It’s been an eventful year for most if not all markets, but especially for crypto markets. Three of the top exchanges have collapsed, two top venture firms got liquidated, two top ten coins with $60B+ market caps went to zero, the DeFi lending market got pretty much entirely wiped out, Bitcoin is down ~80% from its all-time high, and most altcoins are down 90-99% from their highs.

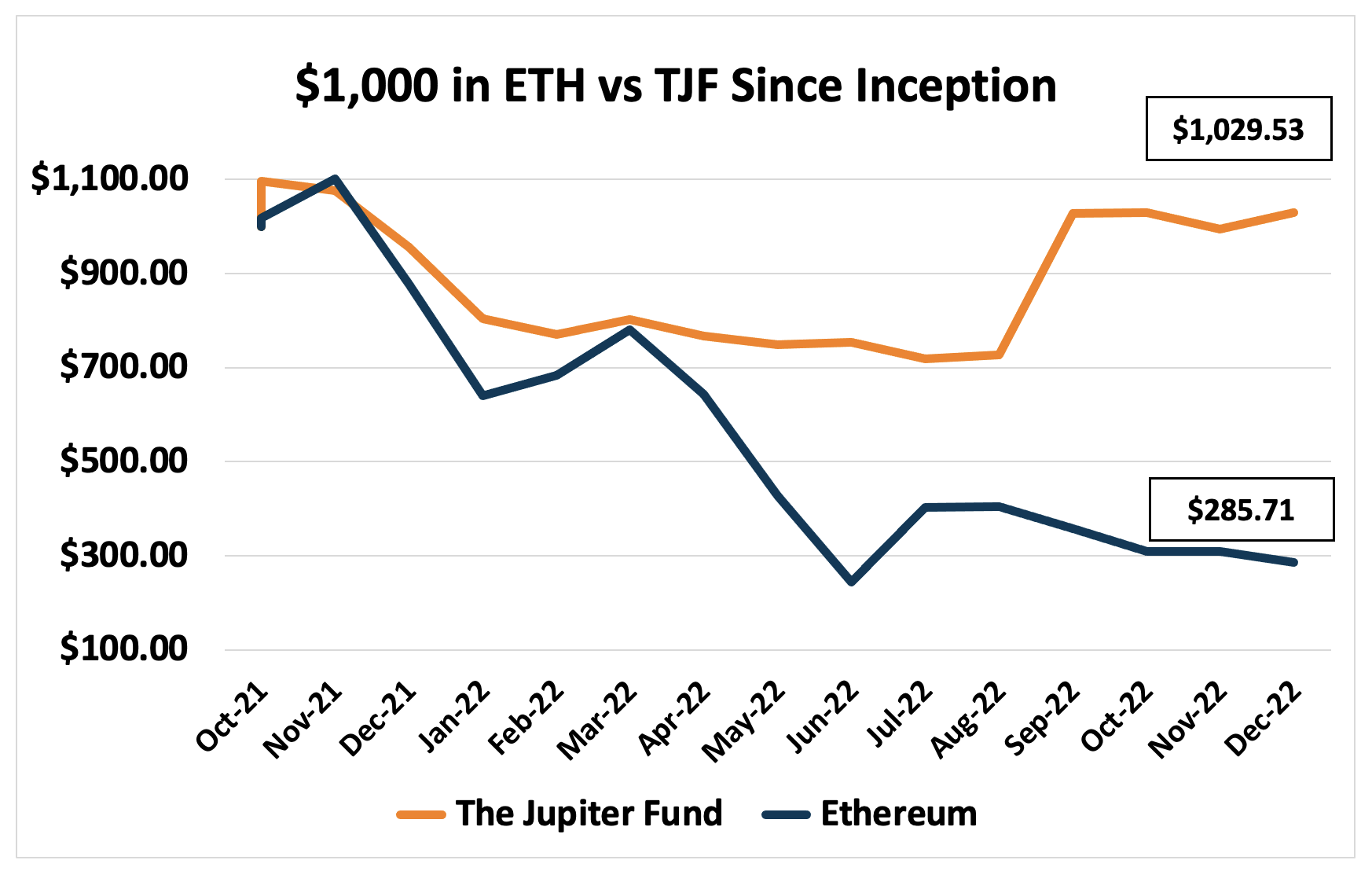

Despite the challenges and volatility, our fund has managed to achieve positive returns on the year, outperforming most funds in the tech space, and our benchmark, Ethereum, by over 70%.

The Jupiter Fund is up just over 2% YTD and our AUM has grown by over 2,000% since inception. Existing investors can log in to their investor portal to view individual performance.

While most groups in the space are going bankrupt, running and hiding from regulators, and straight up lying to their clients about liquidity, we have doubled down on building out internal infrastructure, investor transparency, corporate controls, and downside risk protection protocols across the board. This includes several exciting tech projects that have been underway for some time and Jupiter Fund investors get exclusive access to. One of these projects is aiming to help fill the gaps in current crypto accounting practices.

Before even creating our fund, and certainly before ever asking for any external money, we set up intricate models to track investment activity over time, including realized and unrealized gains for each investor’s capital accounts. It wasn’t until meeting many other groups in the space that we came to understand how sophisticated and proprietary these models were. Because of this, we have doubled down on building and automating these processes internally and look forward to selling these services to other funds and traders in the future as well.

So far, we have been solely focused on making sure our internal transactions are calculated perfectly before selling this to anybody else. However, as we close in on a shippable product, we are very excited to help solve parts of the major regulatory problems facing this space while giving our investors unparalleled exposure to the returns that come with doing so. We are grateful for past conversations with regulators that have admitted how challenging this space is to regulate and hope to continue this type of dialogue as we keep growing and have our eyes set on becoming a leader in not only investing, but also guiding regulation in the space.

Besides our technology-first approach to investing and operating, another key driver of our performance has been our focus on actively managing the fund. We believe that this approach has allowed us to capitalize on arbitrage across markets while also significantly minimizing risk- part of why the fund is positive today.

Learn more about our investment theses and active portfolio management by reading our other insights and subscribing to our newsletter on the bottom of our website’s homepage. As always, nothing we put out to the public is or should be considered financial advice.

0 Comments