesting opportunities at such a steep discount. Without including portfolio companies or the inflated Dollar in the valuation, The Jupiter Fund is sitting up ~3% heading into the close of our first fiscal year, and I couldn’t be more excited about the future of our fund.

As mentioned in the highlights, we have been building, doing diligence on, and investing in select early-stage projects where we see clear supply / demand gaps. One example of this that we were able to take advantage of with a very small amount of capital was providing initial liquidity to build the first decentralized swap / token pool platform on the ICP network. Motokoswap, a 100% Jupiter Fund owned subsidiary launching in October, provides our investors with a 0.1% commission on every trade; these profits will be allocated back into long term holds like the Internet Computer.

I also found the “Dogecoin” of the ICP ecosystem on a Twitter deep dive which I realized we could be a significant shareholder of with a very small amount of capital. What started from a humble $500 investment to purchase a little over 1% of the project turned into over $30,000 before I was able to liquidate for the fund at ~$20,000.

It’s likely that we will continue building and providing liquidity on the ICP blockchain indefinitely, as we believe Dfinity’s product offers the best version of a true Web3 experience (we will dive into this more on our next article but you can see our January 2021 article on ICP to learn more).

Some recent news on this chain is Polychain Capital investing $9MM into DSCVR, a decentralized social media platform built solely on the Internet Computer.

Furthermore, now that we’ve weathered the storm of the first three quarters 2022, I am looking forward to ‘buying the dip’ on Bitcoin, Ethereum, the Internet Computer, select global equities, as well as putting our investors on cap tables of certain blockchain infrastructure- giving fund investors additional kickback from royalties, again getting funneled back into the fund’s accounts for continued long-term growth potential.

Hope you enjoyed reading, and once again, thank you for being a supporter of BMIG / TJF! If you ever have any questions, concerns, or feedback, don’t be afraid to reach out.

Happy investing!

Best,

The Black Mountain and Jupiter Fund Team

0 Comments