Hope that you have been doing well. Although it’s been a couple months since our last update, BMIG has been very busy and up to some incredibly exciting stuff.

- The Jupiter Fund (“TJF”) has now raised over a quarter million dollars in less than seven months, which represents over 850% of growth in AUM since starting the fund in October, and 91% since our last update in January.

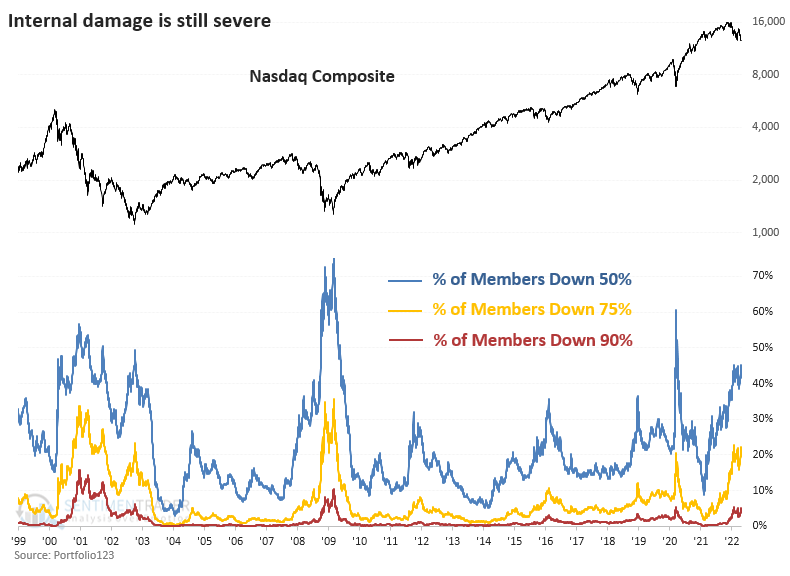

- Last week was an absolutely wild week for equities, with growth stocks now entering Great Recession and even Dotcom Crash territory. Within the Nasdaq alone, more than 45% of stocks are down at least 50%. Even Amazon is down well over 30% from its November high (see image below).

- While markets have been tumultuous to say the least, we have frequently been gaining back profits within the chop and continue to look for unique opportunities across markets in anticipation of major capitulation as the uncertainly of consequences from the instability overseas, inflation at home, supply chain issues across industries, etc. continue to loom in the future.

- The week after BMIG attended Bitcoin Miami, we played a new DeFi protocol developed by some outstanding Utah Founders. Our small initial allocation did exceptionally well, up over 100% in three days, so we have continued to buy in and our position now sits up over 30% in less than two weeks- during some of the worst trading days the markets have seen in years.

- We have amended our fund documents to make TJF much more like a traditional 2/20 hedge fund, however, we haven’t added a catch-up management fee yet, but are heavily considering it depending how our next round of fundraising goes. It’s certainly not too late to get in, but we have raised our minimum investment to $100K with plans to continue increasing it in the future.

- After building out sophisticated and useable models for the preparations of our own K-1s, there has been significant demand for our tax reporting / fund tracking and analysis models, which we have been continuing to build out and evaluate select partnerships for.

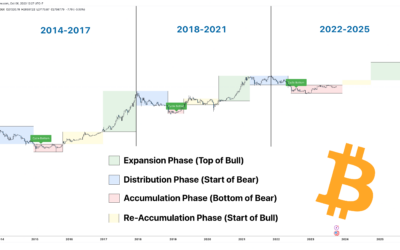

Overall, we are expecting an economic slowdown over the coming months. The main reason for this is the unbelievably tragic foreign turmoil, which has been and will certainly continue to have intense ripple effects throughout the entire global economy. We are particularly worried about a global food crisis stemming from the lack of food supply and resiliency of most countries’ food supply chains. This, paired with out of control inflation and rising interest rates is clearly not boding well with investors, but more than anything it’s starting to impact people’s actual pockets. Because of this, we believe there will continue to be drawdowns of prices across industries and asset classes.

During these choppy market conditions, we’ve been actively protecting against downside by holding mostly USDC on our crypto exchange accounts. In the last month, we saved the fund 17% on ETH by playing a large USDC cash short.

In addition to the cash short of our blue-chip cryptocurrencies, the team has also massively trimmed the fund’s altcoin holdings. During the same period of Ethereum’s recent 17% fall, DOT had a 24% drawdown, and ICP took a 26% tumble. We’re happy to say we got out of the majority of our altcoin holdings before this recent crash.

As we’ve mostly been playing defense by protecting downside fluctuations, we’ve also been on the offensive by taking some short positions. These have been small positions but have done very well so through the next few weeks we will be continuing to evaluate these opportunities and allocating accordingly.

Concluding Thoughts

The team has been getting much more active on social media. Please follow our Twitter to see play by play market updates from us, Instagram to learn more about us, and LinkedIn or email for any professional opportunities / proposals.

We are proud to announce Black Mountain’s first sponsorship with Alleyways Amplified, a concert series hosted in Salt Lake City featuring local musicians. The concert series aims to bring light to the darkest parts of the city and improve the community through music.

In the past we have given out much of our investment theses and even specific plays publicly. While we do want to help as many people get wealthy and understand the markets as possible, we also recognize that this is an extremely competitive space, and we want to reward our clients and partners for choosing us, and for us to be rewarded accordingly. Therefore, we have decided to stop giving away our entire views/positions, or what we like to call “free alpha” so publicly, especially until we are all or mostly allocated into position(s)- part of why it’s been so long since our last update.

Thank you for taking the time to read this and hope that you and your loved ones are doing well during these crazy times. As always, please feel free to reach out to us if you have any questions, concerns, or feedback.

Hope you have a wonderful week.

Best,

Kyle, Thawon, and Elijah

The Q2 update exceeded my expectations. Well done, Black Mountain!

Excited for the future!

As a beginner in trading, I found the articles here super helpful. Thanks!